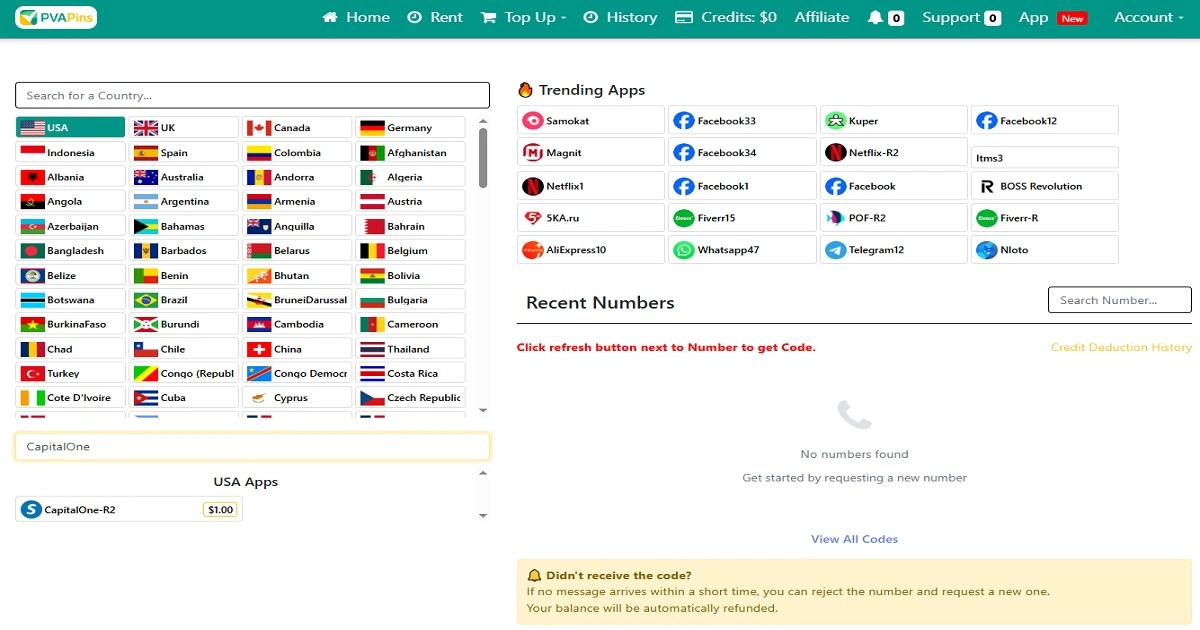

Capital One SMS Verification for OTP Codes

How it works

Confirm your phone number on file

Make sure the country code and digits match what’s saved in your Capital One profile.Request the OTP once

Tap Send code and wait—don’t rapid-fire resend.Wait 60–120 seconds → resend only once

If nothing arrives, wait a bit, then resend one time. More attempts often trigger delays.Check signal + SMS filtering

Turn off airplane mode, confirm you have network coverage, and check blocked/spam/unknown sender filters.Try a backup method if offered

If Capital One shows email verification, app approval, or another option, use it—SMS can be slower depending on carrier routes.Still not receiving codes? Contact Capital One support

For banking accounts, SMS delivery can be restricted for security—support is the safest way to restore access.

OTP not received? Do this

- Wait 60–120 seconds (don't spam resend)

- Retry once → then switch number/route

- Keep device/IP steady during the flow

- Prefer private routes for better pass-through

- Use Rental for re-logins and recovery

Wait 60–120 seconds, then resend once.

Confirm the country/region matches the number you entered.

Keep your device/IP steady during the verification flow.

Switch to a private route if public-style numbers get blocked.

Switch number/route after one clean retry (don't loop).

Free vs Activation vs Rental (what to choose)

Choose based on what you're doing:

Quick number-format tips (avoid instant rejections)

Most verification forms reject numbers because of formatting, not because your inbox is “bad.” Use international format (country code + digits), avoid spaces/dashes, and don’t add an extra leading 0.

