Payoneer SMS Verification with PVAPins

How it works

Enter your phone number correctly

Use international format (country code + digits). Avoid spaces, dashes, and extra leading 0.

Request the OTP once

Tap Send code and wait. Multiple rapid requests can trigger temporary blocks.

Wait 60–120 seconds, then resend only once

If nothing arrives, wait a bit and resend one time. Don’t spam.

Check signal + SMS filtering

Make sure you have network coverage, airplane mode is off, and SMS filters/spam/blocked messages aren’t hiding the OTP.

Try an alternative method if shown

If Payoneer offers email verification, authenticator/app approval, or another option, use it—especially during carrier delays.

If you still can’t receive codes, contact Payoneer support

For account security, Payoneer may restrict verification routes. Support is the safest way to restore access.

OTP not received? Do this

- Wait 60–120 seconds (don't spam resend)

- Retry once → then switch number/route

- Keep device/IP steady during the flow

- Prefer private routes for better pass-through

- Use Rental for re-logins and recovery

Wait 60–120 seconds, then resend once.

Confirm the country/region matches the number you entered.

Keep your device/IP steady during the verification flow.

Switch to a private route if public-style numbers get blocked.

Switch number/route after one clean retry (don't loop).

Free vs Activation vs Rental (what to choose)

Choose based on what you're doing:

Quick number-format tips (avoid instant rejections)

Most verification forms reject numbers because of formatting, not because your inbox is “bad.” Use international format (country code + digits), avoid spaces/dashes, and don’t add an extra leading 0.

Best default format: +CountryCode + Number (example: +14155552671)

If the form is digits-only: CountryCodeNumber (example: 14155552671)

Simple OTP rule: request once → wait 60–120 seconds → resend only once.

Inbox preview

| Time | Country | Message | Status |

|---|---|---|---|

| 2 min ago | USA | Your verification code is ****** | Delivered |

| 7 min ago | UK | Use code ****** to verify your account | Pending |

| 14 min ago | Canada | OTP: ****** (do not share) | Delivered |

FAQs

Quick answers people ask about Payoneer SMS verification.

Can I verify Payoneer without using my personal phone number?

Yes. Payoneer needs a working SMS number for OTP, but it doesn’t have to be your daily SIM. A private PVAPins number you control works as long as it can receive codes and you follow Payoneer’s rules.

Why am I not receiving a Payoneer verification code?

Most failures are caused by formatting mistakes, carrier filtering, roaming delays, or resending too quickly. Double-check your +country code format, wait for the timer, and if it still fails, switch to a fresh private route or app approval.

How do I change my Payoneer two-step verification number?

Go to Settings → Security settings → Two-step verification → Edit, add your new number, then confirm with OTP. Your two-step phone can be different from your profile phone.

Can I use Payoneer verification via the app instead of SMS?

Yes. Payoneer supports push approvals inside the app. Please enable it in Security settings. It’s often more reliable when SMS is slow or you’re traveling.

Is Payoneer's two-step verification mandatory?

In many cases, yes, it’s strongly recommended, and some accounts or regions may require it. That means you might not always see a “skip” option.

What if I lost the phone number linked to my Payoneer account?

Use your recovery code to update your two-step phone. If you've lost both the old number and the recovery code, you’ll need to contact Payoneer support to reset two-step verification.

Read more: Full Payoneer SMS guide

Open the full guide

You know that little exhale you do when Payoneer hits you with “Enter the code we sent you,” and your genuine SIM is either dead, missing, roaming-blocked, or you don’t feel like handing it over again? Yeah, that moment.

Here’s the deal: you can verify Payoneer without a phone number tied to your everyday SIM. You still need a real SMS-capable line for OTP, but it can be a private virtual number you control. That’s precisely what PVAPins is for: fast OTP delivery, clean private routes, and numbers in 200+ countries, without you exposing your main number everywhere.

Alright, let’s break down what Payoneer’s “phone verification” really means, why codes randomly fail, and how to get verified quickly without messing with your personal SIM.

What “Verify Payoneer Without a Phone Number” actually means.

When people say “verify Payoneer without a phone number,” they’re usually not trying to dodge security. They’re just trying to avoid using their personal SIM for OTP.

Payoneer uses two-step verification (2SV) to protect accounts during sign-up, login, and sensitive actions (such as withdrawals or changing settings). That’s why they send a one-time passcode (OTP) by SMS, and sometimes a “call me” option if SMS is slow.

Here’s a key detail many users miss:

The number Payoneer sends an OTP to doesn’t have to match the phone number on your profile. In Payoneer’s own security setup, those can be separate, and updating one doesn’t constantly update the other.

