MoneyLion SMS Verification with PVAPins

How it works

Confirm the phone number on your MoneyLion account

Make sure the country code and digits match what’s saved in your profile.

Request the OTP once

Tap Send code and wait. Rapid repeats can trigger rate limits.

Wait 60–120 seconds → resend only once

If nothing arrives, wait a bit, then resend one time. Don’t spam.

Check signal + SMS filters

Airplane mode off, solid coverage, and check spam/blocked/unknown sender filters (some phones hide short codes).

Restart your phone (quick fix)

A restart can refresh your carrier connection and help stuck SMS deliver.

Use a backup method if offered

If MoneyLion shows email or in-app verification, use it—SMS can be delayed depending on carrier routes.

Still stuck? Contact MoneyLion support

For financial accounts, verification may be restricted for security—official support is the safest path.

OTP not received? Do this

- Wait 60–120 seconds (don't spam resend)

- Retry once → then switch number/route

- Keep device/IP steady during the flow

- Prefer private routes for better pass-through

- Use Rental for re-logins and recovery

Wait 60–120 seconds, then resend once.

Confirm the country/region matches the number you entered.

Keep your device/IP steady during the verification flow.

Switch to a private route if public-style numbers get blocked.

Switch number/route after one clean retry (don't loop).

Free vs Activation vs Rental (what to choose)

Choose based on what you're doing:

Quick number-format tips (avoid instant rejections)

Most verification forms reject numbers because of formatting, not because your inbox is “bad.” Use international format (country code + digits), avoid spaces/dashes, and don’t add an extra leading 0.

Best default format: +CountryCode + Number (example: +14155552671)

If the form is digits-only: CountryCodeNumber (example: 14155552671)

Simple OTP rule: request once → wait 60–120 seconds → resend only once.

Inbox preview

| Time | Country | Message | Status |

|---|---|---|---|

| 2 min ago | USA | Your verification code is ****** | Delivered |

| 7 min ago | UK | Use code ****** to verify your account | Pending |

| 14 min ago | Canada | OTP: ****** (do not share) | Delivered |

FAQs

Quick answers people ask about MoneyLion SMS verification.

1. Can I verify MoneyLion without giving them my personal phone number?

Yes. MoneyLion mainly checks that your number can receive and confirm an SMS code. You can use a private virtual number instead of your daily SIM, as long as it’s reachable, not abused, and you still follow MoneyLion’s terms and local regulations.

2. Is it safe to use a temporary phone number for MoneyLion verification?

It’s generally safer to use a private, paid temporary number than a public free inbox. With a private line, only you can see the codes, reducing the chance that MoneyLion has already flagged the number for abuse or spammy behaviour.

3. What should I do if my MoneyLion verification code is not received?

Start with basics: double-check the number, wait a full minute, and confirm you have SMS coverage. Check your phone's spam filters or blocked senders list. If several attempts still fail, contact MoneyLion support and then consider moving to a clean virtual number with better delivery.

4. Will MoneyLion block me for using a virtual phone number?

MoneyLion doesn’t publish a detailed list of allowed number types. In reality, issues tend to happen with heavily abused public VOIP numbers. A private, stable virtual number that consistently receives SMS is less likely to cause problems, but you still need to respect MoneyLion’s terms.

5. Can I close my MoneyLion account if I lost access to my old phone number?

In most cases, yes. You’ll need to work with support, verify your identity using other details (such as an ID or email), and then update the phone number on file. After that, you can attach a new personal or virtual number to handle final confirmation codes.

6. How does this work if I’m overseas and don’t have my home SIM active?

You can verify using a virtual number that receives SMS over the internet, so you don’t rely on roaming at all. This is especially helpful if your bank texts don’t reach your foreign SIM or you’re using Wi-Fi only while travelling.

7. Does PVAPins work with other apps besides MoneyLion?

Yes. PVAPins supports SMS verification for thousands of global apps and services. The same flow: pick the app, choose a country, and grab the OT. P. Works across many platforms while still keeping your personal SIM private.

