Verify PhonePe Without a Phone Number Safe Work

Verify PhonePe Without a Phone Number with safe fixes for OTP, number change, and new phone setup plus where PVAPins fits for private OTP signups.

Learn HowGet a Number Now

If you’re here, you’re probably dealing with one of the classic headaches: your SIM is gone, your number changed, you’re traveling, or the OTP refuses to show up, and PhonePe keeps looping you back for verification. This guide breaks down what actually works when you’re trying to verify PhonePe without a Phone Number (and what doesn’t). No “bypass” nonsense, just absolute recovery paths that match how PhonePe + UPI verification is designed.

Quick answer: Can you verify PhonePe without a phone number? (Reality check)

Not in the “no-number, no-OTP” way. PhonePe verification uses an OTP sent to your mobile number, and UPI access is tied to the mobile number registered with your bank. What you can do is recover access (SIM replacement, bank number update, re-registration) or use eligible international-number flows if you qualify.

Here’s the clean mental model:

Login verification: OTP sent to the number linked to your PhonePe account.

UPI actions (like setting/resetting the UPI PIN) depend on the bank-registered number.

KYC is its own layer and may include OTP steps depending on the method used.

Before you do anything else, do this quick checklist (it saves time, trust me):

Make sure your phone can receive any SMS right now.

Check permissions (SMS/Phone) + signal.

Confirm the number format is correct.

Don’t hammer “Resend OTP” 10 times. Cooldowns are real.

What “without a phone number” really means (lost SIM, changed number, traveling, OTP issues)

Most people aren’t trying to skip verification. They’re saying: “I can’t access the number PhonePe expects.”

Usually it’s one of these:

Lost SIM / SIM damaged (same number, but OTP can’t arrive)

Number changed (new number active, old number dead)

Traveling / roaming (OTP delivery gets messy)

OTP not received (DND, permissions, carrier routing)

New phone/reinstall (verification becomes picky)

Once you identify the bucket you’re in, the fix becomes a lot less random.

The fast decision path: pick your situation (1-minute flow)

If you’re stuck verifying your PhonePe account, the fix depends on why you don’t have access: OTP delivery issues, number change, new phone, international setup, or suspected fraud. Pick the matching path so you don’t burn retries and end up stuck behind timers.

Quick map:

Lost old number → SIM reissue/bank number update → re-register

OTP not received → DND + permissions + network checks

New phone → device + permission checklist, then verify

International/NRI → follow the eligible onboarding flow.

Fraud/SIM swap → lock down risk and report ASAP

I don’t have my old number.

If the old number is genuinely gone, there’s no “secret trick” here. The practical route is:

Try a SIM reissue from your carrier (same number, new SIM).

If your number has been permanently changed, update your mobile number with your bank first (this step is required for UPI).

Then re-register PhonePe using your new number and follow the in-app flow.

Tiny but essential reality check: with UPI, the bank-linked number is a key identifier, so fixing the bank record first prevents a lot of “verification failed” loops later.

OTP not received

Don’t jump straight to reinstalling. First, check the obvious blockers:

Is DND enabled?

Can you receive a standard SMS from someone?

Did you deny SMS/phone permissions?

Are you retrying too quickly and hitting the resend timer?

If you fix these, OTP issues often clear up without needing support.

New phone/reinstall

New phone setups fail for two boring reasons: SMS permissions are blocked, or the phone is “optimizing” the app so hard it breaks verification.

Do the basics:

Confirm the SIM is active and can receive SMS.

Allow SMS/phone permissions.

Temporarily turn off aggressive battery optimization for the app.

Try again once; calmly rapid retries can make it worse.

International number / NRI setup (PhonePe)

If you’re an NRI, PhonePe has published guidance for using international mobile numbers with eligible NRE/NRO accounts. You’ll still do SMS verification, but supported setups may not require an Indian SIM.

Also, if you’re outside India and OTP delivery is flaky, it’s often roaming/SMS routing, not necessarily your account.