So, in practical terms, verifying without your everyday number means:

You use a different receive SMS capable number that you control

You receive a Payoneer OTP on that line.

You still complete KYC honestly (you’re not skipping identity checks)

Your personal SIM stays out of the loop.

And nope, you usually can’t verify a Payoneer account with a zero number. In most cases, Payoneer’s security flow requires a phone number for two-step verification. That’s just how their system keeps accounts safe.

The phone number Payoneer needs vs the one you use daily.

Think of it like two slots:

Profile phone: the contact number saved in your account details

Two-step phone: the number that actually receives OTP codes

Those two can be different. And honestly, that’s why private virtual numbers are a valid workaround here.

Why does Payoneer ask for OTP

Payoneer doesn’t blast you with OTP every single time you open the app. They trigger 2SV when their risk system thinks a login or action needs a double-check, like:

New device logins

Logging in from a new country

Password resets

Withdrawals or payout actions

Security setting changes

So even if you verified once, you might get asked again later. It isn’t enjoyable sometimes, but it’s normal.

Can you verify Payoneer without using your personal SIM?

Yep. Payoneer needs a real number that can receive OTPs, not your primary SIM, not your “family WhatsApp number,” not the one linked to your bank.

If you care about speed and privacy, the cleanest option is a private virtual number:

You control the inbox.

OTP lands fast

The number isn’t shared with random people.

Payoneer sees a proper SMS line.

And because you’re not relying on sketchy public inbox numbers, you avoid those frustrating “this number can’t be used” errors.

When a private virtual number works best

A private virtual number is a lifesaver when:

You’re traveling and your SIM is roaming-blocked

Your old SIM is lost, expired, or just not working.

Payoneer keeps re-verifying your logins.

You don’t want to attach your personal number to yet another app.

You manage more than one payout account.

Real-world vibe: lots of freelancers keep payout apps on a dedicated number so SIM swaps and phone upgrades don’t turn into a lockout drama later. It’s boring but smart.

One-time activation vs rental number for Payoneer

This depends on how you use Payoneer day-to-day:

One-time activation number:

Great if you need a single OTP right now, sign up, quick login, or a one-off reset.

Rental number:

Better if Payoneer is your regular payout hub, you travel, or you log in a lot. A stable rental keeps future OTP prompts from landing on the same line, so you don't have to start over.

If Payoneer is a “once a month” thing for you, one-time is fine.

If it’s your regular income pipeline, rentals make life easier.

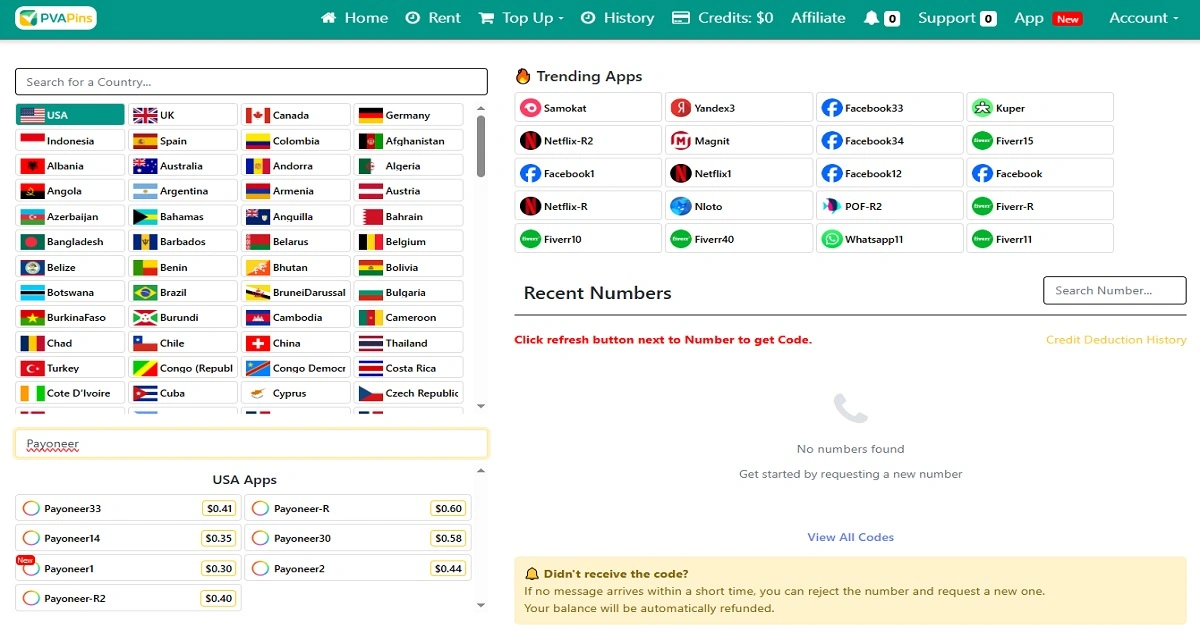

Step-by-step: verify Payoneer using a PVAPins number

Okay, here’s the no-stress flow.

