Paysafecard SMS Verification – Rental & Private Numbers

How it works

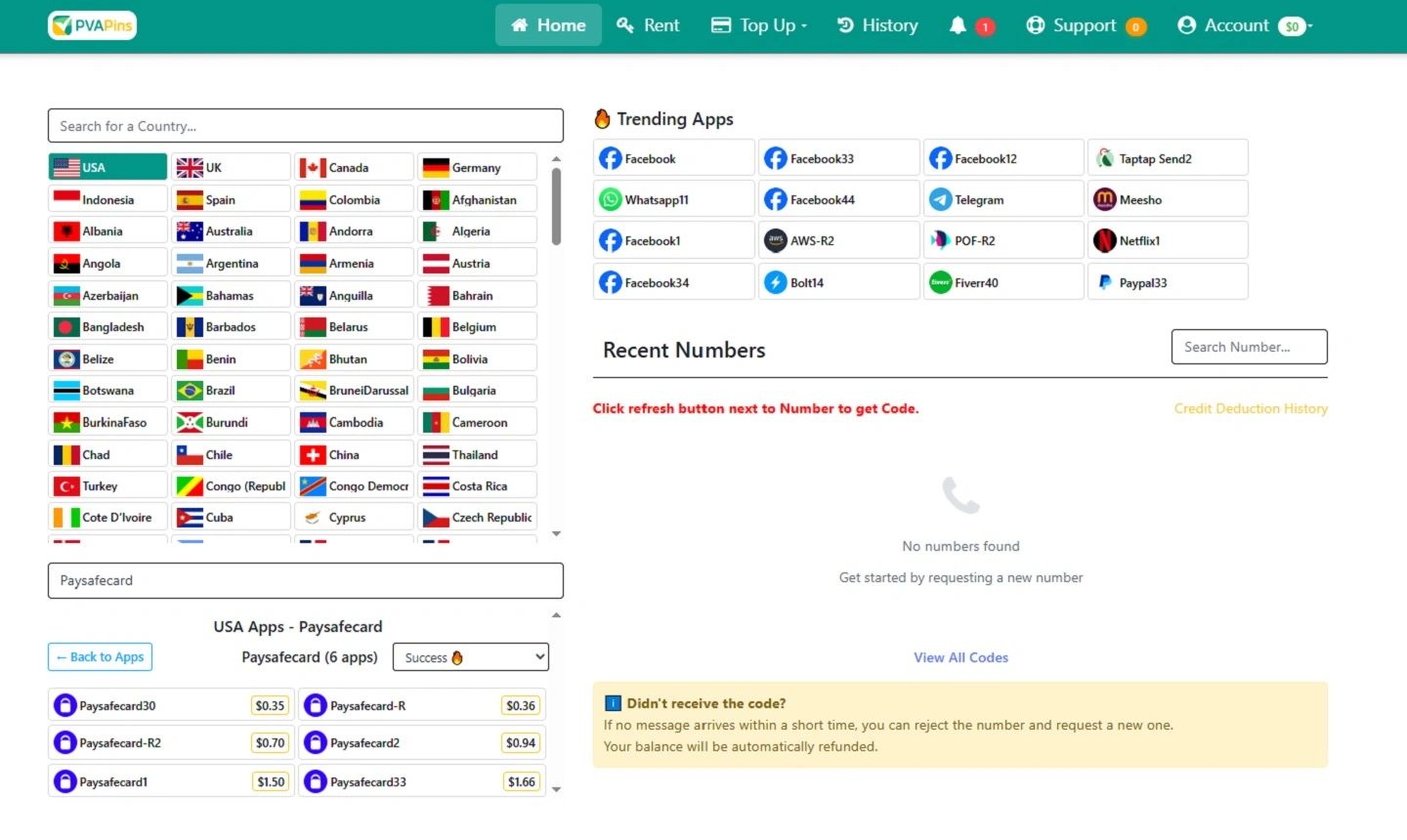

Choose your number type

Free inbox = quick tests. Activation or Rental = typically better delivery and fewer rejections.

Pick country + copy the number

Select the country you need, grab a number, and copy it exactly.

Request the OTP on Paysafecard

Enter the number on the Paysafecard verification screen and tap Send code (avoid rapid retries).