Suspected fraud / SIM swap (PhonePe)

If you see unexpected logins, OTP spam, or someone calling to request an OTP, pause. Treat it like a real risk event.

Don’t engage with unknown callers/messages.

Secure your SIM and bank access.

Use official fraud reporting routes quickly.

This is not the moment to test random advice from forwarded screenshots.

Fix “PhonePe OTP not received” (most common blockers)

Most OTP failures come down to DND blocks, network/SMS issues, or device permissions. Start by checking the DND status, confirming that your phone usually receives virtual SMS, and verifying your number format. Then retry after any cooldown. PhonePe also calls out DND as a common cause.

Try this in order (yeah, it’s basic, but it works more often than people expect):

Check DND / promotional SMS settings (TRAI tools are commonly used for DND management).

Ask a friend to send a regular SMS (not OTP).

Re-check app permissions (SMS/Phone), then update app/OS.

Toggle airplane mode, switch between 4 G and 5 G, or restart the phone.

Wait out resend timers don’t “hammer resend.”

Mini scenario that happens a lot: you restored a new phone from backup, but SMS permissions didn’t carry over cleanly. OTP keeps failing until you re-allow permissions and restart once.

Change mobile number in PhonePe (and what to update at your bank too) (PhonePe)

If you changed your number, you usually need to re-register the new number in the app and update the same number with your bank, because UPI treats the bank-linked mobile number as a key identifier. PhonePe’s UPI terms also note you must update your number with the bank to re-enable service.

Do it in this order (saves time):

Update your mobile number with your bank first.

Then, verify/register the new number in the app.

Re-link the bank account and reset the UPI PIN if required.

If you see “mobile number mismatch” type errors, it usually means:

PhonePe sees one number, but your bank record has another, or

Your number porting/change hasn’t fully propagated yet.

Safety note: number-change + SIM swap fraud is real. Don’t trust random callers or messages; use official routes only.

PhonePe login on a new phone: device + number verification checklist

On a new phone, verification usually fails when the app can’t confirm your registered number/SMS capability, or your device setup blocks verification. Make sure your SIM/number is active for SMS, and your permissions are clean before trying multiple times.

Checklist that’s genuinely worth doing:

Use the same SIM/number (where required) during setup.

Temporarily turn off battery optimization for the app.

Make sure your default SMS app is working and receiving messages.

Clear the cache/reinstall only after you’ve noted the essential account details.

Avoid public Wi-Fi during verification steps (basic security hygiene). RBI safety guidance aligns with this “don’t make it easier for scammers” approach.

Micro-opinion: Reinstalling is a last step, not a first step. It often adds confusion without fixing the underlying SMS problem.

Numbers That Work With PhonePe:

