If you’re trying to use Paysend but don’t want to hand over your personal SIM, yeah, you’re not alone. Sometimes it’s a privacy thing. Sometimes you’re traveling. Sometimes your SIM is dead, and you need to log in to your account right now. The annoying part is pretty consistent: Paysend asks for an SMS code, and that code doesn’t always land where you expect. In this guide, I’ll walk you through what actually works (and what usually doesn't) when you want to verify Paysend without a phone number, plus the quickest fixes when the OTP doesn't show up.

The quickest way to verify Paysend without your personal SIM

If you don’t want to use your personal phone number, the best option is to use a separate SMS-capable number you can access later. Start with a free test if it’s low-risk, then switch to a more reliable private option (and go rental if you expect repeat OTPs).

One-time signup only? Go with a one-time verification number.

Repeat logins/recovery / 2FA? Use a rental number so you can receive sms codes later, too.

If the OTP doesn’t arrive, don’t spam resend, do a quick reset, and try again (Paysend’s own checklist backs this up):

Save your number details in your PVAPins dashboard, so you’re not guessing later.

Mini reality check: security guidance consistently states that stronger authentication reduces the risk of takeover. The practical takeaway is simple: don’t pick a number you won’t be able to access later if the account matters. NIST reference:

Why Paysend asks for a phone number (and when you’ll be forced to use SMS OTP)

Paysend uses phone numbers for identity and access control, especially for login OTPs and security features such as two-step authentication. In many flows, SMS is the confirmation method, so the real question becomes: which number will work reliably, and can I reaccess it later?

Fintech-style services are usually stricter about the quality of numbers and reuse. Overused number ranges get flagged faster.

There are moments you can’t “skip” phone verification (login prompts are the classic example).

“Reliable access later” matters more than people expect: password resets, device changes, recovery prompts it usually circles back to your number.

Example: OTP delivery can be affected by roaming, carrier filtering, or a weak signal, and Paysend recommends waiting and doing basic network refresh steps before trying again:

Login OTP vs account verification vs security checks

Think of it like three layers:

Login OTP: You’re trying to log in to your account. This is often the strictest and most time-sensitive.

Account verification: Identity/profile checks (depends on the account and region).

Security checks: Two-step verification, new-device prompts, “suspicious login” alerts.

The stronger the risk signal, the more likely Paysend is to lean on SMS. That’s why choosing a number you can access again is such a big deal.

Does Paysend accept virtual numbers? Here’s the realistic answer

Sometimes yes, sometimes no, because some platforms and routes treat virtual/VoIP ranges as higher risk. Paysend’s own guidance notes that virtual/VoIP numbers don’t always receive OTP messages, so reliability depends heavily on number type and route quality.

“Virtual number” can mean a bunch of things, but the common problem is the same: some ranges are heavily reused.

OTP delivery fails most often because of filtering, overused ranges, and carrier blocks.

If one number fails, the move is to switch the number type/route, not “resend 10 times and hope.”

Paysend reference: their “SMS not received” guidance is the clearest clue that some number types won’t behave consistently:

Why some number types fail (and what “VoIP/virtual” usually means for OTP)

Here’s the plain-English version:

VoIP/virtual often = cloud-based + reused ranges.

Reused ranges get abused, and abused ranges get filtered.

Even if a number “works” today, it might fail later if that route gets flagged.

So, yes, if this is a low-risk test, you can experiment. But if you’re setting up something you’ll need again, you’ll want a more stable option that isn’t “crowded.”

Free vs low-cost virtual numbers for Paysend verification: What should you use?

Free public-style numbers are okay for testing, but they’re shaky for anything important. If you might need repeat logins, 2FA prompts, or recovery later, a virtual rental number is usually the safer move because you keep access.

Free: fast test, higher failure rate, not great for recovery.

One-time activation: best for “signup OTP only.”

Rental: best for repeat OTPs and ongoing access.

Cost-wise? Spending a little can save you from getting locked out and stuck in a support loop.

Example: shared number ranges are more likely to be blocked over time (telecom/anti-abuse trend). You don’t need a research paper for this. If you’ve ever used a public inbox number, you’ve probably seen the “works once, fails later” pattern.

