Chime SMS Verification: Free & Private Options

How it works

Confirm the phone number on your Chime account

Make sure the country code and digits match what’s saved in your profile.

Request the OTP once

Tap Send code and wait—rapid repeats can trigger rate limits.

Wait 60–120 seconds → resend only once

If nothing arrives, wait a bit, then resend one time. Don’t spam.

Check signal + SMS filters

Airplane mode off, solid network coverage, and check spam/blocked/unknown sender filters (some phones hide short codes).

Restart your phone (quick fix)

This can refresh your carrier connection and unblock stuck SMS delivery.

Use Chime support/recovery if you’re still stuck

For banking apps, verification can be restricted for security—official support is the safest way to restore access.

OTP not received? Do this

- Wait 60–120 seconds (don't spam resend)

- Retry once → then switch number/route

- Keep device/IP steady during the flow

- Prefer private routes for better pass-through

- Use Rental for re-logins and recovery

Wait 60–120 seconds, then resend once.

Confirm the country/region matches the number you entered.

Keep your device/IP steady during the verification flow.

Switch to a private route if public-style numbers get blocked.

Switch number/route after one clean retry (don't loop).

Free vs Activation vs Rental (what to choose)

Choose based on what you're doing:

Quick number-format tips (avoid instant rejections)

Most verification forms reject numbers because of formatting, not because your inbox is “bad.” Use international format (country code + digits), avoid spaces/dashes, and don’t add an extra leading 0.

Best default format: +CountryCode + Number (example: +14155552671)

If the form is digits-only: CountryCodeNumber (example: 14155552671)

Simple OTP rule: request once → wait 60–120 seconds → resend only once.

Inbox preview

| Time | Country | Message | Status |

|---|---|---|---|

| 15/02/26 01:24 | USA | ****** | Delivered |

| 02/02/26 05:52 | USA | ****** | Pending |

| 05/02/26 12:07 | USA | ****** | Delivered |

FAQs

Quick answers people ask about Chime SMS verification.

1. Can I verify Chime without using my personal phone number?

Yes. You still need an SMS-capable number, but it doesn’t have to be your everyday SIM. Many users attach a private virtual number they control and keep that line for OTPs and recovery while their personal SIM stays off the account.

2. Why am I not receiving my Chime verification code?

Most of the time, it’s something small: incorrect number format, missing country code, your carrier blocking short codes, weak signal, or hitting “resend” too often. Fix those first. If codes still don’t arrive, it’s usually time to switch to a more reliable route.

3. Can I log into Chime without access to my old phone number?

Often, yes. Start from a remembered device if you have one, then use email or in-app recovery options. Be ready to prove it’s really you, and once you’re in, attach a new number you actually control so this doesn’t happen again.

4. Does Chime accept virtual phone numbers for verification?

In many real-world cases, a private virtual number works fine, especially when it’s SMS-routable and not a free public inbox. No provider can guarantee that every route will always work, but clean private lines behave much more like normal mobile numbers.

5. Is it safe to verify Chime using a virtual number?

It can be, as long as only you can see the messages and you follow Chime’s terms. Avoid public inboxes, lock down your PVAPins login, and never share OTPs. Treat the virtual number like a genuine SIM dedicated to your financial life.

6. Should I use a one-time activation or a rental number for Chime?

If you need to sign up once and rarely log in from new devices, a one-time activation can be enough. If you travel, swap phones, or expect more security prompts, a rental number is safer for long-term OTPs and recovery.

7. Can I verify Chime while I’m overseas?

Sometimes roaming works, sometimes it doesn’t, especially with short codes. Many travellers keep a US-based number purely for fintech OTPs. A virtual or rented line through PVAPins gives you a stable way to receive codes while you use local SIMs abroad.