Best default format: +CountryCode + Number (example: +14155552671)

If the form is digits-only: CountryCodeNumber (example: 14155552671)

Simple OTP rule: request once → wait 60–120 seconds → resend only once.

Inbox preview

| Time | Country | Message | Status |

|---|---|---|---|

| 04/02/26 01:43 | USA | ****** | Delivered |

| 17/02/26 05:09 | USA | ****** | Pending |

| 04/02/26 02:05 | USA | ****** | Delivered |

FAQs

Quick answers people ask about Capitalone SMS verification.

1. Can I verify Capital One without using my personal phone number?

Yes, as long as you still provide a working, SMS-capable number that matches Capital One’s requirements. Lots of people use a separate line, such as a private virtual number, to receive one-time PINs and alerts while keeping their personal SIM off the account.

2. Why am I not receiving my Capital One verification code?

Most of the time, it’s something small: a typo in the number, a missing country code, your carrier blocking short codes, a weak signal, or a prepaid/VoIP line that doesn’t fully support OTP. Double-check the digits, wait for one complete timer cycle before resending, and ask your carrier whether short-code texts are enabled. If that fails, try app-based prompts or another number.

3. Can Capital One send verification codes when I’m overseas?

Sometimes, but not reliably in every country. Capital One verification code issues overseas usually stem from short codes not being supported by certain roaming partners. Before you travel, test receiving codes, enable app-based verification where you can, or keep a dedicated US number active for OTPs while you use a local SIM for everyday calls and data.

4. Can I use a virtual phone number for Capital One verification?

Some virtual numbers work; others get blocked. Capital One generally warns that particular VoIP or Wi-Fi-based services can’t receive OTP codes, and public inbox numbers are never safe. Your best bet is a private, SMS-capable line that behaves like a normal mobile number, used strictly in accordance with Capital One’s terms and local laws.

5. How do I change my phone number on Capital One if I lost my old phone?

Start by signing in on a trusted device and then go to your profile or security settings to add a new number. If the system still tries to confirm your old line, you may be asked to complete additional ID checks or even in-person verification. If you’re stuck, contact support and ask them to help update your contact details based on your identity checks.

6. Is it allowed to use a PVAPins number with Capital One?

Using a PVAPins number doesn’t change any rules Capital One applies. You still have to provide accurate identity details and follow their terms. PVAPins gives you an alternative, private SMS-capable line you control; it’s not a bypass tool or a way to dodge verification.

PVAPins is not affiliated with Capital One. Please follow each app’s terms and local regulations.

7. What should I do if none of my numbers can receive Capital One codes?

At that point, stop guessing. Collect your device info, carrier, and screenshots of the error. Test any available app or email verification options, and then talk directly to Capital One support. They may need to run more thorough identity checks or help you register a different number that can consistently receive OTPs.

Read more: Full Capitalone SMS guide

Open the full guide

You’re stuck on the Capital One login screen that won't move until you enter the code we sent to your phone. But what if you don’t want to use your personal SIM? Maybe you changed numbers. Maybe you’re traveling. Perhaps the code just never shows up.

That’s where it actually helps to understand how to verify Capital One without a phone number tied to your primary SIM. The goal isn’t to cheat security. It’s to use a safe, SMS-capable alternative line you control, while still staying inside Capital One’s rules.

In this guide, we’ll walk through:

How Capital One’s verification really works

What to do when you can’t verify your Capital One account

When a private virtual number from PVAPins makes life easier as a dedicated OTP line

Can you really verify Capital One without a phone number?

You generally can’t use Capital One with absolutely no phone number, because most security checks still lean on an SMS-capable line. What you can do is stop using your everyday SIM and register an alternative number that fits Capital One’s requirements, but lives completely separate from your personal phone.

When you still must have some SMS-capable number on file

When people search for “verify Capital One without a phone number,” what they really mean most of the time is:

“I don’t want to use my personal, long-term SIM for this.”

