Skrill SMS Verification with PVAPins

How it works

Use the right phone number format

Enter your number in international format (country code + digits). Skip spaces, dashes, and any extra leading 0.

Request the OTP once

Tap Send code and wait. Multiple rapid requests can trigger cooldowns.

Wait 60–120 seconds, then resend only once

If nothing arrives, wait a bit, then resend one time. More retries often reduce deliverability.

Check signal + SMS filters

Make sure you have network coverage, airplane mode is off, and your phone isn’t filtering unknown/shortcode messages into spam or blocked folders.

Try the backup method (if offered)

If Skrill shows email confirmation, app approval, or another recovery option, use it — it’s often faster during carrier delays.

If you still can’t get codes, contact Skrill support

For account security, Skrill may restrict OTP delivery routes. Support is the safest way to restore access.

OTP not received? Do this

- Wait 60–120 seconds (don't spam resend)

- Retry once → then switch number/route

- Keep device/IP steady during the flow

- Prefer private routes for better pass-through

- Use Rental for re-logins and recovery

Wait 60–120 seconds, then resend once.

Confirm the country/region matches the number you entered.

Keep your device/IP steady during the verification flow.

Switch to a private route if public-style numbers get blocked.

Switch number/route after one clean retry (don't loop).

Free vs Activation vs Rental (what to choose)

Choose based on what you're doing:

Quick number-format tips (avoid instant rejections)

Most verification forms reject numbers because of formatting, not because your inbox is “bad.” Use international format (country code + digits), avoid spaces/dashes, and don’t add an extra leading 0.

Best default format: +CountryCode + Number (example: +14155552671)

If the form is digits-only: CountryCodeNumber (example: 14155552671)

Simple OTP rule: request once → wait 60–120 seconds → resend only once.

Inbox preview

| Time | Country | Message | Status |

|---|---|---|---|

| 2 min ago | USA | Your verification code is ****** | Delivered |

| 7 min ago | UK | Use code ****** to verify your account | Pending |

| 14 min ago | Canada | OTP: ****** (do not share) | Delivered |

FAQs

Quick answers people ask about Skrill SMS verification.

1. Can I verify Skrill without using my personal phone number?

Yes. Skrill generally needs a valid, SMS-capable number, but it doesn’t have to be the SIM you use daily. A private virtual number you control can receive OTP codes, as long as you still complete identity and address checks with accurate information.

2. Is it safe to use a virtual phone number for Skrill verification?

It’s usually safe if the number is private, SMS-capable, and only you can see the messages. Avoid free public inboxes or shared numbers, as anyone may read your OTP or reuse that line, increasing the risk of account flags.

3. Why am I not receiving my Skrill verification code?

Common causes include formatting errors, wrong country code, inactive SIMs, SMS blocks, or temporary network issues. Double-check the number in Skrill, wait out the timer, and try a fresh OTP once; if codes keep failing, switch to a more reliable private route.

4. Can I send or receive money on Skrill without verification?

You may be able to perform limited actions with an unverified account, but higher limits, withdrawals, and many features usually require complete verification. Skrill and similar providers use these checks to comply with financial regulations and reduce fraud and abuse.

5. Is it legal to buy a verified Skrill account instead of verifying my own?

Buying a verified account is risky and often violates the terms of use. You don’t control the original identity or history, so that accounts can be frozen and funds locked; it’s much safer to verify your own Skrill account with your real details and a private number you control.

6. Which country's virtual number is best for Skrill verification?

Many users choose their actual country of residence or a nearby route with strong SMS delivery. If one region’s OTPs are unstable, trying a neighbouring country with better routing can improve success rates, as long as your personal data remains accurate and compliant with Skrill’s rules.

7. What should I prepare before starting Skrill verification?

Have your government ID, a recent proof of address, and your chosen phone number ready. Make sure all details match what you enter in Skrill and that your number can receive SMS in real time, so the process completes smoothly.

Read more: Full Skrill SMS guide

Open the full guide

Stuck on a Skrill OTP screen with no access to your usual SIM? You’re not alone. Many people want to verify Skrill without a phone number tied to their main line, whether it’s for privacy, travel, or just to avoid yet another app on their personal SIM.

The good news: Skrill needs a real, SMS-capable number, but it doesn’t have to be the one inside your physical phone. In this guide, we’ll walk through how Skrill verification works, how to plug in a private virtual number instead, how to fix “code not received” issues, and where PVAPins fit into the flow.

Do you really need a phone number to verify a Skrill account?