Read more: Full Chime SMS guide

Open the full guide

You’re trying to log in or finish sign-up, and suddenly Chime pops up: We sent a code to your phone. Great for security until you’ve changed SIMs, lost your number, or don’t want your bank glued to your everyday phone. This guide walks you through practical, safe ways to verify Chime without a phone number. You’ll see what’s actually possible, what isn’t, and how a private virtual number from PVAPins can keep your account secure without tying everything to one fragile SIM card.

What “Verify Chime Without a Phone Number” Actually Means

Most people searching for this aren’t trying to outsmart security. They either want to verify their Chime account without exposing their personal SIM or no longer have access to the number Chime is using.

The key idea: Chime still needs a phone number that can receive SMS codes. It just doesn’t have to be the same SIM you use for calls, WhatsApp, and random delivery texts.

Why Chime Needs a Phone Number in the First Place

Like most modern fintech apps, Chime leans on your phone number as a security anchor. That number helps Chime to:

Send SMS verification codes when you log in or change necessary settings.

Double-check it’s really you on a new device or browser.

Help you recover the account if you forget your password or lose access.

Phone-based checks are popular because they’re familiar and straightforward. Most banking and finance apps use SMS or app-based codes during verification. It’s not bulletproof, but it does a solid job of keeping basic bots and spam out.

So the real goal isn’t “no phone involved ever.”

It’s “use a number you control and feel comfortable attaching to your financial life.”

When You Can’t or Don’t Want to Use Your Main SIM

Totally, everyday situations where your primary SIM isn’t a good fit:

You changed carriers and dropped the old number

You’re traveling and switched to a local SIM to avoid roaming fees.

You want a separate “finance stack” number for banking and money apps.

You’re testing Chime as a freelancer, agency, or dev and don’t want to reuse personal details each time.

In all of those cases, a second line, like a private virtual number, can receive the OTP while your day-to-day phone number stays off the account. You still keep Chime’s security model; you decide which number gets plugged into it.

Can You Really Verify Chime Without a Phone Number?

Here’s the honest version: you can’t skip phone verification entirely, but you can stop using your primary SIM for it. Chime typically needs a working SMS-capable number for OTPs and recovery. A private virtual number you control can often do the job, as long as it receives texts reliably and you respect Chime’s rules.

Cases Where You Still Need a Phone, Just Not Your Main SIM

Some things just aren’t optional:

You need an SMS-capable number to receive codes

That number has to handle short-code or fintech-style messages.

You should be able to access it whenever you log in from a new device or location.

The distinction is simple:

Primary number: your everyday SIM for calls, chats, social apps

Alternate line / virtual number: a dedicated number for Chime and other financial services

What you don’t want to do is throw in random digits from a generator. Fake or invalid numbers almost always fail verification and can trigger security checks or temporary locks.

Many apps still rely on SMS as their primary second factor, with app-based codes or hardware keys as optional upgrades. So when you see chime phone number verification not working, it usually means “this route can’t receive the right kind of SMS,” not “phone checks are optional now.”

Email, Devices, and ID Checks: What They Can and Can’t Replace

Can other methods help? Definitely, but they’re backup players, not the star.

Email: handy for password resets or confirming specific actions

Remembered devices: can temporarily skip extra OTPs when you log in on familiar hardware

ID checks (KYC): used when security systems need to be really sure it’s you

However, Chime will usually still expect to see a valid phone number on file for:

Significant changes like password updates, new devices, or large transfers

Long-term account recovery

Ongoing security monitoring and alerts

So, email and device checks support phone verification. They don’t fully replace having a number attached to your account.

Fixing “Chime Verification Code Not Received” Before You Switch Numbers

Before you throw your current number in the trash, fix the basics. Most Chime verification code not received issues are boring things like formatting mistakes, missing country code, carrier blocking, poor signal, or tapping “resend” five times in a row.

Checklist: Formatting, Short Codes, Signal, and Cooldowns

Quick sanity check:

Number format:

If you’re in the US, make sure it’s +1 plus a full 10-digit number.