When a free number is “fine” (testing)

A free number is “fine” when:

You’re just checking if Paysend sends the OTP at all.

The account isn’t critical.

You don’t mind switching numbers if it fails.

Just don’t build your whole setup on it. Free numbers are significant for quick testing, not for long-term access.

When a rental number is the only sane choice (repeat logins, recovery)

A rental number is the wise choice when:

You expect future logins from new devices.

You might trigger two-step prompts.

You care about account recovery.

You don’t want to re-verify from scratch later.

Honestly, for fintech accounts, it’s usually smarter to assume you’ll need access again because you probably will.

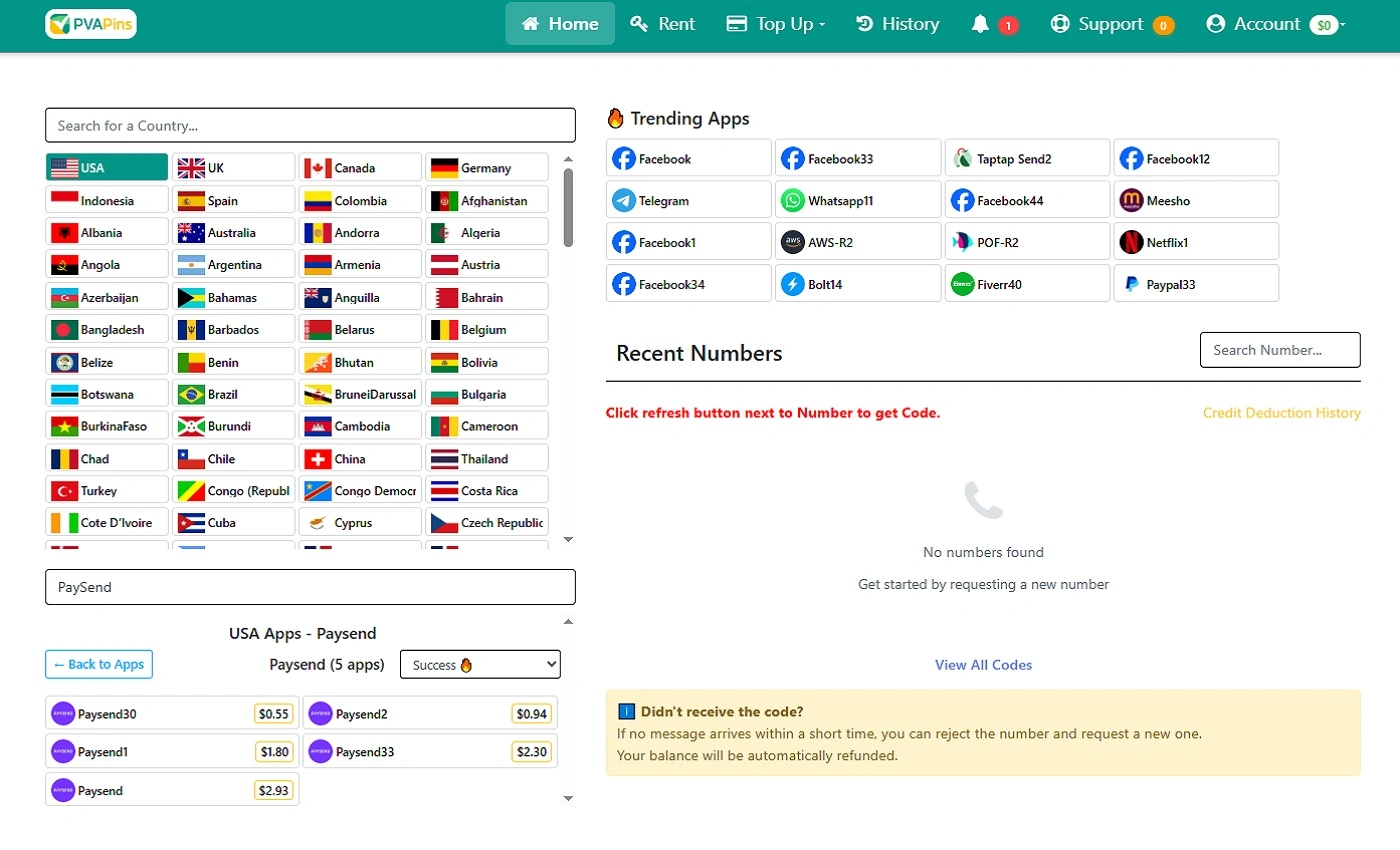

Step-by-step: verify Paysend without a phone number using PVAPins

The clean path is: pick a number you can access → enter it in Paysend → receive the OTP in PVAPins → verify → keep the number if you’ll need future OTPs. Start free if it’s low-risk; upgrade to instant/rental if OTP reliability matters.

Choose your country and number type (free/one-time/rental).

Enter the number in Paysend with the correct country format.

Request the OTP and watch your PVAPins inbox web or Android app.

If the code doesn’t arrive, switch number type/route (don’t brute-force retries).

If you need long-term access, keep the rental active for recovery/2FA.

Paysend’s OTP troubleshooting supports the “wait, then retry + network refresh” approach instead of rapid resends:

Option A : Try a free number (quick test)

Use this if you’re testing the flow.

If it works, great. If it doesn’t, don’t waste 20 minutes switching to a more reliable option.

Option B: Instant one-time verification (OTP-only)

This is the “I need the code now, and I’m done” option.

Use a one-time activation inside PVAPins.

Verify Paysend, complete the OTP step, and you’re finished.

Best when you genuinely don’t need repeat logins or recovery later.

Option C Rental number (repeat OTPs, 2FA, account recovery)

This is the “I want fewer headaches” option.

Rent a number you control:

Use it for login OTPs, two-step prompts, and recovery.

Keep it active as long as the Paysend account matters.