Check PVAPins inbox

Refresh once or twice, copy the OTP as soon as it appears, and enter it immediately (codes expire fast).

If it fails, switch smart

Don’t spam resend. Switch number/route, wait a bit, then try again once.

OTP not received? Do this

- Wait 60–120 seconds (don't spam resend)

- Retry once → then switch number/route

- Keep device/IP steady during the flow

- Prefer private routes for better pass-through

- Use Rental for re-logins and recovery

Wait 60–120 seconds, then resend once.

Confirm the country/region matches the number you entered.

Keep your device/IP steady during the verification flow.

Switch to a private route if public-style numbers get blocked.

Switch number/route after one clean retry (don't loop).

Free vs Activation vs Rental (what to choose)

Choose based on what you're doing:

Quick number-format tips (avoid instant rejections)

Most verification failures are formatting-related, not inbox-related. Use international format (country code + digits), avoid spaces/dashes, and don’t add an extra leading 0.

Best default format: +CountryCode + Number (example: +4915123456789)

If the form is digits-only: CountryCodeNumber (example: 4915123456789)

Simple OTP rule: request once → wait 60–120 seconds → resend only once.

Inbox preview

| Time | Country | Message | Status |

|---|---|---|---|

| 23/02/26 08:59 | USA | ****** | Delivered |

| 23/02/26 08:53 | USA | ****** | Pending |

| 10/02/26 07:45 | USA | ****** | Delivered |

FAQs

Quick answers people ask about Paysafecard SMS verification.

Can I verify Paysafecard without my personal SIM card?

Yes, if Paysafecard accepts the number, you can use a separate SMS-capable line instead of your personal SIM. For important accounts, pick a private option so you can still access future codes.

Do virtual numbers work for Paysafecard verification?

Sometimes. It depends on the number of routes and whether that number range is overused. If a free/shared number fails, a private activation is usually more reliable.

Why is my Paysafecard verification code not arriving?

Most of the time, it’s formatting, resetting cooldowns, or filtering on the route. Double-check the country code, wait a bit, then try a cleaner number type.

What’s the best option if I need future logins or recovery?

A rental number. It keeps the same number active longer, which helps with repeat OTPs, 2FA prompts, and account recovery.

Can I change my Paysafecard phone number after registration?

Usually, yes, go to account settings, update the number, then confirm via SMS to the new number.

Are there limits if I don’t verify?

Limits vary by country and account status. Verification/upgrading status often increases what you can do, so check your “limits/status” inside the account and review Paysafecard’s verification help pages.

Is it legal to use a separate number for verification?

In many places, it’s fine for privacy and account separation, as long as you’re not using it for fraud/spam and you follow the platform’s terms and local rules.

Read more: Full Paysafecard SMS guide

Open the full guide

If you’ve ever tried signing up for a payment app and hit that classic “enter your phone number” wall, yeah. You don’t want the spam. You don’t want your primary SIM tied to everything. You want to get verified and move on with your day.

This guide breaks down what actually works, what usually fails, and how to verify safely without using your personal number. And yep, we’ll cover Verify Paysafecard Without a Phone Number the way people really mean it: without using your own SIM, while staying compliant.

The fastest safe way to verify without your personal SIM

If you don’t want to use your personal number, the most straightforward approach is to use a separate SMS-capable number you control (best: a private route). Free numbers can be okay for quick testing, but if the account matters, switch to an activation or rental so you can access future codes.

Start with PVAPins Free Numbers to learn the flow and do a low-risk test

If the OTP fails, switch to a private/non-VoIP activation for better delivery

Use a rental if you might need logins, 2FA prompts, or recovery later

Keep formatting clean: country code first (+1, +44, etc.), no extra spaces

A lot of “SMS login fails” problems are honestly boring stuff, formatting, resend cooldowns, or the number route being filtered. When that happens, the fastest fix is usually switching to a cleaner number type instead of rage-clicking “resend.”

When free numbers are fine vs when you should go private

Free numbers are fine when you’re just testing a low-risk flow (like “can I even reach the OTP screen?”). But they’re shared, reused, and more likely to be blocked, so it’s not the most brilliant move for anything money-related or long-term.

If you care about the account (or you might need future logins), go private. It’s usually cheaper than wasting 30 minutes on retries that go nowhere.

Can you verify Paysafecard without using your personal phone number?