In practice, Capital One often expects:

A US mobile-style number that can receive short-code SMS or a quick automated call

A line that behaves like a normal mobile number (not an obviously VoIP-only or disposable route)

You’ll usually see one-time PINs (OTPs) in situations like:

Signing in from a brand-new device or browser

Changing your phone number or email

Doing “major account maintenance” such as big transfers or sensitive profile updates

Capital One’s own security docs describe OTP as an extra check for specific account actions, delivered by text or voice call, so some number is still part of the story, even if it isn’t the SIM in your everyday phone.

The part you can control is which number you attach. That’s exactly where a private virtual line from PVAPins helps: it keeps your primary SIM off your Capital One profile and pushes OTPs into a separate, quieter inbox.

“Without your personal SIM” vs “without any phone at all.”

Let’s draw a clean line:

“Without your personal SIM” means:

You still add an SMS-capable number, but it’s a different line:

A dedicated US number you only use for banking

A rented virtual number that can receive OTPs

A spare SIM or eSIM sitting in a second device

“Without any phone at all” would mean:

No SMS or voice-capable number anywhere

Only email, app prompts, or ID checks forever

Right now, banks just aren’t built for actual zero-phone usage. Some flows might let you lean more on app prompts or ID upload, but in the real world, you’ll still need at least one working number at some point, even if that number lives on PVAPins instead of your daily SIM.

So the realistic win isn’t “never attach a number again.” It’s:

No more tying Capital One to the same SIM you use for everything else.

How Capital One verification works today

Capital One mixes a few different tools to confirm it’s really you: one-time PIN texts or calls, app-based prompts, and occasionally ID checks. Depending on risk level and what you’re doing, you might see:

A code was sent to your phone.

A push notification in the mobile app

A request to upload an ID or do extra verification

One-time PIN verification and why Capital One uses it

A typical Capital One verification code is a short numeric OTP that arrives via:

SMS from a short code

Automated voice call to your registered number.

You’ll usually run into it when:

You log in from a new browser or new device

You change your phone number or email address.

You link external accounts or change sensitive settings.

Think of it as a one-time deadbolt on top of your username and password. It’s mainly there to slow down account takeover attempts if your login details ever leak.

Example: you change your address and then change your phone number in the same week. That’s precisely the pattern where Capital One might say, “Wait, let’s send a quick one-time PIN just to be sure this is really you.”

Capital One two-factor authentication basics (SMS, email, app)

On top of one-off OTPs, you’ll see Capital One two-factor authentication show up in a few flavors:

SMS or voice codes to your registered number

Email codes in some flows

Mobile app prompts where you tap “approve” right inside the app

Occasionally, document checks or in-person steps are required for higher-risk actions.

Security folks have been saying for years that SMS-based 2FA is “good, but not great.” App-based verification and authenticators are harder to intercept, so banks have been slowly nudging people toward those—without dropping SMS entirely.

Bottom line: the more stable, private, and consistent your registered number is, the fewer “we need to verify it’s you again” roadblocks you’ll hit.

Step-by-step: Verify Capital One using an alternative number instead of your personal SIM

To keep your primary SIM off a Capital One account, add an alternative number that meets their rules, verify it with an OTP, and then use that as your permanent security line. That number can be a private, SMS-capable route you control like a temporary or rented virtual number as long as you stay within Capital One’s terms and local regulations.

This is how you verify Capital One without a phone number tied to your personal SIM, while still playing fair with their security system.

Choosing a clean, SMS-capable number that fits Capital One’s rules

Before you grab a number, get clear on what you’re doing:

Opening a new Capital One account

Logging in to an existing account from a new device

Changing your phone number on file

Linking an external account or digital wallet

For each situation, you want a line that:

Can receive short-code SMS (those 5–6 digit senders)

Isn’t obviously VoIP-only or on every spammer’s favorite list

Isn’t some free public inbox where anyone can read your OTPs

In many cases, a US-style mobile number that behaves like a regular line gives you the best shot at consistent code delivery.