Skrill usually expects at least one SMS-capable mobile number as part of its security checks. You can’t skip Skrill verification altogether, but you don’t have to expose your everyday SIM. As long as the number can receive OTP codes reliably and you respect their terms, a private virtual line can still complete Skrill verification.

Why Skrill asks for a phone number:

Extra security: SMS codes add a second factor for logins and sensitive changes.

Account alerts: payment notifications, security warnings, and login alerts.

KYC rules: Many e-wallets now need at least one verified number as part of customer due diligence.

Recovery: if you get locked out, that number often helps you get back in.

The critical detail is not “Is this my personal SIM?” but “Is this a number I control that can reliably receive SMS?” If you have zero accessible numbers, no SIM, no virtual line, that’s when Skrill verification becomes a real blocker.

This is where the idea of verifying Skrill without your main number comes in. Instead of tying everything to the SIM you use for family, banking, work, and every other app, you route Skrill OTPs through a private virtual line from PVAPins, keeping things nicely separated.

How Skrill verification works (ID, address, and phone checks explained)

Before you try anything clever with phone routing, it helps to understand how Skrill account verification works overall. Skrill doesn’t just check your number; it typically looks at three pieces of the puzzle:

Identity verification (ID)

You upload clear photos or scans of:

Passport

National ID card

Driving license

The name, date of birth, and photo must match the details on your account.

Address verification

Skrill may ask for a recent:

Bank statement

Utility bill (electricity, gas, water, internet)

Official letter from a bank or authority

The key things: your name, address, and a recent date. Blurry screenshots or cropped images are a common reason for rejection.

Phone number verification

Inside your Skrill dashboard (typically under Settings → Personal details → Phone number), you add a mobile number and request an SMS code. Enter the OTP, and if it matches, your Skrill phone verification is complete.

Once these checks are done and approved:

Your limits usually increase.

Certain features (like higher withdrawals or specific transfers) unlock.

Your account looks less “risky” from a compliance perspective.

Think of it as a three-layer lock: ID, address, and phone. The phone part is essential, but again, it doesn’t have to be your daily SIM. It just needs to be legit, SMS-capable, and under your control.

Can you verify Skrill without using your main phone number?

Short answer: Yes, often you can. Skrill cares that the number is valid and SMS-capable, not that it’s physically inside the phone you’re holding right now. A private virtual phone number for Skrill can receive OTPs just like any regular mobile line and stay attached to your profile.

A few key points:

The requirement is essentially:

Can receive SMS.

Not obviously fake or blocked.

Under your control (not a public inbox anyone can see).

Your primary SIM is just one option. A travel SIM, a secondary SIM, or a private virtual line can all work if they meet the above conditions.

Public/shared numbers (the ones where anyone can read the SMS in a web inbox) are another story. They’re overused, often abused, and in some cases already flagged. You don’t want your Skrill OTP landing where strangers can see it.

This is where PVAPins come in: instead of a public or recycled number, you use a private, non-VoIP route in one of 200+ countries. You can choose between quick one-time activations and longer rentals, depending on how often Skrill pings your number.

Step-by-step: how to verify Skrill without your personal phone number using a virtual line

Here’s the practical flow most readers are looking for: how to actually plug in a virtual number and get verified.

To verify Skrill without your personal phone, you:

Get a private virtual number that supports SMS.

Link it inside your Skrill profile.

Request the OTP and read it in your PVAPins dashboard or Android app.

Enter the code in Skrill and finish your ID/address checks.

Let’s break it down.

