You know that tiny moment when a finance app asks for your phone number and you’re like, “Hmm, do I really want to tie my real SIM to this?” Yeah. Same.

Many people want to verify Revolut without a phone number, not because they’re trying to break the rules, but because privacy matters. Also, fintech apps sometimes re-verify later, and nobody wants to be stuck if their main SIM changes.

Quick reality check before we go any further: Revolut does need an SMS-capable number for OTPs. You can’t skip that step. But you can choose a private line you control, so your everyday SIM stays out of the picture. That’s the whole play here.

Do you really need a phone number for Revolut signup?

Short answer: yes.

Revolut asks for a valid phone number at sign-up so it can text you a one-time passcode (OTP). That OTP is the gate. No number → no code → no account. Simple as that.

But here’s the nuance people miss:

As long as the number is real, SMS-routable, and entered with the correct country code, Revolut will send the OTP to that number and let you continue onboarding. And yeah, Revolut may re-verify your number later, usually after a device change, a suspicious login, or a security check, so using a stable route isn’t just “nice,” it’s smart.

Why Revolut uses SMS OTP in the first place

This isn’t Revolut being dramatic. It’s basic fintech security.

SMS OTP helps Revolut:

confirm you’re a real person (not a bot farm),

tie the account to a unique contact route,

protect logins with a second layer of checks,

and give you a recovery path if you ever get locked out.

In fintech, that “text a code first” step is standard because it’s fast and works almost everywhere. Plus, Revolut provides real support in the app and warns about impersonation scams, so OTP + in-app security are part of their safety setup.

What “without a phone number” actually means

Let’s translate what people really mean when they search this.

Almost nobody is saying, “I want Revolut with literally zero numbers.” What they’re saying is:

“I don’t want to use my real, daily-use SIM.”

And honestly? Fair.

Your personal number is tied to everything: family chats, work stuff, ads, delivery apps, maybe even your bank logins. People are more privacy-aware than ever. A Deloitte survey found that a meaningful chunk of users don’t feel online convenience outweighs privacy concerns. So wanting a separate line for a financial app makes total sense.

Your realistic options:

Personal SIM (what you’re trying to avoid)

Spare/travel SIM (works if you’ve got one)

Private virtual SMS number you control (fastest for most people)

The big “don’t” here: shared/public inbox numbers. They’re recycled, visible to strangers, and often abused. For a finance app, that’s a headache waiting to happen both for security and OTP delivery.

The fastest way to verify Revolut with a private virtual number

If your goal is speed + privacy, this part is the cleanest route:

Use a private virtual number that can receive Revolut OTPs.