Using a PVAPins temporary or rented number for Capital One OTP

Here’s where PVAPins quietly makes life easier.

You can:

Grab a private PVAPins number in a supported country (for Capital One, US-style routes are usually the first pick)

Choose between:

One-time activations for “I just need this OTP right now.”

Rentals if you expect ongoing logins, alerts, and recovery flows

Enter that number on Capital One’s signup or profile screens as your primary verification line.

You’re not bypassing anything here. You’re just moving security traffic off your personal SIM and onto a dedicated, private route.

Testing your number with a low-risk action before significant changes

Don’t test this on a high-stakes transaction first. Give it a small “sandbox” first:

Add your PVAPins number inside Capital One.

Trigger a low-risk action:

Turn on a small balance alert.

Tweak a notification preference.

Make sure the OTP arrives quickly and reliably.

Only then should you rely on it for larger steps, such as large transfers, phone number changes, or account recovery.

This little dry run is worth it. Surveys regularly show that more than half of banking users worry about their phone numbers being used to hijack accounts. Parking your OTPs on a dedicated line is a simple, practical way to reduce that risk.

Fixing “can’t verify my Capital One account” when codes never arrive

If you can’t verify your Capital One account because codes never arrive, start with the boring stuff: confirm the number on file, check for short-code blocking with your carrier, and let the resend timer complete a full cycle. If SMS still fails, try app-based verification where it’s offered or move to a more reliable alternative number you control.

Capital One verification code not received: quick checks.

When you hit a “can’t verify my Capital One account” wall, run this quick checklist:

Check the phone number on file digit by digit.

Make sure the country code is correct (+1 for the US).

Confirm you have a signal and can receive regular SMS.

Let the full timer expire before tapping “resend” again.

People often forget they just switched to an eSIM, ported their number, or turned off text messaging from unknown senders. Any of those can quietly block a Capital One verification code.

When your carrier, prepaid plan, or VoIP route is the problem

Sometimes the issue isn’t Capital One at all, it’s the route:

Some carriers block short-code SMS by default, especially on new or prepaid plans.

VoIP-only numbers or “Wi-Fi-only” apps may not accept financial OTPs at all.

Number porting between carriers can temporarily break OTP delivery.

There are plenty of forum threads where OTPs suddenly started working only after the user called their carrier and said, “Hey, can you please turn on short-code texts for my line?”

If you’re using a VoIP app or a free phone-number widget, don’t be surprised if Capital One refuses to play nicely.

When you should switch to a fresh private number

If basic fixes get you nowhere, it might be time to move everything onto a fresh private number:

Option A: keep wrestling with a flaky line

Option B: set up a clean PVAPins route made for receiving OTPs

The usual flow looks like this:

Add the new number to Capital One.

Confirm one last OTP from your old route if that’s still possible.

Move future logins and alerts onto the new line.

Most people eventually discover it’s less headache to verify Capital One with a dedicated OTP number than to keep debugging every random SIM or VoIP app they’ve ever tried.

How to change your phone number on Capital One

To change your phone number on Capital One, sign in, go to your profile or security settings, add the new number, and confirm it with a one-time code before removing the old one. If you can’t access your old phone, be ready for extra identity checks or a call with support.

Updating your number in the app or website

Here’s the safer sequence for a change phone number Capital One update:

Sign in from a trusted device you’ve used before.

Head to Profile / Settings → Security or your contact info section.

Add your new number (this can be your PVAPins line).

Please wait for the verification code on that new number and confirm it.

Only then remove, downgrade, or de-prioritize the old number.

Capital One’s support content consistently nudges people to add and verify the new contact method first. That’s the easiest way to avoid accidentally locking yourself out mid-change.