PVAPins note: PVAPins supports 200+ countries, offers private/non-VoIP options, and is built for fast OTP delivery with API-ready stability. You can top up using Crypto, Binance Pay, Payeer, GCash, AmanPay, QIWI Wallet, DOKU, Nigeria & South Africa cards, Skrill, and Payoneer.

Compliance reminder: PVAPins is not affiliated with Paysend. Please follow each app’s terms and local regulations.

Numbers That Work With Paysend:

PVAPins keeps numbers from different countries ready to roll. They work. Here’s a taste of how your inbox would look:

| 🌍 Country | 📱 Number | 📩 Last Message | 🕒 Received |

UK

UK | +447472083919 | 166166 | 10/02/26 07:34 |

UK

UK | +447723301615 | 033523 | 09/02/26 08:21 |

UK

UK | +447760183858 | 926004 | 09/02/26 06:44 |

UK

UK | +447782933308 | 695840 | 09/02/26 08:15 |

UK

UK | +447877741374 | 671986 | 09/02/26 09:54 |

Spain

Spain | +34613568594 | 933287 | 05/12/25 03:06 |

UK

UK | +447350543665 | 507671 | 10/02/26 02:51 |

Grab a fresh number if you’re dipping in, or rent one if you’ll be needing repeat access.

Paysend verification code not received fixes that actually help.

If you’re not getting the Paysend SMS code, the fastest wins are: wait a bit, resend once, refresh your network (airplane mode/restart), confirm formatting, and avoid number types that often miss OTP delivery.

Paysend’s own checklist includes waiting and using simple network steps before trying again:

Resend timing, network refresh, roaming, and formatting checks

Try this exact sequence (it’s boring and weirdly compelling):

Wait ~45 seconds before resending (avoid “spam taps”).

Toggle airplane mode on/off, or restart your device.

If you’re traveling, roaming delays are real. Give it a moment.

Double-check formatting: correct country code, no extra spaces, correct digits.

Mini scenario: you request the OTP three times in 10 seconds and hit a cooldown. If you instead wait, resend once, and refresh the network, the code often arrives on the next attempt.

What to do if the app blocks the number range

If you suspect the number type is the issue (especially after multiple fails):

Switch to a different number range/type inside PVAPins.