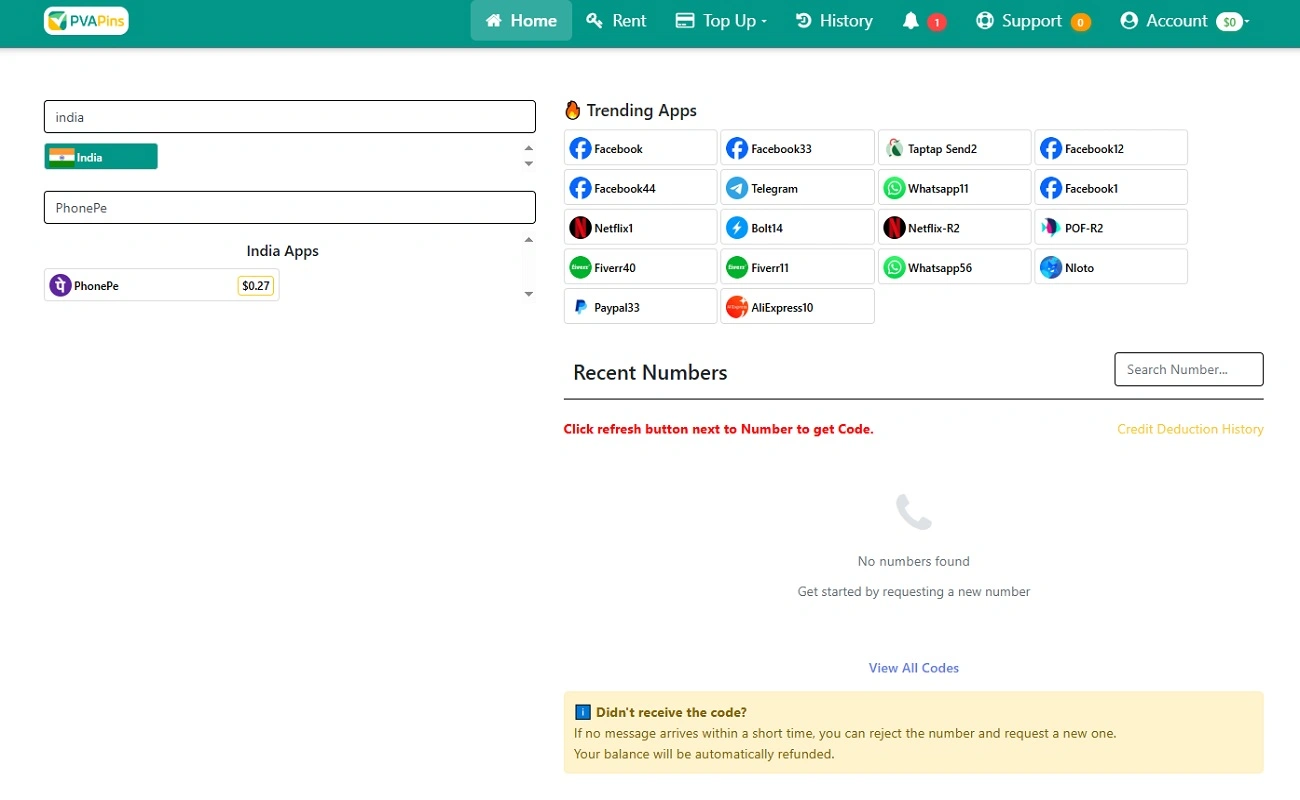

PVAPins keeps numbers from different countries ready to roll. They work. Here’s a taste of how your inbox would look:

+79496236562 9680 05/11/25 01:01 +79517106498 4270 08/12/25 11:20 +79583910811 6326 12/11/25 05:53 +79001669272 6458 17/10/25 07:03 +639300974181 535884 07/03/25 11:38 +573044245551 3830 26/08/25 10:06 +5491130779431 087697 13/08/25 01:08 +34603201842 880732 13/09/25 03:33 +2349116234456 106584 30/10/25 06:24 +27679484802 2258 07/03/25 02:52🌍 Country 📱 Number 📩 Last Message 🕒 Received  Russia

Russia Russia

Russia Russia

Russia Russia

Russia Philippines

Philippines Colombia

Colombia Argentina

Argentina Spain

Spain Nigeria

Nigeria South Africa

South Africa

Grab a fresh number if you’re dipping in, or rent one if you’ll be needing repeat access.

Add bank account in PhonePe + set/reset UPI PIN (number mismatch traps) (PhonePe)

Adding a bank account and setting a UPI PIN requires OTP-based steps that typically depend on the mobile number registered with your bank. If your bank has a different number on file, you’ll hit mismatch or OTP failures. PhonePe publishes step-by-step flows for adding accounts and setting/resetting UPI PIN.

What usually goes wrong:

Bank account links, but PIN setup fails (a mismatch occurs behind the scenes).

OTP comes late due to network routing or DND.

Debit card details are entered incorrectly, and it looks like an OTP issue.

Practical steps:

Confirm your bank has your current mobile number.

Follow the in-app flow to add the bank account.

Set/reset UPI PIN carefully; debit card verification is part of it.

Never share OTPs or UPI PINs. RBI repeatedly warns against that.