What to do if you don’t have the old phone anymore

No access to your old number? You’re not the first:

Try logging in from a remembered device and browser.

Look for flows that let you confirm via email, app prompt, or security questions.

Be ready for:

ID document uploads

In-branch verification

Extra security questions

Real-world forum posts are full of lines like “we’re having trouble verifying your phone” when adding a new number. Most people either had to wait out some background checks or call support to get it pushed through.

Using an alternative number to keep future OTPs away from your primary SIM

Once your new number is verified:

Consider making a dedicated PVAPins number for your long-term Capital One line.

That way:

Random banking alerts don’t ping your personal SIM at 3 a.m.

You can change your personal phone and carrier without affecting your OTP setup.

Your login and recovery numbers stay the same even if you move or travel.

Just don’t change numbers every other week. Rapid-fire number flips can trigger additional security checks, slowing things down.

Verifying Capital One while you’re overseas

Traveling with Capital One gets annoying fast if your US number is offline or SMS short codes refuse to reach your roaming carrier. The easiest play is to make sure your US line can roam, consider a dedicated US OTP number, and set up app-based verification before you even leave the country.

Why SMS short codes can fail abroad

Here’s why Capital One verification code overseas searches are common:

US short-code messages don’t always route properly to foreign networks.

Not every roaming agreement includes those special 5–6 digit senders.

Dual-SIM and eSIM setups can confuse where texts should land.

Frequent travelers report a mixed experience: some trips are fine, others are “no code until I put my original SIM back on a friendly network.”

Options if your US SIM is offline, but you still need codes.

Before you board your flight, do a quick pre-trip checklist:

Turn on mobile app prompts and test them over Wi-Fi.

Confirm you can log in on another device (like a tablet or spare phone).

Consider keeping a US number active just for OTPs, even if you use a local SIM for calls and data abroad.

This is one of those things you really want to sort out before you’re jet-lagged in another time zone staring at a “we texted you a code” screen.

Using a temporary US number for Capital One when traveling

A simple middle ground:

Move your Capital One OTPs onto a temporary US number you manage via PVAPins.

Keep that number as your stable OTP route whether you’re in the US, Europe, or Asia.

Use local SIMs and eSIMs for everything else (calls, data, local apps).

That way:

Travel doesn’t silently break your banking codes.

You don’t have to carry your “bank SIM” in every country.

Your verification line looks stable and predictable to Capital One’s risk systems, which is precisely what you want.

Can you use a virtual or temporary number for Capital One?

Some virtual numbers work fine with Capital One; others don’t. Official guidance makes it clear that particular VoIP or Wi-Fi-based services aren’t eligible for OTP, and heavily reused public inbox numbers are a bad idea. A private, non-obviously-VoIP number you control, like a PVAPins rental, is more likely to work while keeping your primary SIM out of the picture.

Why do many banks block obvious VoIP and overused public numbers?

From a bank’s viewpoint, a shared or obviously VoIP-only number is a big red flag:

The same line might be tied to hundreds of accounts.

Fraudsters love cheap, disposable routes.

OTPs can be seen by strangers if they’re in public inboxes.

So it’s not shocking that financial services increasingly block known VoIP ranges and public SMS sites. It’s not personal; it’s just risk management.

Free inbox tools vs private PVAPins numbers for finance apps

You’ve definitely seen “free receive SMS” sites around. They’re fine for throwaway accounts, but for money? Not worth it.

Free public inbox tools:

Anyone can read your code

Numbers are recycled constantly.

Very high chance of being flagged

Private PVAPins numbers:

Inboxes are private to you

Routes are built for fast, stable OTP delivery where supported.

You can choose between one time activations and longer rentals.

If your card, savings, or credit is involved, private will always beat public both for safety and for simple peace of mind.

Temporary vs longer-term rentals for recovery and charge alerts

For Capital One specifically:

You might lean on a temporary phone number for Capital One verification if you:

Just need to complete a one-off signup or verify a single login.