Read more: Full MoneyLion SMS guide

Open the full guide

Stuck on a MoneyLion verification screen but really don’t want to hand over your real mobile number? Totally fair. Plenty of people enjoy the perks of MoneyLion without giving up privacy, swapping SIMs, or fighting with missing SMS codes. In this guide, we’ll walk through how to verify MoneyLion without a phone number tied to your everyday SIM by using private virtual numbers from PVAPins and a few simple troubleshooting steps.

We’ll keep it practical and straight to the point: get the OTP, stay secure, keep your real number out of it.

Quick answer – can you verify MoneyLion without a phone number?

Short version: yes, you can. MoneyLion needs a phone number, but it doesn’t have to be the one on your physical SIM. As long as the number can receive SMS in real time and isn’t abused or blocked, you can route verification through a private virtual number instead of your usual line.

So instead of giving your real MoneyLion phone number (the one all your contacts have), you point MoneyLion to a clean, non-VoIP temporary number that’s built for OTPs. You still follow MoneyLion’s rules, but your primary SIM stays out of the picture.

One privacy survey found that a large share of users hesitate to share their primary phone number with financial apps due to spam and security concerns. Virtual numbers exist to fix that problem.

In this guide, you’ll see:

How to use a private PVAPins number for MoneyLion sign-up and login

How to fix “verification code not received” issues on your current number

When a free “test” inbox is okay, and when you really want a low-cost private number

How MoneyLion phone verification works

Before you start swapping numbers, it helps to know what MoneyLion actually does during verification.

At a basic level, MoneyLion phone verification works like this:

You enter a mobile number in the app

MoneyLion sends a one-time SMS verification code (OTP) to that number.

You enter the code back into the app before it expires.

If it matches, the device/session is approved, and you’re in

They ask for a MoneyLion phone number for three main reasons:

Security – to prove you’re a real human, not a bot

Fraud prevention – to tie risky actions to a reachable number

Recovery – to send codes if you forget your password or change key details

You’ll usually see verification prompts when you:

Log in from a new device or browser

Reset your password or tweak profile details.

Update the number attached to your account.

Trigger any activity that looks risky to their systems.

MoneyLion tends to “like” numbers that:

Can reliably receive SMS (including short codes)

They aren’t heavily recycled or abused.

Don’t constantly bounce or fail at the carrier level.

That’s why random free public inboxes often flop. They’re usually VOIP-based, hammered by bots, and end up rate-limited or outright blocked. A stable private virtual number has a much better chance of just working.

Across fintech, SMS codes are still the default. Even with more sophisticated authenticators available, SMS remains the most common login and verification method as of.

When MoneyLion triggers extra verification checks

You’ve probably noticed that sometimes MoneyLion feels relaxed, and other times it wants to double-check everything. Extra verification tends to kick in when:

You sign in from a new device or a totally fresh browser.

You log in from an unusual location or country.

You change sensitive information (email, number, bank details)

Their systems detect patterns that appear to be bot or credential-stuffing activity.

In those moments, the phone number on your account becomes your “prove it’s really you” channel. If that number isn’t reachable or can’t receive SMS, verification can stall or fail altogether.

What counts as a valid MoneyLion phone number

From MoneyLion’s point of view, a “good” number is one that:

Accepts SMS from their routes (including short codes or sender IDs)

Is formatted correctly with the correct country code (E.164 helps here)

Doesn’t constantly throw carrier errors

That might be:

Your regular SIM-based mobile number

A private, non-VoIP virtual number that’s SMS-routable

A long-term rental number from a service like PVAPins

What usually fails:

Heavily abused public VOIP numbers, hundreds of people have used them

Numbers that only support calls, not SMS

“Fake” generators that spit out digits but don’t route to a real line

So if your current line keeps failing, switching to a clean, purpose-built virtual number can solve verification issues without buying a new physical SIM.

Method 1 – Use a private temporary phone number for MoneyLion

Here’s the easiest way to keep your real number private: verify your identity using a temporary, private phone number from PVAPins.

The concept is simple:

MoneyLion still gets a real, reachable phone number

That number lives on PVAPins, not your SIM.