PhonePe KYC basics: what verification requires and why (PhonePe)

KYC is a separate verification layer that unlocks higher limits/features in wallets and payment products. It often relies on identity verification plus OTP-linked steps tied to your registered mobile number (like Aadhaar OTP where applicable), so your number needs to be active and correctly linked.

A few simple truths:

If you can’t access your mobile number, the e-KYC steps can fail.

Avoid random “KYC agents” messaging you; use official in-app flows only.

If KYC fails, it’s often a mismatch (name/date/details) or poor capture quality, not some mysterious “block.”

When you’re stuck, use official support channels, not someone’s forwarded “hack.”

India-specific reality: UPI is tied to the bank-registered mobile number (NPCI)

In India, UPI authentication is commonly described as requiring the mobile number linked to the bank and the UPI PIN. If your bank doesn’t have your current number, verification, and PIN set up, verification can break. Update the bank first, then re-register in the app.

Why this matters (a lot):

UPI isn’t just “an app login.” It’s connected to banking identity checks.

The bank-linked number is the foundation. If it’s wrong, everything above it wobbles.

Quick checklist if UPI verification keeps failing:

Confirm your bank-registered number is current.

Make sure SMS works on that SIM (not just data).

Handle DND/SMS permissions.

Be alert for SIM swap risk; it’s a known fraud pattern.

NRIs & travelers: using PhonePe with an international number (eligible flows) (PhonePe)

If you’re an NRI, PhonePe has published guidance on using international mobile numbers for UPI with eligible NRE/NRO accounts. You still need to verify the number via SMS and meet eligibility requirements, but you may not need an Indian SIM in supported setups.

A few pointers that save frustration:

“Eligible” usually means that your bank/account type supports it (often in the NRE/NRO context).

OTP delivery abroad can fail due to roaming and routing issues. Try switching networks and waiting out timers first.

Keep your number updated with your bank, too, especially after changes.

If you’re still stuck, don’t guess. Use official support so you don’t lock yourself out with repeated retries.

Free vs low-cost virtual numbers for verification: what’s safe, what’s risky, and where PVAPins fits

For banking/UPI apps, a virtual number often won’t replace the bank-registered SIM (and you should follow the app’s rules). But for everyday signups where you want privacy and fast OTP delivery, PVAPins can be a clean option: test with free virtual numbers, then move to instant activations or rentals when you need stability.

Here’s the honest breakdown:

Public/shared inbox numbers are risky (privacy + heavy reuse).

Private numbers are usually more stable if you need to access them repeatedly.

Rentals are smarter when you expect ongoing logins or recovery.

Compliance note (always): PVAPins is not affiliated with PhonePe. Please follow each app’s terms and local regulations.

When PVAPins helps (privacy + fast OTPs for non-bank signups)

PVAPins is built for SMS verification when a separate number is allowed, and you want:

More privacy than using your personal SIM

Fast OTP delivery

A choice between one-time activations and rentals (for repeat logins/recovery)

Coverage across 200+ countries

A simple way to use it (no overthinking):

Start with PVAPins' free numbers for low-stakes testing.

If you want consistency, use instant options to receive SMS online.

If you need long-term access, choose a virtual rental number.

For top-ups, you’ve got flexible payments like Crypto, Binance Pay, Payeer, GCash, AmanPay, QIWI Wallet, DOKU, Nigeria & South Africa cards, Skrill, and Payoneer.

When it won’t (bank/UPI apps that require your bank-registered SIM)

For UPI and regulated fintech flows, the system is designed around your bank-registered mobile number and identity checks. That’s why “any number” approaches often fail (or simply aren’t allowed).

So if your goal is specifically UPI inside PhonePe, your best win is:

Fix bank-registered number access

Restore SMS capability on that SIM/number

Re-register cleanly in the PVAPins web or android app

PhonePe customer care number + best support routes (avoid delays) (PhonePe)

If self-fixes aren’t working, use PhonePe’s in-app support first, then escalate via official contact options. PhonePe’s grievance/contact pages list official support routes and escalation paths.

