Monzo SMS Verification – Receive OTP SMS Online

How it works

Choose your number type

Free inbox = quick tests. Activation or Rental = typically better delivery and fewer rejections.Pick country + copy the number

Select the country you need, grab a number, and copy it exactly.Request the OTP on Monzo

Enter the number on the Monzo verification screen and tap Send code (avoid rapid retries).Check PVAPins inbox

Refresh once or twice, copy the OTP as soon as it appears, and enter it immediately (codes expire fast).If it fails, switch smart

Don’t spam resend. Switch number/route, wait a bit, then try again once.

OTP not received? Do this

- Wait 60–120 seconds (don't spam resend)

- Retry once → then switch number/route

- Keep device/IP steady during the flow

- Prefer private routes for better pass-through

- Use Rental for re-logins and recovery

Wait 60–120 seconds, then resend once.

Confirm the country/region matches the number you entered.

Keep your device/IP steady during the verification flow.

Switch to a private route if public-style numbers get blocked.

Switch number/route after one clean retry (don't loop).

Free vs Activation vs Rental (what to choose)

Choose based on what you're doing:

Quick number-format tips (avoid instant rejections)

Most verification failures are formatting-related, not inbox-related. Use international format (country code + digits), avoid spaces/dashes, and don’t add an extra leading 0.

Best default format: +CountryCode + Number (example: +447911123456)

If the form is digits-only: CountryCodeNumber (example: 447911123456)

Simple OTP rule: request once → wait 60–120 seconds → resend only once.

Inbox preview

| Time | Country | Message | Status |

|---|---|---|---|

| 2 min ago | USA | Your verification code is ****** | Delivered |

| 7 min ago | UK | Use code ****** to verify your account | Pending |

| 14 min ago | Canada | OTP: ****** (do not share) | Delivered |

FAQs

Quick answers people ask about Monzo SMS verification.

Can I verify Monzo without using my personal SIM?

Yes. Monzo generally needs a working SMS-capable number, not specifically the SIM you use every day. A private virtual number can receive the OTP and link to your account, as long as you follow Monzo’s terms and local regulations.

Why am I not receiving my Monzo verification code?

Most of the time, it’s something simple: wrong number format, weak signal, roaming blocks, or your number already being linked to another account. Double-check the digits, wait for one full timer, and try a single resend. If it still fails, contact support or move to a fresh private number.

Can Monzo send verification codes to a non-UK number?

Some people do get codes on non-UK numbers when they’re formatted correctly and supported. Others need support to switch. Treat non-UK numbers as “works in some cases” rather than guaranteed, and always rely on Monzo’s latest help docs for anything critical.

What if I lose my phone and can’t access the Monzo app?

You can still use a limited web version in your browser, confirm via a magic link to your email, and freeze your card if needed. Once you’ve got control back, it’s smart to move your Monzo phone number to either a secure SIM or a stable virtual rental so the same thing doesn’t happen again.

Is it safe to verify Monzo with a virtual number from PVAPins?

It can be, as long as the number is private, SMS-capable, and only you can see the messages. Avoid public inbox sites, keep your Monzo profile data accurate, and add strong authentication wherever Monzo supports it. PVAPins gives you a cleaner second number; it doesn’t change the underlying banking rules.

Should I use a one-time activation or a rental number for Monzo?

Use a one-time activation if you only need a single OTP or a short-lived access. Choose a rental number if you’ll use Monzo regularly, expect 3D Secure checks, or want a stable “banking line” that’s not your daily SIM.

Read more: Full Monzo SMS guide

Open the full guide

You’re halfway through setting up Monzo, and it hits you with the classic: Enter the code we sent to your phone. But what if you don’t want your primary SIM tied to your bank at all? Maybe you travel a lot, juggle multiple numbers, or you prefer to keep your money life separate from your “everything else” SIM. Good news: you can’t turn off phone verification completely, but you can choose which number Monzo sees. In this guide, we’ll walk through how to verify Monzo without a phone number, how a private virtual number from PVAPins fits into the picture, and what to watch for so you don’t get locked out later.