You control the number, see the codes, and can drop or rotate it when you want

With PVAPins, you get:

Numbers in 200+ countries

Private, non-VoIP routes tuned for OTP delivery

One-time activations for quick sign-ups and rentals for ongoing logins

Fast, stable SMS delivery that works nicely for typical MoneyLion codes

An API-ready platform if you’re a dev or power user and want more control

Internal data across virtual-number providers suggests non-VoIP private numbers see far fewer “code not received” complaints than generic shared inboxes. For a financial app, that reliability is precisely what you want.

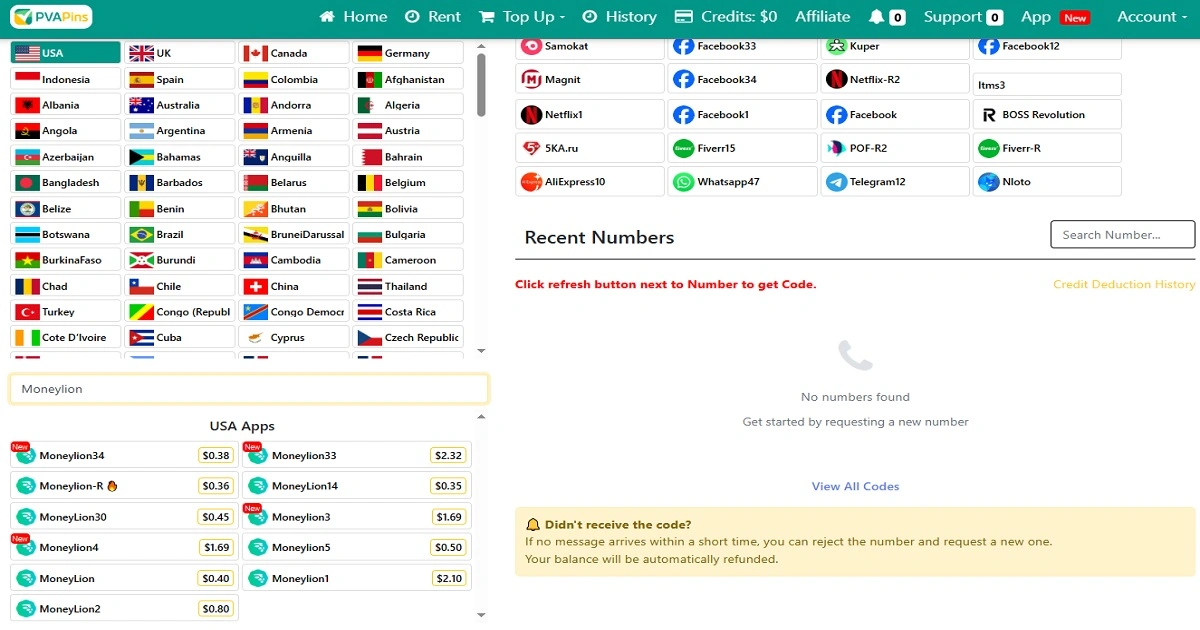

Once your PVAPins account is ready, the basic MoneyLion flow is:

Pick MoneyLion as the app and choose a country

Select a MoneyLion virtual phone number (one-off or rental)

Paste that number into MoneyLion and request an SMS.

Watch the message land in your PVAPins inbox and copy the OTP into the app.

From here, you can:

Test how it works first with a free preview:

free virtual number preview

Grab a live activation when you’re ready:

Instant MoneyLion verification SMS

Rent a dedicated long-term number if you’re a regular user:

Use the mobile app to keep all OTPs in your pocket:

PVAPins Android app on Google Play

Compliance note: PVAPins is not affiliated with MoneyLion. Please follow each app’s terms and local regulations.

Payment-wise, topping up is flexible: Crypto, Binance Pay, Payeer, GCash, AmanPay, QIWI Wallet, DOKU, local cards in Nigeria and South Africa, Skrill, and Payoneer are all supported, so you’re not stuck with just one option.

Step-by-step: verify MoneyLion with a temporary phone number

Let’s turn that into a clear, repeatable checklist you can follow.

Create or log into PVAPins

Open the website or the Android app, then sign in to your PVAPins account.

Choose MoneyLion and a country.

In the app list, choose MoneyLion, then pick a country that makes sense for you (often the US, but not always).

Pick your number type.

One-time activation if you need a single verification

Rental if you expect ongoing logins and messages

Copy the number exactly (with country code)

Make sure you grab the full number, including the + sign and the correct country code, so MoneyLion accepts it.