In many cases, yes, you can verify using a phone number that isn’t your personal SIM, as long as it can receive SMS and Paysafecard accepts it. What you usually can’t do is complete phone/SMS steps with no number at all.

Think of it this way: Paysafecard needs a reachable phone number for SMS-based verification. Your goal is to use a separate number that protects your privacy and still receives the code.

“Accepted number” generally means it’s SMS-capable and not blocked on that route

Requirements can vary by country and account flow (we’ll get into that)

Practical route: test → improve reliability → stabilize with a rental if needed

Without a phone number vs “without your phone number”

Most people aren’t saying, “I want to verify with zero phone number.” They mean: “I don’t want to use my personal phone number.”

That’s a big difference. In most verification systems, a phone number capable of receiving SMS is required. The win is using a separate number you control (and can reuse later if recovery codes ever come up).

Why Paysafecard asks for a phone number (and why SMS sometimes fails)

Paysafecard uses phone/SMS steps to protect accounts and confirm you’re the account holder. SMS can fail due to formatting issues, resend cooldowns, or filtering on specific number routes, so switching to a cleaner/private option often fixes it.

This isn’t about making your life harder. It’s usually basic security plus compliance pressure that comes with anything payment-related.

2-step login + fraud prevention basics

SMS verification is a standard “possession check.” If you can receive the code, you likely control the number. That helps reduce fake signups and protects account access.

The downside is that SMS isn’t always instant, and some routes get filtered more than others. That’s why number quality matters more than people expect.

Country rules and compliance pressure

Verification steps can change depending on region, product availability, and how the account is being used. That’s normal in payments; some flows are stricter than others.

So if someone tells you, “I didn’t need that step,” they might be right. They could be on a different country flow or product path.

Best options to verify Paysafecard without exposing your real number

The “safe” path is to use a separate number you can access again: a spare SIM/eSIM for personal control, or a private virtual number (best for privacy). If you’ll need repeat logins or recovery, a virtual rental number is usually the calmer long-term choice.

Here are the realistic options, from simplest to most scalable.

Spare SIM / eSIM

If you already have a spare SIM (or can add an eSIM), this is the most “traditional” option.

You fully control the number

It’s usually treated like a standard mobile line

Downside: you’re still managing a carrier line, and it’s not always convenient globally

If you only need Paysafecard verification once and you’re okay running a second SIM, this works.

Private virtual number (best for privacy)

A private virtual number is often the best balance: you protect your primary SIM, receive OTPs in an online inbox, and don’t have to swap SIMs to sign up.

With PVAPins, you can choose from 200+ countries, start with a free test number, then move to private options when you need better consistency. That “upgrade path” matters more than people realize.

Rental number for ongoing logins & recovery

If you’re building something long-term (e.g., repeat logins, security prompts, password recovery), rentals are the safer option.

The exact number stays active longer

Better for repeat OTPs, 2FA prompts, and recovery

Less stress later when the platform asks you to “confirm again.”

Also, a quick reality check: SMS-based authentication has known risks (like SIM swaps and number porting). NIST’s digital identity guidance is a solid reference if you want the deeper security context:

How to Verify Paysafecard Without a Phone Number (Step-by-Step with PVAPins)

Pick a number on PVAPins, enter it during Paysafecard signup/verification, then read the OTP inside your PVAPins inbox web or Android app and confirm. If the code doesn’t arrive, switch number type (free → private activation → rental).

Here’s the clean step-by-step flow.

Pick country + number type (free vs activation vs rental)

Start simple:

Use PVAPins Free Numbers if you’re testing the flow

If you want higher success, choose a private/non-VoIP activation

If you want ongoing access, choose a rental

Rule of thumb: if losing the account would annoy you later, don’t rely on a shared/public-style number.

And for topping up, PVAPins supports flexible payments (handy if you’re not using a US card): Crypto, Binance Pay, Payeer, GCash, AmanPay, QIWI Wallet, DOKU, Nigeria & South Africa cards, Skrill, and Payoneer.

Enter the number in Paysafecard and receive OTP in PVAPins

Once you’ve picked your number:

Please enter it in the Paysafecard phone prompt

Open your PVAPins inbox on the web (or use the Android app)

Please wait for the OTP and paste it back into Paysafecard

Please keep it clean: don’t copy extra spaces, don’t add leading zeros, and always use the correct country code.