To get faster help, include this in your ticket (most people forget this stuff):

What you were trying to do (login, bank link, PIN reset)

Time/date of the issue

Exact error text (screenshot helps)

Device model + OS version

Any transaction reference IDs (if relevant)

Red flag reminder: nobody legit will ask you for OTP or UPI PIN.

PhonePe fraud complaint: what to do in the first 10 minutes (PhonePe)

If you suspect fraud, move fast: stop further loss, report through official channels, and don’t engage with unknown callers/messages. PhonePe publishes fraud reporting guidance and SIM takeover prevention tips, and RBI also reminds users never to share OTPs/PINs.

Do this immediately:

Secure your SIM (contact your carrier if a SIM swap is possible).

Secure your bank access (change PINs/passwords where needed).

Report via official routes and document everything.

Save timestamps, numbers, screenshots, and transaction IDs.

Context that matters: India’s DoT initiated discussions and implementation of a “Financial Fraud Risk Indicator (FRI)”-style system to flag risky numbers, so fraud prevention is getting stricter, not looser.

FAQ

Can I verify PhonePe without an OTP?

No. PhonePe uses OTP/mobile verification for activation and key actions. If you can’t receive OTP, fix the number/SIM issue first or use the official support route.

Why is my PhonePe OTP not being received, even with a strong signal?

DND settings, SMS permissions, and carrier routing can block OTP delivery. Check DND, confirm you can receive regular SMS, and retry after the cooldown instead of rapid resends.

How do I change my PhonePe-registered mobile number?

Usually, you must re-register the new number in the app and update it with your bank for UPI services. If only one side is updated, mismatch errors are common.

Can I use PhonePe on a new phone without the old SIM?

For many verification flows, you need access to the registered number to receive OTP. If the SIM is lost, get a SIM reissue or update your number with your bank first, then verify again.

Do NRIs really need an Indian SIM for PhonePe UPI?

Not always. PhonePe has published steps for linking eligible NRE/NRO accounts using an international number, but eligibility and SMS verification still apply.

What should I do if I suspect fraud or SIM swap on my PhonePe account?

Act fast: secure your SIM and bank access, report through official channels, and never share OTPs or UPI PINs. Save screenshots and transaction details for the support ticket.

Will a virtual number work for verifying PhonePe?

For UPI/bank features, a virtual number often won’t replace a bank-registered SIM (and you must follow the app's rules). PVAPins is best for privacy-friendly OTP verification on services that accept a separate number for signups.

Conclusion:

If your goal is to get PhonePe working again, fix the number-access problem first (SIM/bank update), then re-verify cleanly. If your broader goal is privacy + fewer OTP headaches across other apps, start with PVAPins virtual free numbers, then upgrade to instant activations or rentals when you need long-term access.

Quick recap of the top fixes:

OTP not received → DND + permissions + network basics first

Number changed → update bank-registered number first, then re-register

New phone → permissions + battery optimization + SMS working check

Practical and straightforward:

Start with PVAPins Free Numbers → then move to Receive SMS → then Rentals when you need long-term access

Use the PVAPins Android app if you prefer handling OTPs on mobile

Explore More Apps

Top Countries for PhonePe

🔥 Trending Countries for PhonePe

Ready to Keep Your Number Private in PhonePe?

Get started with PVAPins today and receive SMS online without giving out your real number.

Try Free NumbersGet Private NumberWritten by Team PVAPins

Team PVAPins is a small group of tech and privacy enthusiasts who love making digital life simpler and safer. Every guide we publish is built from real testing, clear examples, and honest tips to help you verify apps, protect your number, and stay private online.

At PVAPins.com, we focus on practical, no-fluff advice about using virtual numbers for SMS verification across 200+ countries. Whether you’re setting up your first account or managing dozens for work, our goal is the same — keep things fast, private, and hassle-free.

Last updated: December 15, 2025