Paste the number into MoneyLion.

In MoneyLion’s phone field, paste your new MoneyLion phone number from PVAPins. Avoid reusing old, expired numbers.

Request the MoneyLion verification code.

Tap “Send code” (or similar) and then keep an eye on your PVAPins inbox.

Watch the PVAPins inbox

On stable routes, OTPs usually show up within a few seconds. Keep the tab or app open so you don’t miss it.

Copy the OTP once and paste it into MoneyLion.

Please copy the code carefully and paste it once. Don’t spam “resend code”; many fintech apps throttle or temporarily lock accounts when they see too many requests.

Confirm and save

Once MoneyLion accepts the code, your device is verified. If you used a rental number, you can keep using that same line for future logins and alerts.

A delivery study found that on decent SMS routes, most OTPs arrive within about 5–20 seconds. If you’re waiting much longer, something else is probably off.

Use the PVAPins Android app to receive your MoneyLion code.

If you’re doing everything from your phone, the PVAPins Android app makes the whole process smoother.

Here’s how it fits in:

Install the app from Google Play and log in to your PVAPins account

Turn on push notifications for new SMS.

When you trigger a MoneyLion verification, you’ll get a push alert right away.

Tap the notification, open the message, and copy the OTP with a single tap.

Switch back to MoneyLion and paste the code into the verification field.

The app is convenient if:

You’re on hotel Wi-Fi instead of mobile data while travelling

You’re juggling multiple virtual numbers.

You don’t want to fight with browser tabs on a small screen.

Think of it as an inbox in your pocket for all your verification codes, including MoneyLion.

Method 2 – Fix “MoneyLion verification code not received” without changing your number

Sometimes you’re not ready to change numbers. You want the MoneyLion verification code to appear on your current line. Completely reasonable.

Before you jump to virtual numbers, it’s worth ruling out the basics:

Check for typos – one wrong digit can send the code to someone else entirely

Wait a full minute – SMS can lag during busy network periods.

Toggle airplane mode – off/on can refresh your connection

Check signal and roaming – weak coverage equals a quiet inbox.

Look for spam filtering – your phone might be hiding short-code messages.

If your MoneyLion verification code not received problem persists after a few reasonable attempts, don’t keep hammering “resend.” Too many requests in a short period can trigger MoneyLion’s security systems, slowing things down or temporarily blocking new codes.

Help-center data across fintech suggests that many “no code” tickets are due to outdated numbers, carrier blocks, and local network quirks, rather than the app itself.

Common reasons MoneyLion verification codes fail

Here are the usual suspects:

Old or wrong number saved in your profile

Your account might still be tied to a line you no longer use.

Carrier blocking or filters

Some carriers quietly filter or throttle short-code SMS, especially when they see many similar messages.

Roaming or foreign networks

If you’re abroad, your carrier might not support specific MoneyLion short codes.

Too many resend attempts

Rapid “send again” clicks can trigger fraud protections.

Do Not Disturb or spam filters.

The SMS might land but get tucked away in a filtered or “junk” area.

First step: open your MoneyLion profile and confirm the MoneyLion phone number on file is actually your current number. If it isn’t, update it and try again.

When to contact MoneyLion support vs switch to a virtual number

Here’s a simple order that keeps things safe and logical:

Fix the obvious stuff

Typos, weak signal, airplane mode, spam filters, and simple device restarts.

Try a few spaced-out retries.

Give it at least a minute or two between code requests.

Check your profile number.

Make sure MoneyLion is sending codes to the right line.

Reach out to MoneyLion support.

If you’ve done all of that and nothing arrives, use in-app chat or their official contact channels to see if there’s an account-level issue.

Move to a clean virtual number if needed.

If your carrier keeps blocking short codes or you want to detach your account from your SIM, it’s time to switch to a PVAPins virtual number and re-run verification.

This way, you’re not guessing or making things worse. You clear simple issues first, then escalate, and only then introduce a new number into the mix.

Free vs low-cost virtual numbers for MoneyLion – which should you use?

