Everywhere you look, another app wants a code. OnePay is no different. That’s fine when you’re happy to throw in your genuine SIM, but not so great when you care about privacy, want a clean “money-only” number, or your primary phone line just isn’t available. In this guide, we’ll walk through how to verify OnePay without a phone number tied to your everyday SIM, what actually works (and what doesn’t), and where a private virtual number from PVAPins fits into the picture.

What is OnePay, and why does it require a phone number?

OnePay is a mobile banking–style app with a debit-style card and digital wallet features. In simple terms, it’s an app that lets you spend, earn rewards, and track money from your phone.

Because it deals with money, OnePay leans heavily on your mobile number for security: logins, SMS verification codes, and essential alerts all revolve around that one piece of data.

If you don’t have a working number on file, you’ll struggle to create a OnePay account, sign in on a new device, or recover access if something breaks.

How OnePay uses your phone for security and login

When you first create a OnePay account, the app usually asks you for:

That phone number is then used to:

Send one-time passwords (OTPs) whenever you log in or perform a sensitive action.

Ping you about suspicious activity or new device sign-ins

Double-check your identity when resetting your password or editing your profile.

Is SMS perfect? No. Is it still one of the most common security layers in banking apps? Absolutely. Plenty of banks and wallets still use SMS as the primary “second factor” to confirm it’s really you.

What happens if your OnePay phone number changes?

Phone numbers aren’t permanent. Carriers recycle old lines, people switch SIMs, move countries, or jump to eSIM and forget to update apps.

If the number linked to OnePay changes or disappears:

You may stop receiving verification codes entirely

Account recovery becomes a headache because OnePay keeps sending OTPs to a dead number.

In some cases, a recycled number might belong to someone else, which is a real security risk.

So it’s worth planning. Do you actually want your long-term SIM tied to every app? Or does it make more sense to give OnePay its own number from day one?

Can you verify OnePay without using your personal phone number?

Short answer: often, yes. OnePay generally needs a valid, SMS-capable number. It doesn’t care if that’s your daily SIM, a business line, or a virtual number, so long as the code lands in an inbox you control.

So you can usually verify OnePay without a phone number that’s tied to your primary SIM by using:

The key requirement is simple: OnePay still needs to see that a real person controls the number.

OnePay rules vs practical workarounds

Let’s keep this straight:

OnePay has its own policies, KYC checks, and risk systems

Nothing here is about “bypassing” those rules.

In real life, though, you’ve got a few legitimate options:

A second physical SIM in a dual-SIM phone

A dedicated business line if you don’t want to mix work and personal life

A virtual number (non-public, higher-quality routes) that receives OTPs in an online inbox or app

What’s not okay:

Using fake identities or stolen details

Farming multiple accounts for bonuses, cashback abuse, or fraud

Forcing OTPs through sketchy routes purely to dodge security checks

PVAPins sits firmly in the “practical, privacy-friendly” camp. It gives you a separate SMS-capable number you control, without pretending OnePay’s rules don’t apply.

When a separate number makes sense for privacy

A separate number for OnePay makes a lot of sense if:

You don’t want your primary SIM tied to dozens of apps and potential data leaks

You share your phone number publicly (clients, social media, business cards) but prefer not to link it to your bank account.

You travel often, change SIMs, or use roaming.

You manage payouts or expenses for a side hustle and want that activity cleanly separated.

In all those cases, a dedicated OnePay number is cleaner and safer than putting everything on a single SIM.

Why your OnePay verification code is not received

Sometimes the issue isn’t OnePay itself or the number provider. It’s the boring stuff: formatting, delays, filters, or device quirks.

If you don't receive your OnePay verification code, don’t freak out. Start with a simple checklist and work through it calmly.

Common reasons OnePay OTP fails or times out

Here are the usual culprits:

Country code problems – Missing +1, wrong country, or an extra digit in front

Typos – One wrong number sends OTPs into the void

Short-code blocking – Some devices or carriers quietly block those special SMS numbers.