No extra spaces or missing digits

Carrier & plan:

Some budget or prepaid lines don’t handle short-code or banking SMS well.

Device settings:

Turn off aggressive spam filters, focus modes, or battery savers that might hide texts.

Network:

Move to an area with a stronger signal, or try Wi-Fi calling if your carrier supports it.

Cooldowns:

If you’ve hammered “resend code,” wait a complete timer cycle before trying again.

Industry reports show that a big chunk of OTP failures comes down to carrier filtering and formatting issues, not the app being broken. Annoying, but fixable.

When to Request a New OTP vs Try a New Number

If you’ve:

Checked your formatting

Given it a full resend timer

Confirmed you’re receiving other SMS messages just fine

And the Chime verification code problem is still happening; the route might be unreliable.

At that point, a reasonable next step is:

Request one final fresh OTP

If it still doesn’t show, switch to a new SMS-capable number, ideally a private virtual number from PVAPins, so you can see messages arrive in your dashboard or Android app in real time.

How to Change Phone Number on Chime Safely (Step-by-Step)

To change your phone number on Chime, you generally follow this pattern:

Log in to the Chime app

Go to your profile or account/security settings.

Add your new number

Confirm it with an OTP sent to that line.

Remove or update the old number afterward.

If you no longer have your old SIM, Chime may run a few extra checks to verify it’s really you requesting this.

Changing Your Number When You Can Log In

If you can still log in normally, you’re in good shape:

Open your Chime profile or security section

Add a new phone number and confirm the code sent to it.

Once verified, make that your primary contact and remove the old one.

This is where a PVAPins rental number is handy. Instead of gambling on whatever SIM you’ll be using next year, you attach Chime to a long-term, cloud-based number you control. That PVAPins rental becomes your stable “banking line,” while your personal SIM is free to change with jobs, countries, or carriers.

And people do change numbers a lot, job moves, relocations, plan upgrades, you name it. It’s normal to outgrow a SIM.

What to Do if You Lost Access to the Old Number

If your old number is gone for good:

Try logging in from a device where you’ve previously used Chime

Use email or in-app recovery prompts to kickstart the process.

Be ready to confirm personal details and recent activity (name, address, last transactions, etc.)

Once you’re back in, chime update phone number right away to a line you genuinely control, ideally a stable virtual number that won’t disappear the next time you swap carriers.

Again, a PVAPins rental can act as your “always-on” banking number, surviving SIM swaps, travel, and random life changes.

Login to Chime Without Phone Number: Recovery Paths That Still Work

If you need to log in to Chime without phone number access, your options depend on what else you still have: a remembered device, email, ID documents, etc. Most recovery flows look something like this:

Try a trusted device.

Use email or in-app prompts.

Go through ID checks if needed.

Attach a fresh, SMS-capable number for future logins.

Using Remembered Devices and Email to Get In

Start with the easiest wins:

Remembered device: open Chime on a phone or browser where you’re already signed in or used the app recently

Email-based steps: look for password reset or “magic link” emails and follow them exactly

In-app recovery: if Chime offers guided recovery steps, don’t rush; read everything carefully

These flows exist specifically for users who lost their numbers or changed phones. Once you’re back inside the account, you can attach a new line, like a virtual PVAPins number, to avoid repeating the same nightmare in six months.

When You’ll Need Extra ID Verification

If remembered devices and email aren’t enough, expect more serious verification:

Uploading a government ID

A selfie or short video verification

Confirming recent transaction history or linked card details

It feels slow, but strong identity checks dramatically reduce fraudulent takeovers. Once your Chime account recovery without phone is complete, treat it as your “fresh start” moment and attach a stable number you’ll stick with again, a good use-case for a PVAPins rental.

Using a Chime Virtual Phone Number for Verification

For many people, the best answer isn’t to fight phone verification. It’s to use a Chime virtual phone number for verification, so your primary SIM stays out of it. You still get the security benefits of SMS OTPs, but through a dedicated, private line.