At a glance: can you verify Monzo without a phone number?

Short answer: yes, you can keep your primary SIM out of it. Monzo still needs a phone number for SMS-based OTPs, but it doesn’t have to be the SIM you use every day. As long as the number is live, SMS-capable, and under your control, Monzo can usually use it for signups, logins, and security checks. That can be a spare SIM or a private virtual number.

Like most UK banks, Monzo leans on multi-factor authentication for logins and approvals. Regulators want “something you have”, and in practice, that’s usually the app plus a phone number.

Instead of giving Monzo your personal, do-everything SIM, you can:

Use a secondary SIM that you keep just for banking and important OTPs.

Use a private virtual number that receives SMS reliably and isn’t shared with strangers.

Keep a clear line between money stuff and random apps that constantly drain your phone's battery.

Cut down on promotional texts and calls hitting the number your friends and family use.

The main thing is: the number has to be SMS-routable and not heavily abused. Overused routes, VoIP-ish ranges, or shared inboxes are more likely to get blocked or delayed.

For the rest of this article, we’ll focus on how to verify Monzo without using your primary SIM as your phone number, using PVAPins as your private second line.

How Monzo phone verification works

Monzo ties your account, app, and phone together using one-time SMS codes. You install the app, enter your details, and at some point, Monzo sends a short code to the number on file. You type that code into the app before it expires to prove “this device and this number belong together.”

Behind the scenes, it’s roughly:

Monzo hands your number to an SMS provider.

That provider hands the message off to your carrier or roaming partner.

Your phone checks in with the network and pulls the text down.

The app checks that the OTP is correct and still within its time window.

Typically, these codes:

They are valid for only a few minutes.

Can’t be reused after they’ve been accepted or expired.

They are tied to a specific action, such as signup, device change, login confirmation, or strong customer authentication on a transaction.

How long do Monzo verification codes last, and how are they sent

Monzo doesn’t publish a full technical breakdown, but from user reports and similar banking flows:

Codes usually work for a short window before timing out.

Sometimes several delayed texts show up at once when networks are congested or routing is flaky.

If you spam the “send again” button, later messages may take longer to send as safety throttles kick in.

Most of the time, when a Monzo verification code isn't received, it’s not due to a massive outage. It’s usually one of these:

The number is in the wrong format (missing the +44 prefix, extra digits, or stray spaces).

The signal is weak, or the phone’s in airplane mode.

The SIM is roaming, and international SMS is either blocked or painfully slow.

The number is already tied to another Monzo account.

There’s a temporary hiccup with the SMS provider or your local carrier.

Monzo usually suggests that you:

Double-check the number in the app.

Wait a bit don’t hammer “resend” every five seconds.

Restart the app and your device.

Reach out to support if the codes never arrive or arrive hours late.

If your SIM situation is just messy, you're long-term traveling, you're frequently changing numbers, or you're using a non-UK mobile, moving Monzo to a single stable virtual number and leaving it there is often calmer. That’s where PVAPins can help.

Temporary Monzo phone number: free vs low-cost options

When you only need one OTP, it’s very tempting to Google “receive SMS online”, click on a random site, grab a public number, and cross your fingers that Monzo sends a code there.

For throwaway email signups, that might be fine. For your bank? That’s where you need to slow down.

Free public inbox sites usually mean:

Shared numbers that anyone can see.

A public web page listing every OTP and login code they receive.

The exact numbers are recycled across thousands of signups.

No control if someone else grabs “your” code first.

With banking or anything involving real money, that’s a serious risk:

Someone could see your OTP and interfere with the flow.

Those numbers are often heavily abused and more likely to be flagged or blocked.

You have no long-term control over the site; it can remove the number tomorrow, and you’re done.

Security guidance has been consistent: SMS OTPs are already a weaker factor than app-based codes. If you then put those codes on a public web page, you’re basically shouting your security step to the whole internet.