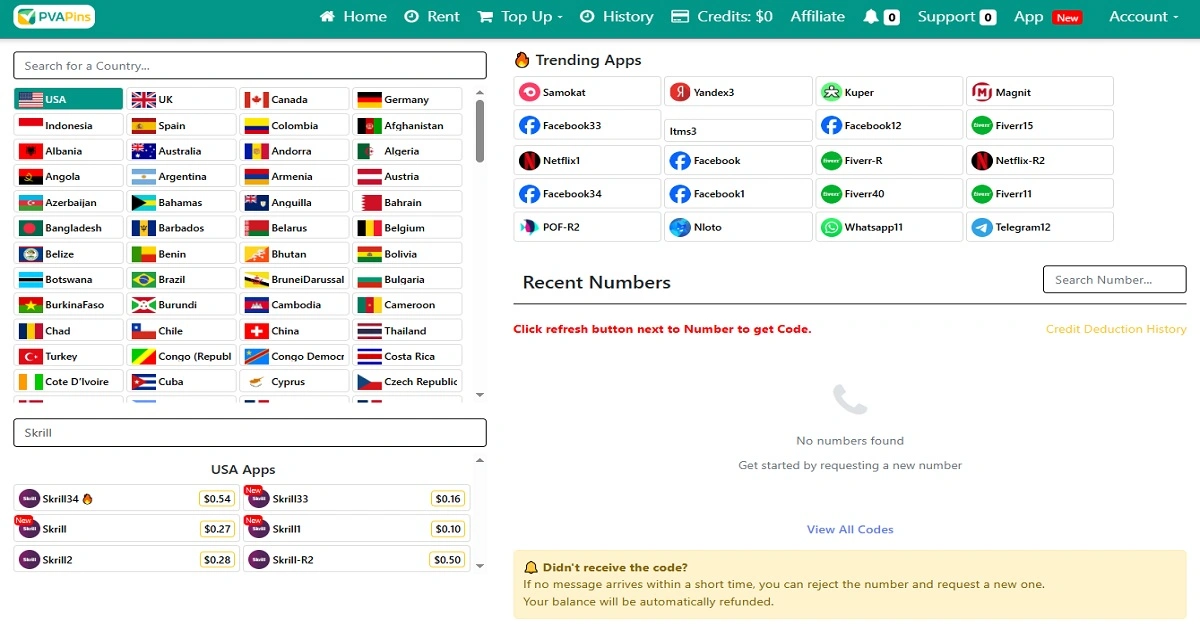

Choose your private virtual number via PVAPins

Head to PVAPins and pick a country with good Skrill routing.

Decide whether you need a quick one-time activation or a longer rental (more on that below).

Open your Skrill settings.

Log in to Skrill.

Go to Settings → Personal details → Phone number.

If a wrong/old number is there, update it.

Add the virtual number in the correct format.

Enter the number in full international (E.164) format, starting with “+” and the country code.

Double-check the digits; a single typo means your OTP goes to the wrong person or nowhere.

Request and read the SMS code.

Tap to send the verification code.

Open your PVAPins web inbox or Android app.

You should see the Skrill OTP appear shortly.

Finish ID and address verification

After the phone is verified, upload your ID and address documents if you haven’t already.

Once all three checks are approved, your Skrill verification process is considered complete, and your limits usually improve.

When your documents are clean and your number works correctly, approvals can be fast. When there are issues, it’s usually due to unclear photos, mismatched data, or using unstable phone routes, precisely what you’re avoiding by using a stable private line.

Option 1 – One-time activation number for quick Skrill verification

Use this when:

You only need to verify Skrill once,

You rarely change devices or locations, and

You don’t expect constant re-verifications.

The flow is simple:

Buy a one-time activation number for Skrill in PVAPins.

Plug it into Skrill, receive the OTP once, and complete your KYC.

Keep that number tied to the account as long as possible.

The main risk is future re-checks. If Skrill asks again for an SMS code months later and that activation number is long gone, you’ll be stuck updating your phone data, which might trigger additional checks.

This option is perfect if you just want a fast, clean verification now and don’t mind switching to a rental later if Skrill gets stricter.

Option 2 – Rent a dedicated virtual number if Skrill keeps re-checking your account

Use this when:

You’re a frequent Skrill user,

You move between devices or countries a lot, or

You’ve seen Skrill ask for additional verification before.

Here, you:

Rent a number for 7, 30, or more days via PVAPins.

Use it for the initial Skrill phone verification and for future logins or security checks.

Enjoy continuity: the same line stays yours for the entire rental period.

Pros:

Fewer lockouts or “we sent you a code” dead ends.

Easier account recovery if Skrill wants to reconfirm your number.

Less stress if you rely on Skrill for regular transfers or payouts.

This is where PVAPins /rent really shines, especially for accounts you can’t afford to lose.

Free vs low-cost virtual phone numbers for Skrill – which should you use?

Yes, there are free public numbers on the internet. For low-stakes tests, they can be entertaining. But for a real money account like Skrill, relying on them is let’s say, brave.

Free public inboxes:

They are heavily reused for sign-ups and spam.

Often end up blocked or restricted by financial apps.

Let anyone see the OTPs, not just you.

Low-cost private virtual numbers:

Give you unique routes, so you’re not sharing a number with strangers.

Usually offer better deliverability and fewer “no code received” headaches.

They are far safer for long-term Skrill accounts, especially when real funds and identity are involved.

A simple rule:

Free → okay for testing, receiving SMS delivery or learning the flow.