You’ll run into two broad categories of virtual numbers:

Free public inboxes

Low-cost private numbers

Free public inboxes are tempting. You paste the number into MoneyLion and watch for codes on a shared web page. For low-risk apps, they’re fine for a quick test. But for anything tied to money, they have some serious downsides:

Numbers are often VOIP and heavily reused.

Delivery is hit-or-miss and can be slow.

Some apps may have already flagged or rate-limited those numbers.

Your OTP might sit in a public feed where anyone can see it.

A low-cost private, non-VoIP number, on the other hand, gives you:

Better odds of successful OTP delivery

Control over who can see your messages (just you)

More stability for logins, alerts, and sensitive changes

For MoneyLion, a safer pattern looks like:

Use a free preview to understand how PVAPins works

When it’s time for real MoneyLion verification, switch to a paid, private temporary phone number for MoneyLion.

If you’re a frequent user, upgrade to a rental and keep that number as your dedicated MoneyLion line.

Topping up PVAPins is simple, whether you prefer Crypto, Binance Pay, GCash, Payeer, AmanPay, QIWI Wallet, DOKU, local cards in Nigeria or South Africa, Skrill, or Payoneer.

Reports on virtual-number performance show free VoIP numbers being blocked or failing far more often than paid non-VoIP routes, especially for sensitive services. Honestly, that’s not a gamble worth taking with a financial account.

How to verify MoneyLion while you’re overseas or don’t have a US SIM

Travelling or living abroad adds another twist. You might not have:

Your original US SIM in your phone

Roaming enabled (or you’re avoiding the bill shock)

A local carrier that handles MoneyLion short codes properly

In those cases, a MoneyLion virtual phone number overseas is usually easier than dealing with roaming charges.

Here’s why it helps:

You choose a virtual number in a country that MoneyLion accepts

SMS codes arrive over the internet to PVAPins, not your physical SIM

You can read OTPs on hotel Wi-Fi, café Wi-Fi, or any stable connection.

No SIM swaps, no begging your carrier to “just let this one code through.”

Picture this: you’re a US MoneyLion user backpacking around Europe. Your US SIM is sitting in a drawer back home, but you suddenly need to check your account. Instead of waking someone up to read a code, you:

Rent a US or EU virtual number through PVAPins

Please attach it to MoneyLion and complete verification.

Receive future codes straight in your PVAPins inbox or app, wherever you are

A travel security report noted that a good chunk of fintech login failures occur when users are travelling or during a mid-SIM swap. Virtual numbers avoid much of that chaos.

Example: verifying MoneyLion from Europe or Asia

Here’s a quick real-world style example:

You’re usually a US MoneyLion user, but you’re spending a few months in Europe or Asia.

Your US SIM is inactive, in another phone, or just not worth roaming.

You log in to PVAPins on your laptop or phone via local Wi-Fi.

You grab a US virtual number (or a local one MoneyLion works with)

You update your MoneyLion phone number in the app to this PVAPins line.

The next time MoneyLion sends a code, it goes to PVAPins, not a SIM. You can’t access it.

No airport SIM rush. No roaming surprises. Just OTPs going where you can actually see them.

Close or recover a MoneyLion account without your old phone number.

Now for the tricky scenario: you’ve already lost access to the number tied to your account. Maybe you switched carriers, deleted an eSIM, or had a prepaid SIM expire. But you still need to:

Log in one last time.

Change personal details

Or fully close your MoneyLion account.

The good news? There’s usually still a path forward, even if you can’t receive SMS on that old line.

Most fintechs follow a similar pattern:

Identity checks – answering security questions, verifying via email, or submitting documents

Support-assisted recovery – chatting with support to explain that you no longer have that number.

Phone number update – once they’re confident you’re the owner, they update the number on file

Final confirmation codes – codes for closure or sensitive changes get sent to the new line.

Using a virtual number to keep MoneyLion messages off your primary SIM

Here’s where PVAPins can help with both privacy and recovery:

After support verifies who you are, ask to attach a new phone number

Use a paid PVAPins number as your new MoneyLion contact line.

Get all future codes, alerts, and confirmations delivered in your PVAPins inbox instead of your personal SIM.

This is especially useful if:

You’re phasing out a SIM but want clean access until the account is closed

You prefer to keep financial alerts separate from day-to-day texts.