Why a low-cost private virtual number is safer

A private virtual number from PVAPins behaves much more like a real SIM:

It has a private inbox that shows only incoming SMS.

You can pick non-VoIP, app-friendly routes where available.

PVAPins supports 200+ countries, so you can choose a number that matches your region or where you bank.

You can use one-time activations for a single Monzo OTP or rentals if you want Monzo on that number long term.

The routes are tuned for fast OTP delivery and API-ready stability.

In practice:

Use a one-time activation if you need to log in to Monzo once (for example, to close an account or fix something quickly).

Go for a rental number if you log in regularly, travel a lot, or expect ongoing 3D Secure checks and SMS prompts.

When real money is involved, privacy and control matter more than shaving a few cents off. Free public number inboxes are fine for quick test accounts; for Monzo, the safer play is a private, stable temporary phone number, not one shared with half the internet.

Step-by-step: verify Monzo without a phone number using a virtual number from PVAPins

Here’s the part you were really scrolling for.

You want to keep Monzo off your primary SIM while still getting through verification without drama. This is a simple, copy-paste flow using PVAPins.

Step 1: Create or log in to your PVAPins account.

Head to PVAPins on the web and sign up, or log in if you’re already a user.

Using the same email as your Monzo account can make life easier later.

On Android, install the PVAPins app, so OTPs appear as push notifications.

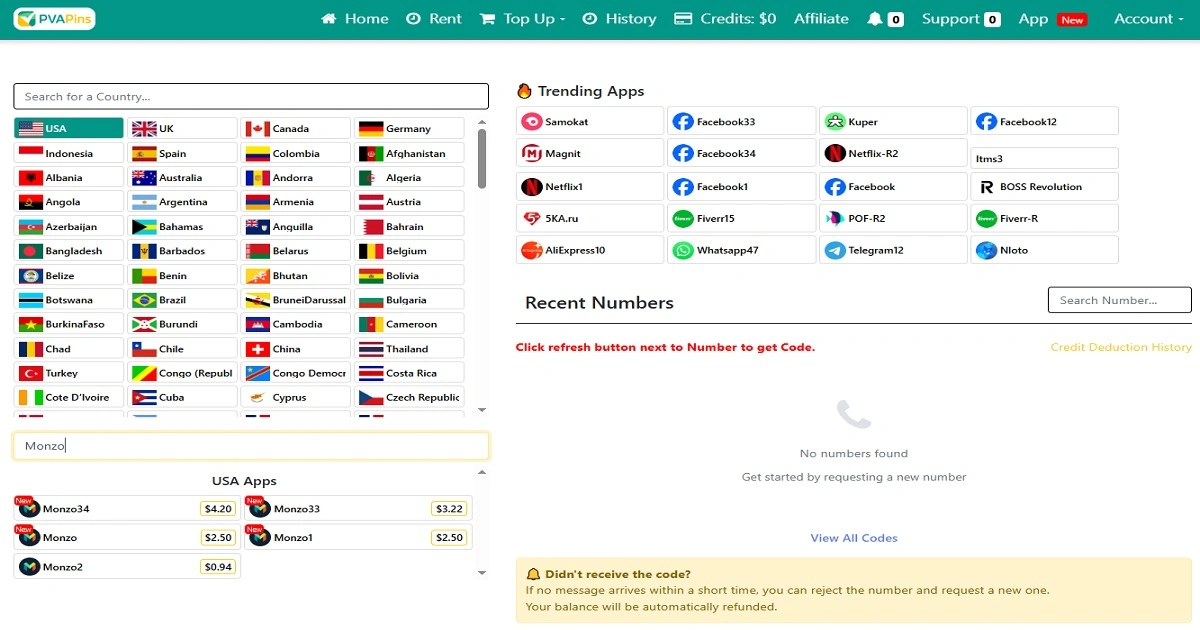

Step 2: Choose Monzo and a suitable country.

Go to the Receive SMS section or the list of supported apps/services.

Select Monzo from the list.