PVAPins gives you SMS-capable numbers across 200+ countries. You can start free if you want a quick OTP, then go instant or rental if you need more reliability.

Option A: Use a free PVAPins number for a quick one-time OTP

Go to PVAPins Free Numbers

Pick a country number that matches your Payoneer region (or a nearby route).

Copy the number and paste it into the verification screen on Payoneer.

Tap Send code.

Open your PVAPins inbox (web or android app) and refresh until the code shows.

Copy the OTP → paste into Payoneer → done.

Quick, clean, and your personal SIM stays untouched.

Option B: rent a private number to keep for future logins

If Payoneer keeps hitting you with OTP prompts, this is the smoother long-term move:

Go to PVAPins Rent

Choose a private, SMS-ready number.

Use it for Payoneer 2SV the same way as above.

Keep that rental active so future codes land on the same line.

It’s the “set it once, stop thinking about it later” option.

Pick the correct country route for better delivery.

OTP success rates usually improve when your number’s routing matches the region Payoneer expects. If you’re in South Asia, pick a route that's South Asia-friendly. If you’re dealing with EU marketplaces, use an EU route. Simple.

Cross-border apps lean on regional routing to improve OTP reliability. [2025 example: source]

Also, PVAPins supports flexible payments, Crypto, Binance Pay, Payeer, GCash, AmanPay, QIWI Wallet, DOKU, Nigeria & South Africa cards, Skrill, and Payoneer, so you can pay however you already operate.

Compliance note: PVAPins is not affiliated with Payoneer. Please follow Payoneer’s terms and local regulations.

Payoneer verification via app: use push approval instead of SMS

Don’t sleep on this option: Payoneer also supports app-based two-step verification. Instead of waiting for an SMS, you get a push notification in the Payoneer app prompting you to approve the sign-in.

How app verification works

The flow is pretty simple:

You log in or do a sensitive action

Payoneer sends a push notification to your app.

You approve it (sometimes with biometrics)

You’re in

You can enable this by going to Settings → Security settings → Two-step verification in the app.

When app approval is more reliable than SMS

Push approval is great when:

SMS delivery is slow where you are

You’ve got Wi-Fi, but a weak cellular signal.

Your carrier filters international OTP.

You travel a lot

That said, it’s still smart to keep a stable backup number on file. Payoneer can fall back to SMS in specific flows, so having a private line ready saves you from later headaches.

Have you not received Payoneer's two-step verification? Real fixes that work

If Payoneer OTP isn’t arriving, first rule: don’t spam resend. That’s how people walk into temporary blocks.

Here’s what actually fixes it most of the time.

Formatting + country code checks

Make sure your number is in clean international format:

Use E.164 style: +CountryCodeNumber

No leading zeros after the country code

No spaces or dashes

Double-check you picked the correct country.

This is the #1 reason codes don’t land. It’s boring, but it matters.

Carrier filters / DND/spam blocks

Even with perfect formatting, carriers can be messy:

DND/spam filters block short codes

Roaming networks delay international messages.

Local carriers throttle repeated OTP requests.

If SMS is delayed, waiting out the timer and retrying once is usually smarter than brute-forcing it.

When to switch to a new private route

If you waited, formatted right, and the code still doesn’t show:

Swap to a fresh private number

Try a different country route.

Or flip to app push approval.

Repeated failures usually indicate routing issues, not that your Payoneer account is broken.

Free public inbox numbers vs low-cost private numbers, which should you use?

Let’s be real: free public inbox numbers are tempting. But for Payoneer, they’re also one of the fastest ways to get stuck.

Why shared numbers fail on Payoneer

Shared numbers are public, which means:

Lots of people reuse the same line

OTP inbox isn’t private

Payoneer detects reuse patterns.

Verification gets rejected or flagged.

Payoneer wants a number that looks like a real, user-owned phone. Shared inbox routes don’t look like that.

Cost vs stability vs account risk

No big table here’s the plain answer:

If you care about privacy + success rate, go private.

If Payoneer matters to your earnings, don’t risk your login in a shared inbox.

If you need a one-off OTP and don’t care about future access, free might work but it’s the least reliable route.

Private numbers are just safer long-term.

Verify Payoneer without a phone number in Bangladesh

If you’re in Bangladesh, OTP delays are pretty standard. Cross-border routing and carrier filtering are usually the culprits.

Best routing approach for BD carriers

Use complete +880 formatting.