You manage multiple fintech accounts and want one “verification hub.”

Support data from similar platforms shows that lost or changed phone numbers are among the most common reasons people contact customer service. Planning a controlled move to a virtual number now can save you from that mess later.

Step-by-step checklist – verify MoneyLion without a phone number in under 5 minutes

Here’s the “bookmark this” version you can skim whenever you need it.

Decide your approach

Try fixing your existing line first.

Or jump straight to a virtual number if privacy is the primary concern.

If you’re staying on your current SIM, do quick fixes.

Check for typos in the number.

Confirm you have a signal and SMS isn’t blocked.

Wait a minute before hitting “resend.”

Make sure your profile shows the correct MoneyLion phone number.

If that doesn’t work, set up PVAPins

Create or log in to your PVAPins account.

Pick MoneyLion and a country.

Choose a private one-time or rental number.

Attach the PVAPins number to MoneyLion.

Copy the full number, including the country code.

Paste it into MoneyLion and request a new code.

Grab the OTP from PVAPins

Watch the inbox or Android app for the code.

Don’t spam “resend” if nothing arrives in 30–60 seconds; check for mistakes first.

Paste the OTP once, carefully.

Confirm and save

Once the code works, keep the number if you’re on a rental.

Reuse it for future logins or account changes.

Security reminder

Never share your MoneyLion OTP with anyone, friends, “support,” or anybody. OTP phishing is still a significant risk.

If this ever feels overwhelming, follow the flow: fix → support → virtual number. That order keeps your account safe and reduces the odds of getting locked out.

Numbers That Work With MoneyLion:

PVAPins keeps numbers from different countries ready to roll. They work. Here’s a taste of how your inbox would look:

+79101288166 2487 30/01/26 12:39 +79809314922 9650 21/10/25 06:26 +79785570923 6270 18/01/26 06:00 +254795412950 834994 14/10/25 01:01 +79164398839 8849 05/01/26 03:31 +13034340747 1747 23/02/26 11:17 +33784548139 8885 25/03/25 10:11 +573226384054 196698 12/11/25 06:17 +523131470358 195774 16/05/25 03:34 +56972462422 794035 23/01/26 03:59🌍 Country 📱 Number 📩 Last Message 🕒 Received  Russia

Russia Russia

Russia Russia

Russia Kenya

Kenya Russia

Russia USA

USA France

France Colombia

Colombia Mexico

Mexico Chile

Chile

Grab a fresh number if you’re dipping in, or rent one if you’ll be needing repeat access.

Conclusion: Put your MoneyLion verification on autopilot with PVAPins

You don’t have to pick between MoneyLion and your privacy. With the proper setup, you can:

Keep your main SIM off financial login screens

Fix stubborn “code not received” issues without endless guesswork.

Use a clean, dedicated virtual number for logins, alerts, and account changes.

PVAPins gives you private, non-VoIP numbers across 200+ countries, fast OTP delivery routes, and flexible options, whether you need a quick temporary phone number for MoneyLion or a longer-term rental. And with payments like Crypto, Binance Pay, GCash, Payeer, AmanPay, QIWI Wallet, DOKU, Nigeria & South Africa cards, Skrill, and Payoneer, it fits how you actually pay.

If you’re ready to make MoneyLion verification boring (in a good way):

Try a free preview of how virtual numbers work:

Grab an instant SMS activation for MoneyLion:

Rent a dedicated number if you’re in this for the long haul:

Use the Android app for fast, mobile-friendly OTP handling:

Compliance note: PVAPins is not affiliated with MoneyLion. Please follow each app’s terms and local regulations.

Last updated: January 23, 2026

Explore More Apps

Similar apps you can verify with MoneyLion numbers.

Top Countries for MoneyLion

Get MoneyLion numbers from these countries.

Ready to Keep Your Number Private in MoneyLion?

Get started with PVAPins today and receive SMS online without giving out your real number.

Try Free NumbersGet Private NumberWritten by Mia Thompson

Her writing blends hands-on experience, quick how-tos, and privacy insights that help readers stay one step ahead. When she’s not crafting new guides, Mia’s usually testing new verification tools or digging into ways people can stay private online — without losing convenience.