Choose a country that fits how you bank often, the UK, but a regional option can work better depending on where you live or travel.

Where available, look for notes about non-VoIP or “bank-friendly” routes.

Step 3: Decide between one-time activation and rental.

PVAPins gives you two main ways to grab a temporary phone number for Monzo:

One-time activation

Perfect when you only need a single OTP.

Suitable for quick tests, one-off access, or account closure.

Rental number

Better for daily Monzo use and ongoing logins.

Works well if you expect regular 3D Secure checks or SMS prompts.

The number stays attached to your Monzo profile for weeks or months.

No need to panic if you lose a physical SIM while travelling.

If Monzo is a big part of your money stack, a rental is usually the calmer, long-term choice.

Step 4: Paste the PVAPins number into Monzo and request your OTP.

Copy the virtual number from PVAPins exactly, including the + and country code.

In the Monzo app, when it asks for a phone number, please enter it.

Double-check there are no extra zeros or missing symbols.

Tap to send the SMS code.

Within a short time, you should see the OTP land in your PVAPins inbox. If you’re using the PVAPins Android app, you’ll also get a notification, which is handier than sitting staring at the screen.

Step 5: Enter the code and test access.

Type the OTP into the Monzo app before it expires.

Once the app confirms your device, do a quick sanity check:

Log out and back in.

Refresh your feed.

If your account is already active, maybe trigger a small, low-risk action to prove everything’s tied together.

From that point on, Monzo sees your PVAPins virtual number rather than your personal SIM. Future SMS checks should go to that private inbox instead.

On the payment side, topping up your PVAPins balance is easy. You can use Crypto, Binance Pay, Payeer, GCash, AmanPay, QIWI Wallet, DOKU, Nigeria & South Africa cards, Skrill, or Payoneer, so you’re not stuck hunting for one specific payment method.

Fixing common Monzo verification problems

Before you move everything to a new number, it’s worth giving your current setup a fair chance. A lot of “Monzo verification code not received” complaints boil down to simple, fixable issues.

At a high level, run through this mini-checklist:

Confirm the phone number and country code are correct.

Check signal and any SMS-blocking settings.

Wait out one full timer before hitting “resend”.

Make sure the number isn’t already attached to another Monzo account.

Only then think about switching to a private virtual line.

Monzo verification code not received. Quick checks before you switch numbers.

Here’s a quick, practical flow:

1. Check the format

Is the country code correct (for example, +44 for the UK)?

Did you copy and paste extra spaces, brackets, or characters?

2. Check your phone settings

Is the device in Do Not Disturb with SMS restricted?

Are you using an SMS filter, spam app, or antivirus that might be blocking short codes?

3. Check timing

Codes only work for a short window.

Constantly hitting “resend” can actually slow everything down.

4. Check for account conflicts

If your number’s tied to a different Monzo account, you may need support to untangle it.

This happens more often than you’d think when people change phones or share numbers.

5. Know when to escalate

If you’ve done all the above and still get nothing, it’s probably a provider or routing problem.

That’s when using in-app chat or official support is worth the time.

If you’re fed up repeating this dance every time you change SIMs or travel, that’s your cue to move to a private PVAPins number and cut out half the variables.

Monzo SMS verification abroad when you’re roaming or travelling

Once you’re abroad, reliability drops:

Roaming agreements can delay or silently drop SMS.

Some countries are stricter about bank messages from foreign numbers.

Hotel basements, airports, and older buildings can wreck your signal.

If you depend on your UK SIM while living or travelling abroad, you’ll probably notice that Monzo's SMS verification is less reliable.

When that’s your reality:

Consider a local or regional virtual number via PVAPins, based on where you actually are.

Keep mobile data or Wi-Fi on so both Monzo and PVAPins can sync.

Check your home carrier’s roaming rules; some block incoming texts entirely unless you add a roaming pack.

Often, a country-matched virtual number is both more reliable and cheaper than keeping a UK SIM alive solely for OTPs on long trips.