Prefer a cleaner, more private route if available.

If you’re seeing “try later” messages, stop and cool down first.

This is precisely why “free first, then upgrade if needed” is a solid strategy.

Paysend login code not received, what’s different from signup?

Login OTPs can be stricter because they’re tied to account security, device changes, and sometimes additional checks. If login codes fail repeatedly, treat it like a security flow: reduce retries, ensure the number is stable, and be ready to contact support if you’re locked out.

New device prompts and two-step checks

Login issues often show up when:

You’re signing in from a new phone.

You changed SIM/device recently.

Two-step prompts trigger an extra step.

What helps:

Don’t rapid-fire resends (you can trigger temporary blocks).

Use a number you can access again (rentals help a lot here).

If you think a route is filtered, switch the number type instead of forcing retries.

Example: extra verification steps reduce takeover risk even when credentials leak. This is why 2FA exists in the first place (industry security guidance trend).

How to change phone number on Paysend (without losing access)

Paysend allows phone number changes in profile settings, but you must confirm the change via SMS. There are rules: the new number generally needs to match the old number’s country and can’t already be linked to another account.

Official Paysend steps/rules:

Country-matching + “number already used” issues

Two common blockers:

If you’re planning, this is another reason rentals help you avoid losing access during a change.

Two-step authentication on Paysend: keep it secure without using your primary SIM

Two-step authentication adds an extra security layer by sending a code to your phone. If you don’t want to use your primary SIM, set it up with a number you’ll keep access to because 2FA is only helpful if you can actually receive the codes later.

Choosing a number you can access again later

Best practice is simple:

Don’t use “disposable-only” access for ongoing 2FA.

If you need repeat codes, go rental.

Keep your login setup consistent to avoid triggering extra checks.

Micro-opinion: if the account is even slightly important, disposable access is a gamble. A minor upgrade is usually cheaper than losing the account.

How this works in the United States (formats, support options, common blockers)

In the US, the main issues are usually formatting, carrier filtering, and overused number ranges. If you get stuck, Paysend provides US support options you can use after you’ve tried the standard OTP fixes.

US formatting: use the correct country code (+1) where required.

If OTP fails repeatedly, switch to a different number or route type instead of resending forever.

If you’re roaming, do the network refresh steps first.

Paysend US help page:

How this works in India (common OTP delays, formatting habits, and safer number choices)

In India, OTP delays and filtering can happen more often during peak congestion or when a number range is flagged. The best move is to use a stable number type, follow resend timing, and pick rentals if you’ll need repeat access.

Format habits: correct country code (+91) and no extra spaces.

Don’t hammer, resend, wait, then retry.

If the OTP doesn’t arrive after basic checks, switch to a different route/type early.

Example: weak signal or carrier delays can delay SMS delivery (common support guidance across OTP help centers).

When you should contact Paysend customer support (and what to send them)

Contact support when you’re locked out, can’t change your number, or repeated OTP failures continue after standard fixes. Send a tight summary (phone format, timestamps, screenshots) to speed up resolution.

Paysend’s official support contact guidance:

The “fast support” checklist

Send this upfront (it saves a lot of back-and-forth):

Your country + number format used (don’t share full sensitive details publicly)

Device type + OS version

Exact error message

Timestamp of attempts (with timezone)

Screenshots (OTP screen, error prompts)

Whether you were traveling/roaming

Whether you tried waiting + network refresh steps

Keep it honest and compliant. Don’t frame it as “workarounds.” Frame it as I can’t receive the code, and I need access restored.

Conclusion: pick the right number type and verify with less stress.

If you need one OTP, a one-time code will suffice. If you want fewer headaches long-term, use a rental number you can access for repeat logins, 2FA, and recovery, and keep everything aligned with the app’s rules.

Quick recap:

Compliance reminder: PVAPins is not affiliated with Paysend. Please follow each app’s terms and local regulations.

Ready to do this the smooth way? Start with PVAPins → test with free numbers → move to instant verification if needed → rent a number for long-term access.

UK

UK Spain

Spain