Overused/low-quality routes – Shared or abused number ranges get filtered or delayed.

Device issues – Full SMS inbox, airplane mode, weak signal, or an app that “protects” you by blocking SMS

In many cases, those tiny details are why a OnePay OTP failed to appear.

How long should you wait before resending the code?

Most of us smash the resend button the second nothing appears. Honestly… that usually makes things worse.

A calmer, safer pattern:

Wait 30–60 seconds for the first SMS

Re-check the number and country code.

Try one resend

If it still doesn’t arrive, stop spamming.

From there:

Test the number with another SMS (another app, or a test message if possible)

Consider switching from a public or overused route to a private virtual number.

If several clean attempts fail, talk to official OnePay support instead of burning more codes.

Option 1: Using a secondary SIM or phone line for OnePay

A secondary SIM is the old-school solution. You keep OnePay on a different number, but it’s still a traditional mobile line.

This works well if you:

Already use a dual-SIM phone

Have a spare handset sitting in a drawer.

Want a clear split between “personal SIM” and “money apps.”

Pros and cons of a second physical SIM

Pros

Strong, carrier-level reliability

Less likely to be flagged than obvious throwaway routes

Works anywhere you have normal network coverage

Cons

Extra monthly cost for the line or data

Roaming fees if you travel a lot

Often tied closely to your ID (SIM registration in many countries)

Useless when the spare phone is at home, and you’re not.

You can update your OnePay account registration later if you switch numbers, but that usually means more verification steps.

When a backup phone is still the best option

A backup phone or second SIM is still hard to beat if:

OnePay is core to your daily finances

You rarely travel, and your local carriers are stable.

You’re okay with the number being “yours” in the telco’s system.

If you’d rather have more privacy and flexibility than a physical SIM can offer, a virtual number starts looking far more attractive.

Option 2: Using a virtual number to verify OnePay

A virtual number is a phone line that lives in the cloud instead of on a tiny plastic card. You manage it from a website or app, but as far as OnePay is concerned, it’s just a normal number that receives SMS.

To verify OnePay without your personal SIM, you basically:

Get a virtual number from a provider like PVAPins

Enter that number on the OnePay sign-up screen.

Read the OTP in your online inbox or app.

Paste it into OnePay and finish the setup.

Done with private, non-public routes, this is a nice balance between privacy and reliability.

What is a virtual number for OnePay OTP?

Here’s the simple version:

You activate or rent a temporary phone number

It lives on a server, not in your physical phone.

OnePay sends the OTP to that number.

The message pops up inside your PVAPins dashboard or Android app.

You can use that virtual phone number for OnePay the same way you’d use a standard mobile line, as long as the route is accepted and not used for spam.

Temporary vs rental virtual numbers for OnePay

With PVAPins, you’ve usually got two clear options:

Designed for long-term logins, 2FA, and password resets

You keep the same number active for days, weeks, or months.

For a one-off setup, a temporary OnePay phone number is fine. If OnePay becomes part of your everyday routine, a rental gives you a stable login channel that doesn’t suddenly vanish.