What to do if the OTP doesn’t arrive

If it doesn’t show up quickly, don’t panic-click resend 12 times. That can trigger throttles and make the delay worse.

Do this instead:

Double-check the country code format and number formatting

Wait out the resend cooldown

Switch number type (free → private activation)

If you expect future OTPs, move to a rental so you’re not rotating numbers

Free vs low-cost virtual numbers: Which should you use for Paysafecard verification?

Free numbers are fine for quick, low-risk testing, but they’re shared and often blocked. For anything you care about (logins, recovery, money-related accounts), a low-cost private number is the safer, more reliable move.

Here’s the honest breakdown.

Risk tradeoffs (public inbox vs private)

Public/shared inbox numbers can be:

Overused (more likely to be blocked)

Not private (codes can be exposed in some setups)

Unstable (numbers rotate, access changes)

Private numbers (especially non-VoIP routes) tend to be:

More consistent for OTP delivery

Better for privacy

More suitable when the account matters

If you’re verifying something payment-related, in most cases, it’s smarter to spend a little and avoid the repeat-fail loop.

Quick decision table (test vs important account)

Just testing the signup screen? Use free numbers.

Need it to work today? Use an activation.

Need repeat access for logins/recovery? Use a rental.

That’s the ladder. No drama.

One-time activation vs rental number for Paysafecard (which one is safer?)

If you only need a single OTP to finish signup, one-time activation is usually enough. If you expect repeat logins, security prompts, or recovery codes, rental is safer because you keep access to the same number.

Use-cases: signup-only vs repeat logins, 2FA, recovery

Use one-time activation when:

You only need one verification SMS

You don’t expect recovery prompts later

You’re validating a basic signup flow

Use a rental number when:

You’ll log in again from new devices

You want stable access for future OTPs

You might need password resets or security confirmations

For serious accounts, rental is the “future you won’t hate present you” choice. Honestly, it’s just less stressful.

Numbers That Work With Paysafecard:

PVAPins keeps numbers from different countries ready to roll. They work. Here’s a taste of how your inbox would look:

| 🌍 Country | 📱 Number | 📩 Last Message | 🕒 Received |

Estonia

Estonia | +37256067083 | 985945 | 31/01/26 04:48 |

Estonia

Estonia | +37256072421 | 212462 | 31/01/26 02:56 |

USA

USA | +12525079375 | 144864 | 23/02/26 08:53 |

USA

USA | +13162291772 | 745771 | 10/02/26 07:45 |

Estonia

Estonia | +37256188878 | 141032 | 31/01/26 04:06 |

Estonia

Estonia | +37256058391 | 177921 | 31/01/26 10:28 |

Estonia

Estonia | +37256041482 | 156467 | 31/01/26 05:40 |

Estonia

Estonia | +37256024573 | 163620 | 31/01/26 09:48 |

Estonia

Estonia | +37256066416 | 133167 | 31/01/26 03:20 |

Estonia

Estonia | +37256304057 | 148880 | 30/01/26 02:06 |

Grab a fresh number if you’re dipping in, or rent one if you’ll be needing repeat access.

Paysafecard SMS verification code not received fixes that actually work.

Most missing OTP issues stem from country-code formatting, cooldowns, or route filtering. Fix formatting, wait out resend limits, then switch to a cleaner/private number type if the code still doesn’t arrive.

Formatting + country code checklist

Quick checklist before you blame the universe:

Use the correct +country code

Please don’t add extra spaces or dashes unless the form formats it automatically

Avoid leading zeros (unless your country format explicitly requires it)

Make sure the country selection matches the number (if there’s a dropdown)

Cooldowns, retries, switching number type

If you hit resend too quickly, many systems throttle or temporarily block retries.

Better flow:

Wait a couple of minutes

Try once more

If it fails, switch to a cleaner number type (private activation)

If you need stability, move to a rental

When to change route/country

Only change route/country if the platform flow actually allows it and it matches your account setup.

If you’re stuck on an account-level issue (verification loops, profile changes, access problems), it’s smarter to follow official troubleshooting instead of brute forcing. Paysafecard has a basic troubleshooting guide that’s worth checking when things get weird: official troubleshooting steps.