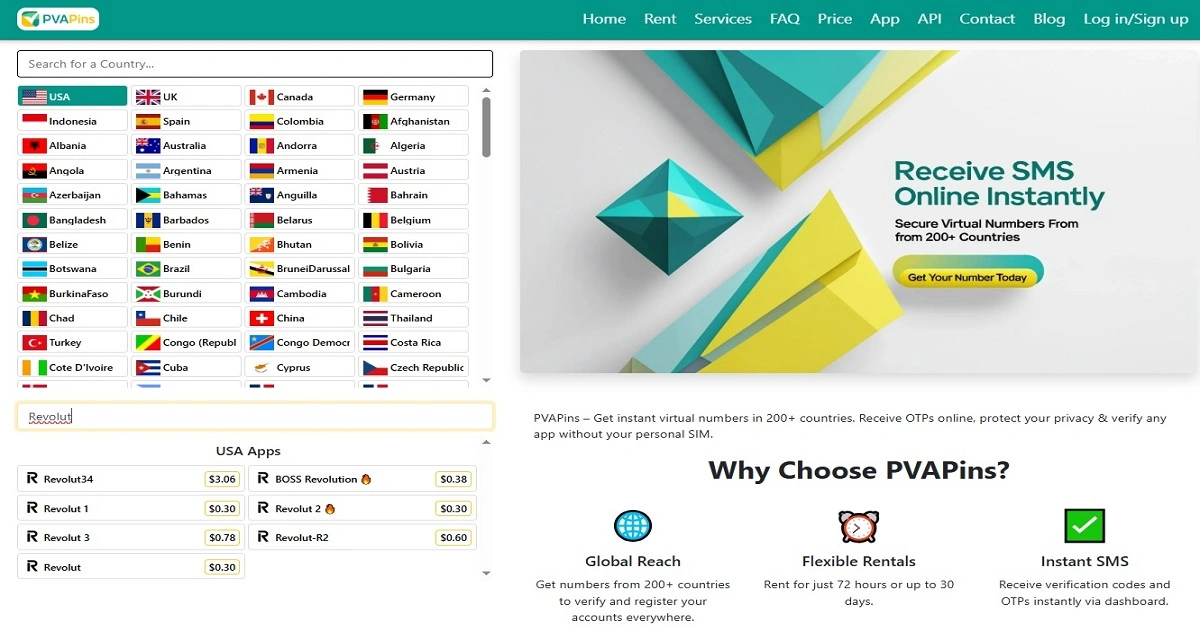

PVAPins gives you private, receive SMS capable numbers across 200+ countries, including non-VoIP/private routes where available. That matters because fintech OTPs can be picky, and private routes usually deliver codes more reliably than shared or overused lines.

Why PVAPins works well for Revolut:

Private inbox: only you see the code.

Clean routing: better for banking-style OTP delivery.

Country flexibility: choose a route close to your Revolut market.

Fast OTP delivery: codes appear in real time.

Flexible duration: one-time activations or rentals depending on how long you need the line.

Payments are easy too, especially if you’re outside the usual card bubble. PVAPins supports Crypto, Binance Pay, Payeer, GCash, AmanPay, QIWI Wallet, DOKU, Nigeria & South Africa cards, Skrill, and Payoneer.

One-time activation vs rental, which fits Revolut better?

Here’s the simple way to decide:

One-time activation

Great if you only need the signup OTP right now and don’t care about keeping the number afterward. Quick, low-cost, done.

Rental number

Better if you want a stable line for the long run, future logins, re-verification prompts, or recovery. If Revolut asks for OTP again later, you won’t be scrambling.

Rule of thumb? If you plan to actually use Revolut regularly, a rental is the calmer choice.

Step-by-step: verify Revolut using PVAPins

Alright, here’s the exact flow:

Go to PVAPins and search/select Revolut as the service.

Choose your country route (UK/EU routes usually match Revolut markets best).

Pick one-time activation or rental.

Copy the number in E.164 format (like +44… or +49…).

Open Revolut and start signing up.

Paste the PVAPins number and request the OTP.

Read the OTP in your PVAPins inbox/app and enter it in Revolut.

If you choose a rental, keep the line active for future logins.

That’s it. You’re not bypassing Revolut’s rules; you’re just keeping your personal SIM private.

CTA if you want to do it right now:

Revolut verification code not received? Fix it in minutes.

OTP issues happen. Even when you do everything right, SMS can get delayed by carriers or your phone settings.

Here’s the deal: most “code not received” problems are boring-but-fixable.

Try this first:

Don’t mash resend.

One resend is fine. A bunch of resends can trigger rate limits.

Check formatting.

Make sure it’s +countrycode + number—no extra zeros.

Refresh your signal.

Toggle airplane mode on/off, or switch data/Wi-Fi.

Check SMS filters.

Some phones quietly hide unknown codes.

If the route isn’t delivering, switch once.

A clean private line often fixes it instantly.

Common real causes

Most OTP failures come from one of these buckets:

Wrong country code or number format

Roaming / low signal/network hiccup

Device SMS spam filters or blocked senders

Overused/shared number route

Temporary Revolut SMS delay

Quick fix checklist

Run this in order:

Confirm digits and +country code

Wait for the full timer

Toggle airplane mode

Restart the app/device.

Check SMS spam/blocked folders.

![]() Resend once

Resend once

Switch to a private number if needed.

Follow that, and you’ll solve most OTP problems without guessing.

Change phone number Revolut after signup

SIMs expire. Numbers change. Travel happens no big deal.

Revolut lets you change your phone number, but they’ll verify the new line with an OTP because that number is tied to account security.

If you still have your old number

This is the easy path:

Log in normally, PVAPins Android app

Go to profile / personal details.

Tap phone number → enter the new one.

Confirm the OTP Revolut sends.

Once verified, your account shifts to the new line. Keep the old number active until the change goes through.

If you lost the old number completely

Revolut has a recovery flow for this:

Open Revolut and tap “Lost access to my phone number.”

Enter your old number, email, and passcode.

Follow prompts. Revolut may ask for a selfie or ID photo.

That extra check is routine for fintech safety. After recovery, update to your new stable number. If you don’t want to repeat this later, a rental line can save you much stress.