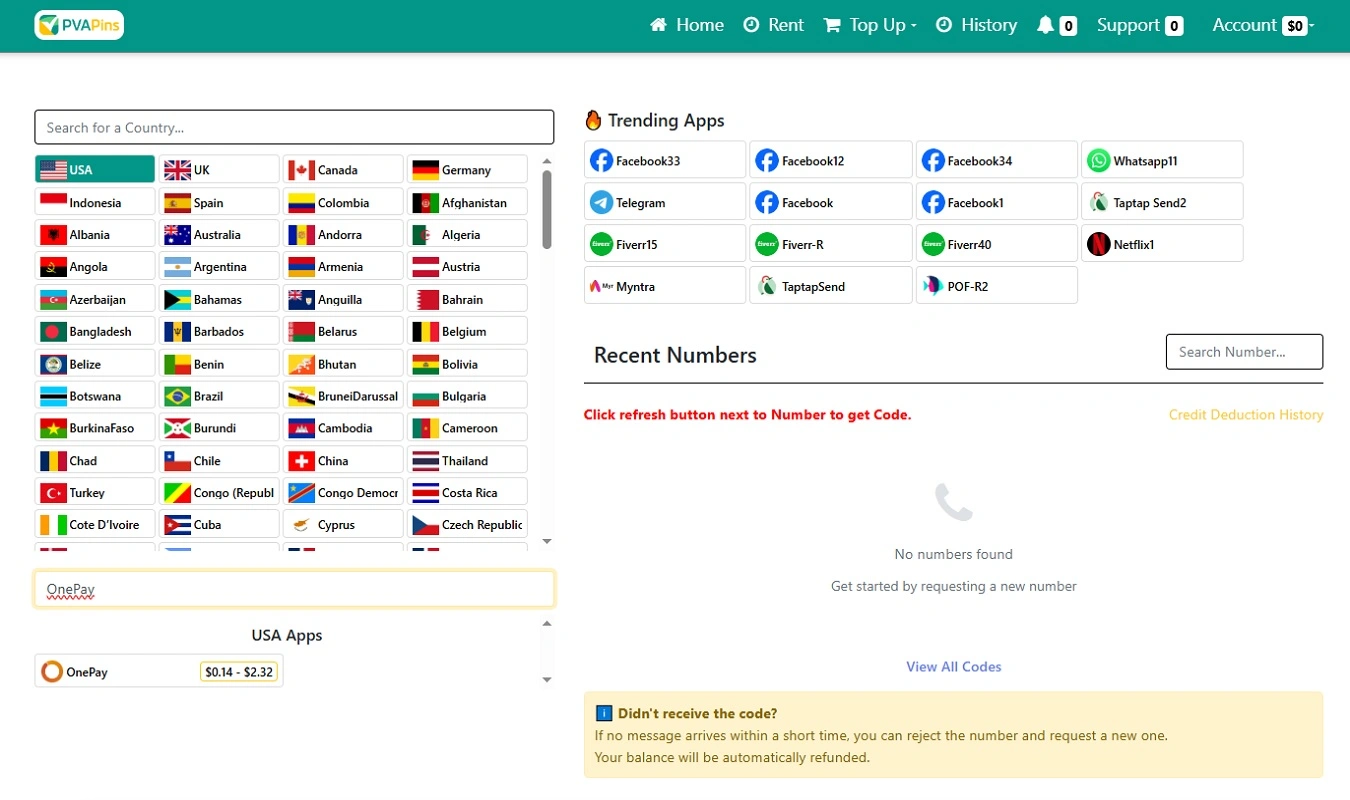

Step-by-step: Verify OnePay without a phone number using PVAPins

Let’s put everything into a simple flow. Here’s how to set up OnePay using PVAPins instead of your primary SIM.

Reminder: PVAPins is not affiliated with OnePay. You’re responsible for using any virtual number in line with OnePay’s terms and local regulations.

Create your PVAPins account and add a balance.

Go to PVAPins and create a free account.

Secure it with a strong password and (ideally) 2FA.

Add a small balance just enough to cover a couple of OTPs or a short rental.

Payment options usually include:

You don’t need to start big. A modest top-up is enough to test OnePay once or twice and find which route works best.

Choose a OnePay-supported country and number.

Next steps:

Open the PVAPins receive SMS or free numbers section.

Filter by country (for OnePay, many people start with the USA, but you can test others).

Look for numbers or routes used for banking, fintech, or OTP traffic.

Either activate a one-time number for instant signup, or choose a rental if you already know you’ll be using OnePay long term.

This is where you build your OnePay without a phone number: you’re using a number you control, but it’s not your personal SIM.

Enter the number in OnePay and read your SMS.

Jump back into OnePay:

Start the sign-up or verification flow

Paste your PVAPins number into the phone field.

Double-check the country code and formatting.

Request the OTP

Within a few seconds, the OnePay code should pop up in your PVAPins dashboard or Android app. Copy it into OnePay, finish the flow, and you’re done. Your primary SIM stays completely out of it.