What Makes a Virtual Number Work Better for OTPs

Not all virtual numbers are equal. A good one for Chime should:

Be fully SMS-capable, including short-code or fintech messages

Be private, only you can see incoming texts.

Use routes tuned for US banking/fintech traffic.

Avoid acting like a throwaway spam route.

This is why public inbox sites and “random free numbers” tend to fail. Thousands of users hammer them, get flagged more often, and might already be tied to other accounts. A private PVAPins number behaves much more like a regular phone line that happens to live in the cloud.

One-Time Activations vs Rentals for Chime

You’ve basically got two ways to play it:

One-time activations

Perfect for a single sign-up or quick test

Cheaper short-term, but not ideal if you log in from new devices often

Rentals

A dedicated inbox for your OTPs

More reliable for ongoing Chime logins, device changes, and recovery

Great if you want a single “finance stack” number for banking, exchanges, and other money apps

With PVAPins, you might:

Start with a temp phone number for Chime verification to see how fast codes land.

Then upgrade to a rental when you realise you want a clean, stable line for all your financial apps.

As more banking moves online, virtual numbers and cloud telephony have exploded in usage, and it makes sense. Keeping sensitive stuff off your everyday SIM is just smart.

How to Verify Chime Without a Phone Number Using PVAPins

Here’s the practical “just tell me what to click” version. You can verify Chime without a phone number that’s your primary SIM by using a PVAPins number instead. Chime still sees a regular, SMS-capable line. You get the code online and keep your personal SIM out of the equation.

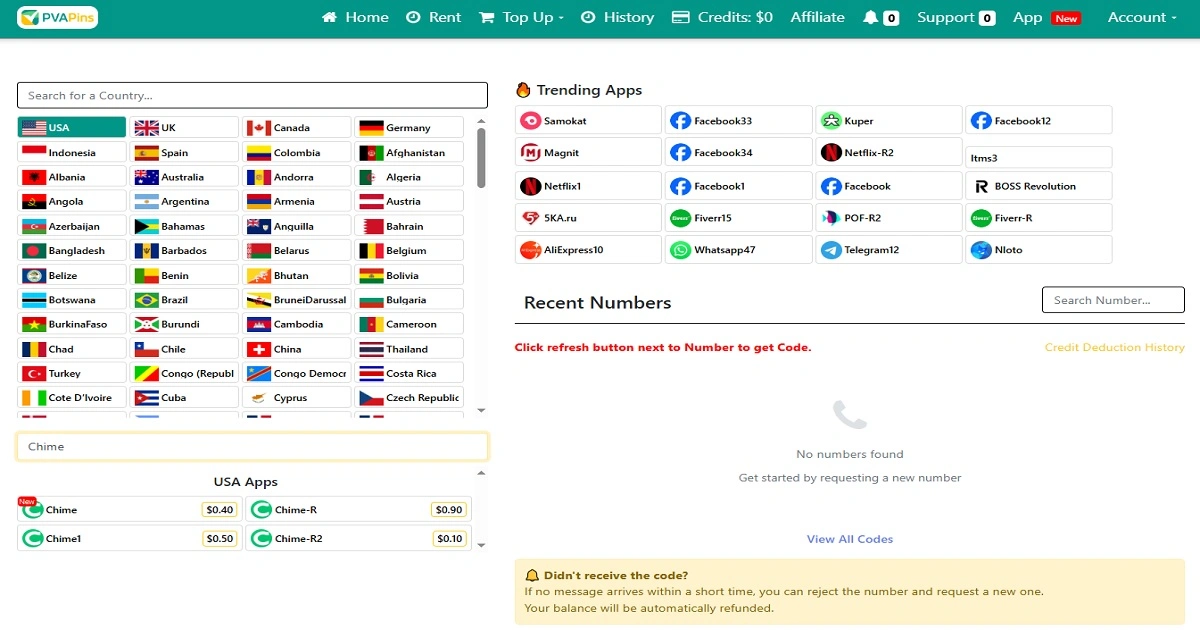

H3: Choose a Private Number in the Right Country

Step-by-step:

Sign up or log in to PVAPins.