Monzo login without phone: what you can still do from web access

What if you’ve lost your phone completely and can’t open the app?

Monzo has a limited web access option that lets you:

See introductory balances and recent transactions.

Freeze your card if something looks suspicious.

Get a magic link sent to your email to confirm it’s really you.

That’s great for emergencies, but it’s not built as a full-time replacement. You’ll still want a working phone number on your profile for:

Normal logins and re-verifications.

3D Secure SMS prompts on online card payments.

Account recovery flows if anything else goes wrong.

A PVAPin's rental number can take over from a lost or compromised SIM in that role. Once you’ve confirmed everything via web access and support, you can point your Monzo profile to that stable virtual line and stop worrying about losing a physical SIM.

Changing your Monzo phone number to a stable virtual line

If you’re constantly swapping SIMs, moving abroad, or hate the idea of being locked out, one of the best things you can do is change your phone number in Monzo while everything still works.

Short version: log in, update the number, confirm one OTP, and treat that line as your “Monzo SIM” going forward.

A typical flow looks like this:

Open the Monzo app while you’re still logged in.

Go to your Profile or Settings.

Find the Phone or Contact details section.

Tap to add or change your phone number.

Enter your PVAPins rental number in full international format.

Please wait for the SMS OTP on that number and confirm it in the app.

Doing this while you already have app access is much easier than changing numbers after you’re locked out. In “lost phone” scenarios, support can help, but expect more friction and identity checks.

When choosing a PVAPins rental for Monzo, think about:

Region A UK number is often simplest, but a regional one closer to where you live can sometimes behave better.

Usage SMS-only is usually enough for OTPs; call support is optional.

Stability Plan to keep that number attached for months, not days.

Some users have successfully used non-UK numbers, but policies can evolve. Treat that as “works today, keep an eye on updates”, and always check Monzo’s own help if you’re unsure.

Pro tip: after you change it, take a quick screenshot of the phone number screen, and make sure your email and password manager entries are all up to date. If anything breaks later, you’ve got an explicit reference.

examples: verifying Monzo from the UK, EU, and while abroad

Monzo is very UK-centric, but real life is messier. People live abroad, commute between countries, or work remotely across time zones. The common thread in all of this is SMS routing, whether the code can reliably find you.

Example 1: UK resident in London, travelling around Europe

You live in London but hop between Spain and France every few months.

Your options:

Keep Monzo on a UK virtual number that always works, no matter which physical SIM is in your phone.

Or use a local EU virtual number for OTPs if you’re primarily based in Europe.

Both beat, depending entirely on UK roaming rules, which can change or get expensive without warning.

Example 2: UK expat in Asia or the Middle East

You’ve moved out of the UK but still use Monzo for travel, subscriptions, and online purchases.

Typical issues:

That old UK SIM in a drawer barely gets a signal (if at all).

Roaming with a UK SIM can be pricey and unreliable in the long term.

Cleaner approach:

Move Monzo to a PVAPins number in a region that works well with your local carriers.

Keep that number reachable anywhere via the PVAPins app or dashboard.

Example 3: Remote worker or digital nomad

You work from multiple countries with no permanent local SIM.

In that case, a stable virtual number becomes your “banking anchor” as your physical SIMs change. You don’t have to keep track of which tiny piece of plastic your finances depend on.

Because PVAPins covers 200+ countries, you can match your Monzo verification number to where you actually spend most of your time, instead of forcing your lifestyle around a single UK SIM.

Is it safe and allowed to use a virtual number for Monzo verification?

Big question, fair concern.

A virtual number can be safe for Monzo if:

It’s private; only you can see the inbox.

It’s SMS-capable and reliable for OTP traffic.

Your profile and identity details stay honest and accurate.

People usually run into issues when they treat banking OTPs like throwaway codes. Security guidance is pretty straightforward: SMS isn’t the toughest factor out there, and exposing those codes on public inbox sites or sharing the login with other people makes things worse.

Using a private PVAPins number doesn’t let you dodge bank rules:

You still go through KYC checks (identity verification).