Don’t expect codes or alerts again afterward.

A longer-term rental makes more sense when you:

Want a persistent login and recovery number

Rely on SMS for fraud alerts or large transaction confirmations.

Want the same OTP line across multiple finance or fintech apps.

No provider can promise every number will work perfectly in every scenario forever. That’s just not how telecom works. But a private, non-VoIP-looking line gives you a far better baseline than some random public inbox.

Again, to keep everything crystal clear:

PVAPins is not affiliated with Capital One. Please follow each app’s terms and local regulations.

Capital One Shopping and other linked services: phone verification basics

Capital One Shopping and similar linked tools sometimes ask for their own phone verification, even if your primary banking login is already verified. The nice part? You can keep all of those on the same dedicated virtual line and avoid dumping more noise onto your personal SIM.

When Capital One Shopping needs an SMS-capable number

Extensions, shopping portals, and rewards apps often:

Ask for phone verification during signup

Send OTPs when you change devices or emails.

Require a number to cash out rewards or connect a card.

So yes, you might see another Capital One shopping phone verification prompt, even if the primary account is sorted.

Keeping logins and alerts on a separate number for privacy

The easy solution is to point those codes to the same PVAPins line you already use for Capital One logins.

Benefits:

Your personal SIM isn’t drowning in promo texts and reward alerts.

Phishing or suspicious messages are easier to spot when they’re confined to one inbox.

All your finance- and shopping-related OTPs live in a single, controlled place.

E-commerce reports keep highlighting how many people now rely on cashback and coupon tools. Many of those add phone verification for security, so a dedicated number makes everything tidier.

Safety, legality, and compliance when using virtual numbers with banks

Using a virtual number with a bank is usually fine if it's private, stable, and linked to accurate personal details, but it doesn’t change your obligations. You still need to be honest, follow Capital One’s terms, and respect local telecom rules when you route OTPs through any third-party service.

Keeping your details accurate while separating your phone

A virtual number:

Doesn’t replace KYC. Capital One still uses your legal identity, not just your phone.

Doesn’t erase regulations. Your activity still has to be legitimate and truthful.

What it does do is split:

The SIM you use for chats, social apps, and everyday life

The line you use for Capital One verification code texts and banking alerts

That separation is a huge win for privacy, and organizations don’t confuse it with anonymity.

SIM swap, OTP theft, and how private routing helps

Security reports have been clear: SIM swap and account takeover incidents have been on the rise. Attackers try to:

Convince your carrier to move your number to their SIM.

Intercept OTPs to drain accounts or open new lines in your name.

A private virtual number with strong account protection can:

Limit who even knows your “banking number” in the first place

Reduce the blast radius if your personal SIM is ever compromised.

Make OTPs easier to monitor by removing them from marketing messages.

Still, this isn’t a magic shield. Stack it with:

App-based prompts

Authenticators

Security keys, when supported

Compliance note and when to contact support instead

Quick reminder:

PVAPins is not affiliated with Capital One. Please follow each app’s terms and local regulations.

If:

Your account is locked

You suspect fraud

Or verification loops keep failing even on a clean number.

Then it’s time to speak directly with Capital One support. That’s the only way to fully clear certain flags, limits, or identity issues.

PVAPins setup guide: from “need a number now” to first Capital One OTP in minutes

If you need a separate number for Capital One fast, PVAPins lets you pick from 200+ countries, choose a private SMS-capable route, and start catching OTPs in just a few steps. You can test things cheaply, then scale up to a longer rental if you decide to keep that line for all your banking logins and alerts.

Free numbers vs instant paid activations: which should you use?

Here’s a simple way to look at it:

Free public numbers → good for low-risk testing

Try out how generic OTP flows behave.

Test non-financial signups

Private paid activations or rentals → for anything involving identity, money, or cards

With PVAPins, you can:

Play around with /free numbers or receive sms to see how the platform works.