Paid private → essential for serious accounts, balances, and long-term use.

That’s why PVAPins is designed with both modes in mind: you can experiment with free numbers in some contexts, then switch to private non-VoIP routes once you’re handling real transactions.

Fixing Skrill phone verification problems (code not received, wrong number, locked out)

If your Skrill code never arrives, don’t panic. Most Skrill phone verification issues stem from a few predictable causes.

Here’s your quick checklist:

Check the country code and format.

Make sure the number is in full international format, starting with “+”.

Check the SIM or virtual route.

Is the number still active? Has your SIM expired?

Don’t spam the resend button.

Request the code, wait for the timer, then try once more if needed.

Review device and app filters.

On physical phones, check if SMS is blocked, filtered, or diverted to another app.

If the number itself is dead or incorrect, update it in Settings → Personal details → Phone number, then link a fresh, stable line, ideally a private virtual number you control.

Some users get temporarily locked out if:

They enter too many wrong codes.

They repeatedly change numbers in a short time.

Their account is under extra review.

If that happens, you may need to wait, then follow Skrill’s support instructions. In the future, using a reliable PVAPins route reduces the chance of “code not received” drama.

Is it safe and legal to use a virtual phone number for Skrill verification?

In most cases, yes, using a virtual phone number for Skrill is fine as long as you:

Provide real, accurate personal information for your ID and address.

Use a private, SMS-capable line you control.

Follow Skrill’s terms and local regulations.

What’s risky is:

Using public/shared numbers where anyone can read your OTP.

Trying to hide your identity or bypass KYC rules entirely.

Repeatedly swapping numbers in a way that looks suspicious.

From a safety perspective, the key is exclusive access. If only you could read the OTP and manage the number, a virtual line behaves a lot like a standard SIM, just easier to manage.

PVAPins leans into this model: private, non-VoIP options where your codes aren’t dumped into a public inbox. You get the convenience of a virtual number with the control you need for financial apps.

Again: PVAPins is not affiliated with Skrill. Always follow Skrill’s terms and local regulations.

Why buying a “verified Skrill account” is risky (and what to do instead)

If you’ve ever searched around, you’ve probably seen sketchy offers to buy a verified Skrill account. On paper, it might look like a shortcut. In reality, it’s a fast lane to account freezes and headaches.

Why it’s risky:

You don’t know whose identity or documents were used.

You inherit all previous activity on that account, good and bad.

If Skrill connects the dots, the account can be frozen or permanently closed.

You have no clean way to prove ownership if there’s a dispute.

You’re basically renting risk. Funds can be held, verification can be revoked, and you may be left with no practical appeal.

A much safer path:

Verify your own Skrill account using accurate details.

Use a private virtual number you control for phone verification.

Keep everything aligned: ID, address, and phone, so your story is consistent.

Instead of paying for gray-market shortcuts, use tools like PVAPins to address legitimate pain points (such as phone access) while still complying with Skrill’s rules.

How to verify Skrill without a local SIM in India and nearby countries

What if you’re in India (or a nearby country) and no longer have a local SIM? Maybe you travel a lot, moved abroad, or prefer not to keep multiple physical SIMs.

You can still verify Skrill without a local SIM in India using a private virtual number:

Choose an Indian route or a nearby region with strong SMS delivery.

Add that number in Skrill, request the OTP, and receive it online.

Complete your ID and address checks as usual.

This is especially useful if:

You closed your old Indian SIM, but still use Indian banks or INR.

You’re abroad, and roaming charges make SMS unreliable.

You want a dedicated Skrill number instead of juggling multiple SIMs.

Example flow – Skrill verification in India using a private virtual number

Here’s how a typical Indian user might do it with PVAPins:

Select India as your PVAPins country.

If Indian routes are unstable at that moment, consider a nearby backup country that still works well for Skrill OTPs.

Choose one-time or rental.

One-time activation if you just need to get verified quickly.

Rental if you expect repeated logins, 2FA, and security checks.

Add the +91 number in Skrill.

Go to your phone settings, plug in the virtual number, and request the SMS code.

Receive and enter the OTP.

Open PVAPins, read the OTP, and paste it back into Skrill.

Complete PAN/passport and address docs.

Make sure your Indian identity and address proofs are clear and consistent with your Skrill details.

Test with a small transaction.

Once verified, log out and back in, and try a small, low-risk transaction to confirm everything is stable.

The same logic applies to nearby regions; you just switch the country choice and the local examples.