Choose the country you need most. Most people use a US number for Chime.

If available, select Chime (or the relevant category) as the target service.

Decide between a one-time activation for quick sign-up or a rental for ongoing use.

PVAPins supports numbers in 200+ countries, with private, non-VoIP routes tuned for OTP delivery and stability. That means fewer surprises when you’re waiting on a critical code.

Receive the OTP Online and Complete Chime Verification

Once your number is ready:

Enter the PVAPins number into Chime’s verification screen

Watch for the OTP in your PVAPins dashboard or Android app.

Paste the code into Chime before the timer runs out.

Confirm that verification is complete and the number is now linked.

If you choose a rental, keep it active for future logins, device changes, and recoveries.

On a good route, OTPs often appear in just a few seconds. And because messages live in your PVAPins account, you’re not tied to a single physical SIM or device.

PVAPins is not affiliated with Chime. Please follow each app’s terms and local regulations.

Verifying Chime When You’re Outside the US

Verifying Chime from outside the US can be hit-or-miss. Some roaming setups handle short-code texts beautifully. Others drop them into a black hole. That’s why many people keep a dedicated US number, physical or virtual, just for banking OTPs.

If You’re in the UK or Europe

Typical headaches:

US short codes are not always supported on local SIMs

Roaming fees and random delays

Codes showing up way too late (or never)

A US-based virtual number from PVAPins lets you:

Keep a stable OTP route while using your UK/EU SIM for everyday calls and data.

Receive Chime codes online even if you change your local plan or carrier.

You basically disconnect “where you are physically” from “where your banking number lives,” which is powerful.

If You’re in Asia, Latin America, or Africa

In some regions, international SMS is even more unpredictable. You might see:

OTPs that disappear completely

Local carriers are silently dropping short-code messages.

Timeouts every time you try to verify or log in.

With PVAPins, you can:

Rent a US number tuned for OTP and fintech traffic

Use it while living in India, Brazil, Nigeria, the Philippines, or almost anywhere else.

Keep your local SIM for daily life, while using the virtual number for secure verification.

Global studies continue to find significant differences in SMS delivery rates across carriers and regions. Offloading your Chime verification to a stable US route avoids that lottery.

Is It Safe and Legal to Use a Virtual Number for Chime?

Short answer: It can be safe and allowed as long as you’re using a private line you control, and you respect Chime’s rules. The problems usually start when people lean on shared public inboxes, fake generators, or use virtual numbers to hide abusive behaviour.

Compliance, Risk, and Account Security Best Practices

A few common-sense rules:

Private beats public: don’t use free inbox sites where strangers can see your OTPs

Lock down your PVAPins account: use strong passwords, enable 2FA where possible, and don't share it.

Stay within the rules: don’t use a virtual number to create fake identities or dodge security policies.

Use the privacy boost wisely: a dedicated line reduces spam and keeps your primary SIM away from high-risk apps.

Security incidents in the wild often involve recycled or shared numbers being reused for sensitive accounts. You can dodge that simply by using a number that only you control.

PVAPins is built for privacy-conscious, legitimate users who want clean separation between personal life and finances, not for people trying to game the system.

PVAPins is not affiliated with Chime. Follow each app’s terms and local regulations.

When You Shouldn’t Try to Bypass Chime Phone Verification

This part’s simple: if your goal is fraud, ban evasion, or anything shady, don’t do it. Trying to work around Chime’s phone verification to abuse the system is the easiest way to get shut down.