When you’re serious about Capital One OTPs, go to /rent and switch to private numbers.

Decide between:

A one-time activation for a single verification task

A rental you keep for logins, alerts, and recovery going forward

This lets you start small, then “graduate” to a proper long-term banking line when you’re ready.

Picking the correct country and route for banking OTPs

Some quick, practical tips:

For Capital One, a US-style route is usually the safest first choice.

Inside PVAPins, look for non-VoIP, SMS-stable routes where available.

Keep an eye on status notes like:

OTP compatibility flags

Typical delivery times

Any known limitations

Because PVAPins covers 200+ countries, you can also pick numbers that match where you live or where you often travel, as long as they still fit Capital One’s requirements.

Paying with crypto, wallets, and local cards

Payment-wise, PVAPins are flexible. You’re not limited to one card:

Crypto and Binance Pay

Payeer, GCash, AmanPay, QIWI Wallet, DOKU

Nigeria & South Africa credit/debit cards

Skrill and Payoneer

That mix makes it easier to set up your Capital One OTP number, even if your primary card is temporarily blocked or you prefer to separate expenses.

And if you’re a dev or running larger workflows, PVAPins’ API-ready setup lets you automate number provisioning and SMS polling instead of managing everything by hand.

Numbers That Work With CapitalOne:

PVAPins keeps numbers from different countries ready to roll. They work. Here’s a taste of how your inbox would look:

+13392310418 776580 04/02/26 01:43 +13392284490 183161 03/02/26 08:49 +16088671949 902272 17/02/26 05:27 +16085150944 586594 17/02/26 05:09 +13392310292 998621 04/02/26 02:06🌍 Country 📱 Number 📩 Last Message 🕒 Received  USA

USA USA

USA USA

USA USA

USA USA

USA

Grab a fresh number if you’re dipping in, or rent one if you’ll be needing repeat access.

Conclusion:

If you still can’t verify Capital One, slow things down and focus on three moves: use a stable SMS-capable number, try app-based or ID-based verification when it’s offered, and only then switch to a fresh private line through PVAPins. If even that doesn’t work, it’s time for a proper chat with Capital One support.

A quick checklist:

Fix your number

Make sure it’s entered correctly and supports short codes.

Talk to your carrier about short-code SMS if needed.

Try alternate verification

Use app prompts, email codes, or ID upload when the flow offers them.

Move to a dedicated PVAPins line.

Use a private, clean route for future OTPs and alerts.

Keep this number steady so risk checks see consistency.

Call support for the final mile.

If you still see “can’t verify my Capital One account,” gather screenshots, error messages, and device details

Let support walk you through recovery and number updates.

Forum stories make one thing pretty clear: persistent verification issues often took multiple support interactions to resolve. Having a reliable, pre-tested number in place from PVAPins means you’re starting that process from a stronger position.

Bottom line.

You don’t have to tie your entire financial life to your everyday SIM. Use app prompts where you can, and for everything else, let a private PVAPins number quietly handle the OTP side of things while you keep your main phone number for, well, your actual life.

Quick compliance note: PVAPins is not affiliated with Capital One. Please follow each app’s terms and local regulations.

Last updated: February 3, 2026

Explore More Apps

Similar apps you can verify with Capitalone numbers.

Top Countries for Capitalone

Get Capitalone numbers from these countries.

Ready to Keep Your Number Private in Capitalone?

Get started with PVAPins today and receive SMS online without giving out your real number.

Try Free NumbersGet Private NumberWritten by Team PVAPins

Team PVAPins is a small group of tech and privacy enthusiasts who love making digital life simpler and safer. Every guide we publish is built from real testing, clear examples, and honest tips to help you verify apps, protect your number, and stay private online.

At PVAPins.com, we focus on practical, no-fluff advice about using virtual numbers for SMS verification across 200+ countries. Whether you’re setting up your first account or managing dozens for work, our goal is the same — keep things fast, private, and hassle-free.