Paysafecard limits without verification (and what changes after you verify)

Limits depend on the country and the account status. Verification/upgrading status generally unlocks higher limits, while unverified use can be more restricted.

Paysafecard’s own verification help section is a good reference for status topics, document questions, and timing expectations: Paysafecard verification support category.

Standard vs upgraded status and why it matters

Think of verification as a trust step. When an account is verified/upgraded, platforms often allow higher limits or more features because the risk profile is lower.

If you plan to rely on the account long-term, that’s another reason rentals make sense. You’ll want consistent access if the platform asks you to confirm something later.

How this works in the United States (US-specific notes)

In the US, Paysafecard availability and account tools may differ from those in parts of Europe. You may see prepaid code usage emphasized, and the exact verification flow depends on the product and partner context.

Availability differences and what you’ll see in practice

In practice, many US users use Paysafecard as a prepaid code/payment method in supported locations, and the “account experience” can vary by region.

Your safest approach stays the same:

Use correct +1 formatting if SMS is required

Use a stable number type if you want repeat access

Don’t rely on shared/public inbox behavior for essential accounts

Global & country rules explain why verification steps vary.

Paysafecard isn’t “one-size-fits-all.” Country availability, account tools, and verification requirements can differ, so the same phone/OTP step may appear in one country but not another.

Country availability + “account required” scenarios

Some countries have different product availability or different verification steps depending on how the account is being used. That’s normal for payments.

If your goal is consistency, match your number country selection to the flow you’re using and avoid bouncing between regions unless the platform explicitly supports it.

Programmatic idea: “Verify Paysafecard without a SIM.”

This is where programmatic SEO can actually be clean and helpful (not spammy):

“Verify Paysafecard without a SIM”

“Receive SMS for Paysafecard verification”

PVAPins already supports 200+ countries so that those pages can map neatly to real user intent.

How to change your Paysafecard phone number later

You can update your phone number from account settings, then confirm the change using an SMS code sent to the new number. Paysafecard’s support article literally outlines the “SMS to the new number” confirmation step: “How to change your phone number.”

Common issues if you lost access to the old number

The big issue is simple: if you can’t receive verification SMS anymore, changes and recovery become harder.

Best practices:

If the account matters, keep a stable number (rental)

Don’t rotate numbers randomly after signup

If you’re locked out, use official support instead of guessing

Safety, privacy, and compliance notes (read this before you start)

Using a separate number for privacy is fine, as long as it complies with platform rules. Don’t use verification tools for abuse, and avoid public inbox numbers for sensitive accounts because they can expose recovery codes.

Also, keep your security expectations realistic: SMS codes are convenient, but not the strongest option for high-risk protection. If you want the technical background, NIST’s guidance is a good baseline reference:

The PVAPins compliance reminder

PVAPins is built for privacy-friendly verification, letting you get OTPs without handing your real SIM to every site.

Compliance matters too, especially in payments:

PVAPins is not affiliated with Paysafecard. Please follow each app’s terms and local regulations.

Conclusion + next step CTA (free → activation → rental)

If you want to test Paysafecard verification, start with a free number. If you want it to work consistently, use a private activation. And if you’ll need repeat logins or recovery later, lock it in with a rental number so you’re not scrambling when a code suddenly becomes “required.”

Start here:

Try virtual PVAPins Free Numbers first

Move to instant activation when you need reliability

Use rentals for ongoing access and peace of mind

And if you prefer managing OTPs on your phone, grab the PVAPins Android app.

PVAPins is not affiliated with Paysafecard. Please follow each app’s terms and local regulations.

Last updated: January 26, 2026

Top Countries for Paysafecard

Get Paysafecard numbers from these countries.

Ready to Keep Your Number Private in Paysafecard?

Get started with PVAPins today and receive SMS online without giving out your real number.

Try Free NumbersGet Private NumberWritten by Team PVAPins

Team PVAPins is a small group of tech and privacy enthusiasts who love making digital life simpler and safer. Every guide we publish is built from real testing, clear examples, and honest tips to help you verify apps, protect your number, and stay private online.

At PVAPins.com, we focus on practical, no-fluff advice about using virtual numbers for SMS verification across 200+ countries. Whether you’re setting up your first account or managing dozens for work, our goal is the same — keep things fast, private, and hassle-free.