Risky behaviours look like:

Spinning up multiple fake or “throwaway” accounts

Using stolen identities or credentials

Sharing OTPs or account access with random people

And the outcomes aren’t fun:

Account freezes or closures

Funds held while the support investigates

Permanent bans from the platform

Virtual numbers are tools for privacy and convenience, not loopholes. PVAPins does not support abusive use cases, and you should always align with proper KYC and compliance standards.

PVAPins: Fast Ways to Get a Number That Works for Chime

Suppose you want your Chime verification to work without exposing your primary SIM. PVAPins gives you a clean path: flexible numbers, fast OTP delivery, and payment options that actually fit where you live.

Free Numbers vs Private Rentals for Chime Logins

Think of the options like this:

Free or very short-term numbers

Okay for low-stakes testing or one-off flows

Not what you want tied to long-term banking

Your own dedicated inbox for OTPs

Ideal for ongoing Chime logins, device changes, and account recovery

Helpful if you keep personal and “business/finance” profiles separate

A smart flow many users follow:

Try a quick activation to see how fast a Chime virtual phone number for verification works via PVAPins

If you’re happy with the route, upgrade to a rental and make it your permanent “finance stack” number.

Payment Options: Crypto, Local Cards, and More

PVAPins is built for a global user base, so paying for your numbers doesn’t have to be a headache. You can typically use:

Crypto and Binance Pay

Wallets like Payeer, Skrill, Payoneer

Regional methods such as GCash, AmanPay, QIWI Wallet, DOKU

Local card options in countries like Nigeria and South Africa

As cross-border payments and virtual numbers grow, it becomes much easier to maintain a stable number for Chime even if your SIM, city, or job keeps changing.

Numbers That Work With Chime:

PVAPins keeps numbers from different countries ready to roll. They work. Here’s a taste of how your inbox would look:

+16822962214 719910 15/02/26 09:20 +16264772159 961810 16/02/26 06:04 +12543651474 303343 22/12/25 10:11 +19096693473 877797 14/02/26 10:55 +13126801823 458463 12/10/25 01:58 +12138253265 361154 26/01/26 12:11 +13106902642 802952 10/01/26 07:27 +19493140099 696041 22/01/26 07:39 +14697386861 021852 17/02/26 06:50 +16822967976 624679 11/02/26 12:49🌍 Country 📱 Number 📩 Last Message 🕒 Received  USA

USA USA

USA USA

USA USA

USA USA

USA USA

USA USA

USA USA

USA USA

USA USA

USA

Grab a fresh number if you’re dipping in, or rent one if you’ll be needing repeat access.

Conclusion: Keep Chime Secure Without Tying It to Your Everyday SIM

You don’t have to choose between “locked out forever” and “banking tied to my one fragile SIM.” Chime still needs a phone number, but that number doesn’t have to be your daily one. By fixing fundamental SMS issues, using recovery paths properly, and moving to a private virtual number, you can keep your account secure and your personal phone number out of harm's way.

If you’re done fighting with codes that never arrive or numbers you keep losing, this is the clean next step:

Start with free temporary numbers for Chime OTPs to see how the flow feels.

Upgrade and rent a private virtual number for banking apps once you’re ready for long-term stability.

Learn how to receive SMS online for fintech verification and manage everything from a simple dashboard or the PVAPins Android app for instant OTP notifications.

That way, your money stays accessible and secure even if your SIM, carrier, or country keeps changing.

PVAPins is not affiliated with Chime. Please follow each app’s terms and local regulations.

Last updated: January 23, 2026

Explore More Apps

Similar apps you can verify with Chime numbers.

Top Countries for Chime

Get Chime numbers from these countries.

Ready to Keep Your Number Private in Chime?

Get started with PVAPins today and receive SMS online without giving out your real number.

Try Free NumbersGet Private NumberWritten by Mia Thompson

Her writing blends hands-on experience, quick how-tos, and privacy insights that help readers stay one step ahead. When she’s not crafting new guides, Mia’s usually testing new verification tools or digging into ways people can stay private online — without losing convenience.