Revolut verification UK number tips

If you’re onboarding from the UK, a UK-routed number (+44) usually delivers OTPs the smoothest. Local routing is just less messy.

Quick tips:

Use the full E.164 format: +44, then your number (drop any leading zeros).

Avoid SIMs stuck in roaming with SMS blocks.

If a UK SIM keeps failing, a private UK virtual route is safer than a public/shared inbox.

When you write your final version, GBP examples (such as small top-ups, plan fees, etc.) help UK readers feel instantly oriented.

EU/EEA & travelers: choosing the correct country route for OTP success

If you’re in the EU/EEA or hopping around Europe, match your number route to your Revolut market and residency. It’s the simplest way to keep OTPs fast and predictable.

Why this helps:

Nearby EU routes often deliver OTPs faster.

Roaming can silently delay or block SMS.

Revolut may re-check if your region and route feel mismatched.

Travel a lot? Keeping a stable rental line is way less annoying than swapping numbers every trip. EUR examples in your final copy will keep this section grounded.

Free public inbox vs low-cost private number: what should you use for Revolut?

Let’s be real: finance apps and free public inbox numbers don’t mix.

Shared inbox numbers are:

public (anyone can read the OTP),

recycled (you don’t know who used them before),

and often flagged from overuse.

A low-cost private number wins because:

Time is money. One failed signup loop can cost more than a small private OTP fee.

Numbers That Work With Revolut:

PVAPins keeps numbers from different countries ready to roll. They work. Here’s a taste of how your inbox would look:

| 🌍 Country | 📱 Number | 📩 Last Message | 🕒 Received |

France

France | +33603028044 | Autorisez une connexion. Code utiliser : 467-379. Ne jamais partager. RevolutDu0Z94STqHw | 02/01/26 06:59 |

UK

UK | +447440478471 | Authorise a login. Use the code: 098-010. Don't share this code with anyone. Revolut Business | 08/09/25 11:26 |

France

France | +33744123298 | Autorisez une connexion. Code utiliser : 117-275. Ne jamais partager. RevolutDu0Z94STqHw | 04/01/26 05:11 |

UK

UK | +447564760301 | Authorize a login. Use code: 271-944. Never share it. RevolutDu0Z94STqHw | 05/09/25 01:57 |

UK

UK | +447525781181 | Authorise a login. Use code: 560-745. Never share it. RevolutDu0Z94STqHw | 18/07/25 01:23 |

USA

USA | +13303301585 | Authorise a login. Use code: 621-500. Never share it. Revolut@revolut.com #621500 | 06/06/25 02:55 |

USA

USA | +13303301585 | Authorize login. Use code: 020-410. Never share it. RevolutDu0Z94STqHw | 04/04/25 10:32 |

France

France | +33662580926 | Autorisez une connexion. Code utiliser : 312-575. Ne jamais partager. RevolutDu0Z94STqHw | 03/01/26 05:27 |

UK

UK | +447546955588 | Authorise a login. Use code: 610-453. Never share it. Revolut@revolut.com #610453 | 02/02/26 12:31 |

UK

UK | +447858056365 | Authorise a login. Use code: 345-548. Never share it. Revolut@revolut.com #345548 | 28/09/25 04:23 |

Grab a fresh number if you’re dipping in, or rent one if you’ll be needing repeat access.

Safety, legality, and KYC reality check

Using a private number is a privacy move, not a KYC bypass.

Revolut still requires identity verification because fintechs must comply with AML/KYC rules to reduce fraud and money laundering. And that’s not “extra.” It’s standard for anything money-related.

So what you can do:

Use a separate phone number for OTPs to improve privacy.

Keep your personal SIM off the account.

Choose a stable private route.

What you can’t do:

Also worth repeating: real Revolut support contacts you inside the app. Be suspicious of random calls claiming to be “support.”

Compliance note: PVAPins is not affiliated with Revolut. Please follow Revolut’s terms and local regulations.

Conclusion:

So yeah, Revolut needs a phone number.

But it doesn’t have to be your number.

If you want Revolut without exposing your primary SIM, the path is simple:

PVAPins makes this easy with quick one-time activations and stable rentals in 200+ countries.

Here’s your ladder:

Compliance note: PVAPins is not affiliated with Revolut. Please follow Revolut’s terms and local regulations.

France

France UK

UK USA

USA