You still have to meet Strong Customer Authentication requirements where they apply.

You still need to follow Monzo’s terms and local laws.

Think of PVAPins as changing which number Monzo sees, not as switching off the requirement for a number altogether.

For extra peace of mind:

Lock down your PVAPins account with strong passwords and, where available, extra factors.

Treat your email as a crown jewel. Monzo leans on it for magic links and recovery.

Don’t treat OTPs as harmless; they’re a key to your account, even if they expire quickly.

PVAPins is not affiliated with Monzo. Please follow each app’s terms and local regulations.

Numbers That Work With Monzo:

PVAPins keeps numbers from different countries ready to roll. They work. Here’s a taste of how your inbox would look:

| 🌍 Country | 📱 Number | 📩 Last Message | 🕒 Received |

Russia

Russia | +79379739211 | 5581 | 19/10/25 06:33 |

Russia

Russia | +79028324703 | 1817 | 10/12/25 06:31 |

Russia

Russia | +79147317813 | 3936 | 29/12/25 02:29 |

USA

USA | +15674576186 | 2987 | 21/03/25 11:33 |

Bhutan

Bhutan | +97577515343 | 864289 | 15/12/25 07:51 |

Canada

Canada | +15484282192 | 730519 | 18/12/25 04:55 |

USA

USA | +17428880655 | 78973 | 30/09/25 04:40 |

Russia

Russia | +79132928463 | 7026 | 18/12/25 03:26 |

Thailand

Thailand | +66979641658 | 4333 | 27/04/25 05:52 |

Canada

Canada | +12268552664 | 6614 | 22/05/25 10:15 |

Grab a fresh number if you’re dipping in, or rent one if you’ll be needing repeat access.

When a virtual number isn’t a good idea

Virtual numbers are potent tools, but they’re not a fit for absolutely everyone.

You might be better off sticking with your primary SIM if:

You’re in the middle of a complex fraud investigation or dispute with your bank.

You’re going through significant credit changes or a mortgage, and want as little friction as possible.

You regularly lose access to emails, logins, and password managers, even though you know you’re forgetful about digital stuff.

There are some edge cases too:

Banks and regulators can change direction, and specific ranges may be blocked or scrutinised more closely in the future.

If you share your PVAPins login with other people, you’ve basically made that virtual number “shared” again.

If you rely on a single rental number and forget to renew, it can expire, causing headaches.

Bottom line: PVAPins works best as a controlled, private second line for people who are intentional about their security. It’s not meant to be a burner phone for sketchy use.

To reduce the risk of surprises:

Keep a secure recovery email that you actually check.

Use a password manager, so losing one device doesn’t mean losing all your logins.

Stay loosely aware of SCA rules and Monzo updates, so verification changes don’t catch you off guard.

Conclusion:

If you’re ready to take your primary SIM off your Monzo account, here’s a simple path:

Start with free virtual numbers to test SMS delivery and see how fast codes land.

When you’re ready to verify, grab a dedicated line from receive SMS online for banking OTPs in 200+ countries.

For long-term use, move your account to a stable rental via Rent a Private Number for long-term Monzo logins.

Need help or details? Check PVAPins FAQs about virtual phone numbers and OTP verification.

Prefer mobile? Use the PVAPins Android app for instant OTP notifications.

PVAPins is not affiliated with Monzo. Please follow each app’s terms and local regulations.

Last updated: January 26, 2026

Explore More Apps

Similar apps you can verify with Monzo numbers.

Top Countries for Monzo

Get Monzo numbers from these countries.

Ready to Keep Your Number Private in Monzo?

Get started with PVAPins today and receive SMS online without giving out your real number.

Try Free NumbersGet Private NumberWritten by Mia Thompson

Her writing blends hands-on experience, quick how-tos, and privacy insights that help readers stay one step ahead. When she’s not crafting new guides, Mia’s usually testing new verification tools or digging into ways people can stay private online — without losing convenience.