If codes don’t arrive:

Check the troubleshooting section below

Try a different PVAPins route or country.

Resist the urge to hammer the resend button.

Quick CTA:

• Test with a free or low-cost number: “Free test numbers for OnePay-style apps” →

• Need instant OTP delivery? “Virtual numbers to receive OTP codes online” →

• Want something long-term? “Rental phone numbers for ongoing logins and 2FA” →

Verify OnePay without a phone number in the USA

OnePay is heavily focused on US-style banking and debit use. You don’t have to live in the USA to use it, but US routes often behave differently from those in other countries.

OnePay without a phone number in the USA – what changes?

If you’re in or targeting the US, it often makes sense to:

Use a US virtual number that behaves like a regular mobile line

Prioritize routes that deliver reliably to major US carriers.

See pricing in USD, so you know precisely what each OTP or rental costs.

Using a PVAPins US number lets you set up OnePay without tying a personal AT&T/Verizon/T-Mobile SIM to your account, while still appearing like a “normal” US user to OnePay.

Examples for India, Mexico, and other regions

Outside the US, the logic is similar; you have a few more levers to pull.

India – You may want to keep your Indian SIM private while still using OnePay. Testing a US number vs an Indian route can show which path delivers OTPs more consistently.

Mexico – If you’re often between countries, a stable US or local MX route keeps your OnePay codes flowing, even when your physical SIM changes.

Philippines, Nigeria, others – Same idea: pick a route that OnePay accepts and your carrier doesn’t mangle or filter.

On PVAPins, you can view pricing in currencies like USD, INR, MXN, etc., so you’re not guessing how much each verification will cost.

Free vs low-cost virtual numbers for OnePay – which should you use?

If you Google OnePay SMS verification online, you’ll quickly bump into “online receive SMS number” websites. They’re tempting, no signup, no card, just a big public inbox.

For a banking-style app like OnePay, though, those free inboxes are usually a terrible idea.

When a free public inbox is too risky

Most free public inboxes are:

Shared by thousands of people

Sometimes indexed by search engines.

Often attached to heavily abused number ranges.

That means:

OTPs might never arrive at all

If they do, anyone can see and reuse your code.

OnePay may start distrusting or blocking those ranges over time.

For anything involving money, a free public inbox is more of a “playground test” than a real solution.

Why low-cost private routes are usually more stable

A low-cost, private virtual number from PVAPins gives you:

A number only you control during the activation or rental period

Much cleaner routes, so OTPs are more likely to land

A better security posture, no random strangers reading your messages

Transparent pricing per activation or rental (often just a small amount per verification)

For OnePay, that’s the difference between:

Constant failures, lockouts, and stress

Versus a reliable, private login channel that quietly does its job

Safety, compliance, and when you shouldn’t use a virtual number for OnePay

Virtual numbers are tools, not magic cheat codes. Used correctly, they make it easier to protect your privacy and still get your OTPs. Poorly used, they can get your account flagged.

Avoiding scams and fake security texts

A few basics that go a long way:

Only enter codes inside the official OnePay app or website

Never share screenshots of your OnePay OTPs with anyone.

Ignore “support” messages asking for your code. Legit teams don’t do that.

Only download OnePay from official app stores

Most banking-related scams revolve around stealing SMS codes. Treat your OTP like a password: private, non-negotiable.

When OnePay support is the only safe option

There are situations where the best move is to stop experimenting and talk to OnePay directly:

You’ve tried several clean routes and still can’t receive codes.

OnePay has explicitly asked for documents or ID.

Your account is locked, under review, or shows security warnings.

In those cases, virtual numbers aren’t a workaround. Follow the instructions OnePay gives you and use the channels they recommend.

What to do if OnePay still doesn’t send or accept your code

Sometimes you do everything “right,” and the app still refuses to cooperate. Here’s how to approach that without losing your mind.

Checklist before you contact OnePay support

Before you open a support ticket, run through this list:

Check the number format – Correct country code, no extra digits

Test your device: turn airplane mode off, reboot, and clear SMS storage.