When you should still use your real number or contact Skrill support

There are situations where a virtual number isn’t the magic fix, and you should switch back to your real phone or talk directly to Skrill.

Consider using your real number or contacting support when:

Your account is already heavily flagged or under investigation.

Your ID or address documents have been rejected multiple times.

You’ve repeatedly changed the numbers, and the system now treats your account with suspicion.

You’re dealing with frozen funds or critical issues that clearly require manual review.

In those cases:

Clean up your documents first (clear photos, matching details).

Prepare a simple, honest explanation of what happened.

Contact Skrill via their official support channels and follow their instructions.

Virtual numbers are great for solving the problem of phone access. They can’t magically fix deeper compliance or fraud concerns.

How PVAPins helps with fast, private Skrill OTP delivery (free, instant, rental)

Let’s talk about how PVAPins actually fits into all of this.

PVAPins gives you private virtual numbers in 200+ countries, optimized for OTP use cases like Skrill. You get three main ways to plug it into your flow:

Test:

Use selected free virtual numbers (where appropriate) to see how SMS routing behaves before you commit.

Instant:

Buy one-time activation codes to quickly verify your Skrill account. This is perfect when you just want to pass the OTP step right now.

Rent:

For accounts you rely on, rent a dedicated number for 7, 30, or 90 days (or longer) and use it as your Skrill line for repeated logins and re-verifications.

Alongside that, PVAPins leans on:

Private/non-VoIP options for better deliverability and fewer blocks.

API-ready stability if you’re automating verification flows or managing multiple accounts for a business.

An exhaustive list of payment options, including Crypto, Binance Pay, Payeer, GCash, AmanPay, QIWI Wallet, DOKU, Nigeria & South Africa cards, Skrill itself, and Payoneer.

You can manage everything from:

The PVAPins web dashboard, or

The PVAPins Android app lets you grab numbers and read codes without being stuck at your desk.

A simple funnel that works nicely:

Try a free number to get comfortable with the flow.

Use an instant activation for your real Skrill verification.

Move to a rental if Skrill keeps messaging your number over time.

Summary checklist before you try to verify Skrill without a phone number

Before you dive in, take 30 seconds to run through this checklist:

Your ID and address documents are clear, valid, and match your Skrill details.

You’ve decided whether you need a one-time activation or a rental number.

You’ve picked a country route known for decent OTP delivery.

You’ve tested receiving at least one SMS on your chosen PVAPins number.

You understand Skrill’s limits and terms, and you’re not trying to dodge KYC.

Most failed verifications don’t come from the concept of virtual numbers; they come from messy documents, mismatched addresses, or unstable phone routes. Fix those, and your chances of a smooth verification go way up.

Numbers That Work With Skrill:

PVAPins keeps numbers from different countries ready to roll. They work. Here’s a taste of how your inbox would look:

| 🌍 Country | 📱 Number | 📩 Last Message | 🕒 Received |

Spain

Spain | +34613454372 | 436639 | 02/08/25 08:28 |

Indonesia

Indonesia | +6285601662336 | 254671 | 18/06/25 09:55 |

Poland

Poland | +48691015294 | 690912 | 05/09/25 07:33 |

France

France | +33673928111 | 433176 | 08/06/25 09:14 |

Grab a fresh number if you’re dipping in, or rent one if you’ll be needing repeat access.

Conclusion:

You can verify your Skrill account without using your everyday phone number, but you can’t skip providing honest data. Use accurate ID and address details, then let a private virtual number from PVAPins handle the OTP side. That way, you stay compliant, keep your primary SIM out of yet another app, and still enjoy a verified Skrill account you can trust.

Compliance note: PVAPins is not affiliated with Skrill. Please follow each app’s terms and local regulations.

Last updated: January 23, 2026

Explore More Apps

Similar apps you can verify with Skrill numbers.

Top Countries for Skrill

Get Skrill numbers from these countries.

Ready to Keep Your Number Private in Skrill?

Get started with PVAPins today and receive SMS online without giving out your real number.

Try Free NumbersGet Private NumberWritten by Team PVAPins

Team PVAPins is a small group of tech and privacy enthusiasts who love making digital life simpler and safer. Every guide we publish is built from real testing, clear examples, and honest tips to help you verify apps, protect your number, and stay private online.

At PVAPins.com, we focus on practical, no-fluff advice about using virtual numbers for SMS verification across 200+ countries. Whether you’re setting up your first account or managing dozens for work, our goal is the same — keep things fast, private, and hassle-free.