Prefer Bangladesh or nearby regional routes.

Wait for the timer before resending.

Use app approval if SMS feels flaky.

BDT examples + common OTP pitfalls

Most people get locked out because they:

hammer resend

Use the wrong prefix.

Try a shared inbox line.

Switch SIMs too often.

If Payoneer is your payout lifeline, renting a stable PVAPins number is usually cheaper than losing hours to recovery loops. Think of it like paying a tiny BDT amount to protect a much bigger payout stream.

Verify Payoneer without a phone number in India

India’s two big OTP troublemakers: DND filtering and resend throttling.

Best routing approach for IN carriers

Use the exact +91 format.

No spaces

Avoid rapid re-requests

Try an India route or a nearby regional route for better speed.

INR examples + resend limits

Payoneer can temporarily block verification after too many repeated or incorrect attempts. So if it’s not landing, don’t brute force it. Switch routes or use app push approval.

Cost-wise, a private PVAPin's number is usually lower than what you lose by waiting an hour for a payout delay. That’s an easy trade.

How to change Payoneer phone number

This part matters a lot if you’ve switched devices or lost your SIM.

Change the two-step phone in Security settings.

Do this inside your Payoneer dashboard:

Sign in

Go to Settings → Security settings

Under Two-step verification, click Edit

Enter the new number.

Save and confirm with OTP.

Re-store your recovery code.

And yep, your two-step code can be different from the one on your phone in your profile. That’s normal.

Use the recovery code if SMS isn’t possible.

If you can’t access the old number, Payoneer lets you use your recovery code to update two-step settings. That’s why saving it is such a big deal.

When you must contact support

If both the old number and recovery code are gone, Payoneer support is your only way to reset two-step verification.

Numbers That Work With Payoneer:

PVAPins keeps numbers from different countries ready to roll. They work. Here’s a taste of how your inbox would look:

| 🌍 Country | 📱 Number | 📩 Last Message | 🕒 Received |

Colombia

Colombia | +573023232816 | 018776 | 15/12/25 05:39 |

Philippines

Philippines | +639066723913 | 017182 | 26/10/25 09:27 |

Argentina

Argentina | +541164405287 | 273113 | 27/10/25 03:14 |

Israel

Israel | +972548300417 | 029481 | 09/12/25 12:49 |

USA

USA | +12182164312 | 925083 | 17/09/25 07:36 |

Israel

Israel | +972553179507 | 421194 | 28/12/25 05:01 |

USA

USA | +16109562912 | 084968 | 19/09/25 09:31 |

Argentina

Argentina | +541125136768 | 247097 | 29/12/25 01:51 |

Colombia

Colombia | +573244379537 | 891149 | 14/12/25 04:35 |

Colombia

Colombia | +573007096329 | 532719 | 12/10/25 06:58 |

Grab a fresh number if you’re dipping in, or rent one if you’ll be needing repeat access.

Safety, legality, and account stability

Using a private virtual number is usually fine as long as:

The number is real and SMS-capable

You control it privately.

You follow Payoneer rules.

You don’t fake identity details.

Payoneer’s core concern is security. They’re not forcing you to use one specific SIM forever.

Compliance note: PVAPins is not affiliated with Payoneer. Please follow Payoneer’s terms and local regulations.

What’s allowed vs risky behavior

Allowed / safe

Private virtual number for OTP

Keeping a stable 2SV line

App approval + number backup

Honest KYC details

Risky

Public/shared inbox numbers

Reusing OTP lines across multiple users

Aggressive resend spam

Inaccurate profile info

Simple rules to avoid flags

Use a private route, not shared numbers.

Keep the number stable if Payoneer is important.

Save your recovery code.

One resend per timer, max.

If OTP fails twice, switch the route instead of forcing it.

Conclusion:

Bottom line: if you want Payoneer verified fast without exposing your personal SIM, here’s the smooth path:

Go instant if you need higher success.

Rent a private if Payoneer re-verifies you often.

That keeps your account secure, payouts flowing, and your real number away from unnecessary exposure.

Compliance note: PVAPins is not affiliated with Payoneer. Please follow Payoneer’s terms and local regulations.

Last updated: January 23, 2026

Explore More Apps

Similar apps you can verify with Payoneer numbers.

Top Countries for Payoneer

Get Payoneer numbers from these countries.

Ready to Keep Your Number Private in Payoneer?

Get started with PVAPins today and receive SMS online without giving out your real number.

Try Free NumbersGet Private NumberWritten by Mia Thompson

Her writing blends hands-on experience, quick how-tos, and privacy insights that help readers stay one step ahead. When she’s not crafting new guides, Mia’s usually testing new verification tools or digging into ways people can stay private online — without losing convenience.