Disable SMS blockers – Check spam filters and security apps that might catch short codes

Switch routes in PVAPins – Move from public/free-style options to private, non-VoIP routes

Try another country – If a local route fails, test a US or alternate-country virtual number.

Take screenshots, note timestamps, and keep any error messages. That info helps support teams help you.

When to switch to a different number route

If:

You’ve requested 1–2 codes

You’ve checked formatting and device settings.

You’ve waited a reasonable amount of time.

And OnePay still doesn’t send or accept your OTP, it’s time to:

Once multiple clean attempts have failed, throwing more numbers at it usually doesn’t fix the root issue.

How PVAPins fits into a long-term OnePay setup (rentals, multi-use numbers)

If you plan to use OnePay regularly, you don’t just need a one-off verification. You need a stable way to receive OTPs for logins, 2FA prompts, and recovery.

That’s where PVAPins rentals and multi-use virtual numbers for OnePay come in.

Using rentals for ongoing OnePay logins

With a rental number:

You keep the same line active for a defined period (days, weeks, or months)

OnePay can continue sending OTPs to that exact number.

You don’t get locked out just because a one-time number expired.

Rentals make sense if:

OnePay is part of your daily financial routine

You’re getting payouts or handling business-related money.

You log in from multiple devices and want a predictable 2FA channel.

Keeping your account recoverable without exposing your SIM

By putting OnePay on a rental virtual number instead of your primary SIM:

You avoid tying your financial life to a number you might change or lose

You reduce chaos by switching carriers, countries, or physical devices.

You keep a consistent OTP channel for account recovery.

Pair that with solid habits, strong passwords, official app downloads, and regular security checks, and you get a nice blend of privacy, reliability, and recoverability.

Numbers That Work With OnePay:

PVAPins keeps numbers from different countries ready to roll. They work. Here’s a taste of how your inbox would look:

| 🌍 Country | 📱 Number | 📩 Last Message | 🕒 Received |

Philippines

Philippines | +639265464133 | 352148 | 15/08/25 08:23 |

Russia

Russia | +79132318386 | 16585 | 14/12/25 08:31 |

Brazil

Brazil | +5588988867038 | 708018 | 17/10/25 01:38 |

USA

USA | +16465272417 | 6398 | 29/07/25 10:47 |

Russia

Russia | +79033472902 | 446-232 | 21/12/25 06:20 |

Russia

Russia | +79891733359 | 4823 | 01/02/26 09:32 |

Philippines

Philippines | +639649138513 | 728716 | 19/03/25 09:09 |

UK

UK | +447529723902 | 8686 | 12/02/26 05:55 |

Russia

Russia | +79142135942 | 1031 | 05/11/25 05:29 |

Malaysia

Malaysia | +601135163680 | 151393 | 11/02/26 09:13 |

Grab a fresh number if you’re dipping in, or rent one if you’ll be needing repeat access.

Conclusion: Verify OnePay Without a Phone Number, the Smart Way

You don’t have to hand your everyday SIM to every app that asks for it. With a bit of planning, you can keep your personal number private, stay compliant, and still get your OnePay OTPs on time.

Quick recap:

OnePay needs a real SMS-capable number, but it doesn’t have to be your personal line.

Secondary SIMs work, but they’re not always the most flexible or private option.

A private virtual number from PVAPins gives you a clean, dedicated route for OnePay OTPs.

Rentals keep your login and recovery channel stable for long-term use.

If you’re ready to tidy up your setup:

Start small: test OnePay with a low-cost, private PVAPins number

If it works well, move to a rental for ongoing logins and 2FA.

Keep everything aligned with OnePay’s policies and your local laws.

Your SIM stays private. Your OnePay account remains accessible. That’s a much healthier setup and beyond.

Compliance note: PVAPins is not affiliated with OnePay. Please follow each app’s terms and local regulations.

Philippines

Philippines Russia

Russia Brazil

Brazil USA

USA UK

UK Malaysia

Malaysia