You open Bybit to place a quick trade, and suddenly you’re stuck on that “enter the code we just texted you” screen. Maybe you don’t want every crypto move tied to your primary SIM. Maybe the SMS code just never shows up. Either way, you start wondering if there’s a way to verify Bybit without a phone number that’s glued to your real identity.

Here’s the deal: you still have to respect KYC and security rules, but you don’t have to hand over your everyday SIM. In this guide, we’ll walk through how Bybit verification works, where the phone step fits in, and how a private virtual number from PVAPins can catch your OTPs while your personal SIM stays out of the spotlight.

Compliance note: PVAPins is not affiliated with Bybit. Please follow each app’s terms and local regulations.

What Bybit verification actually checks

Bybit’s verification is basically its “who are you really?” check. It connects your real-world identity to your trading account using documents, residency details, and risk screening. On top of that, it layers phone numbers, email codes, and 2FA on top to secure logins and withdrawals. You can’t dodge KYC, but you can choose which SMS-capable number lives on your profile.

How Bybit KYC works

Bybit will be firmly in regulated-exchange territory. KYC isn’t a “maybe later” thing anymore; it’s the default expectation if you actually want to use the account.

The KYC ladder usually looks something like this:

Standard level Basic ID + selfie, with a reasonable daily withdrawal limit.

Advanced level: Extra documents like proof of address, higher limits, and access to more features.

Pro / institutional tiers: Deeper due diligence for big money or business accounts.

Regulators spent the window pushing centralized exchanges into a more traditional KYC/AML model, closer to banks than wild-west platforms. Many major exchanges now require some level of verification to deposit or withdraw, and often for spot trading as well.

You don’t need to memorize every tier. What matters is this:

The documents prove who you are.

The phone number is there for security, not for identity verification.

So KYC is really about you, not your SIM. Your phone is more like a security key than a passport.

Why SMS and 2FA matter for withdrawals and security

So why does Bybit push so hard for a phone in the first place? Because passwords are fragile.

Most exchanges now stack security like this:

Password: The thing you (hopefully only you) know.

Email code: A quick one-time code for sensitive actions.

Receive SMS code sent to the phone number on your profile.

Google Authenticator or a similar app, with Time-Based 2FA codes that refresh every 30 seconds.

If someone grabs your password, they still need at least one of those extra channels to get in or withdraw money. That’s where phone verification becomes the second gate.

But nothing in that stack says it must be your primary, never-changing SIM. Any number that:

Can do the job. That’s precisely where a PVAPins virtual number fits: it captures the codes, while your genuine SIM stays off the front line.

Can you verify Bybit without a phone number?

You can’t verify your Bybit account without a phone. KYC and security flows assume at least one SMS-capable number exists. What you can do is use a private virtual line instead of your everyday SIM, so you stay compliant while keeping your personal mobile out of the picture.

What you can’t skip: KYC and real identity

Let’s be blunt: the “no-phone, no-KYC, unlimited trading” days are gone.

Bybit has made KYC mandatoryfor its main features and services.

Trading, derivatives, and higher withdrawal limits require verified identity.

Trying to push serious volume through a totally anonymous profile is asking for a flag.

Any guide promising full-blown Bybit access with zero KYC is either outdated or playing with fire. You still need to:

Submit genuine documents.

Pass the standard checks.

Keep things consistent with your real-life details.

A virtual number doesn’t cancel that. It only changes where the OTP lands, not how KYC works.

What you can change: the number you use for SMS

This is the part you actually control: the phone number itself.

Instead of handing over the same SIM that’s tied to:

Use a private virtual phone number just for exchanges and fintech.

Keep that line separate for testing or side projects.

Swap physical SIMs in real life without breaking Bybit logins.

Reduce the impact if your personal number gets leaked or spammed.

That’s where PVAPins slots in nicely. You’re still the human behind KYC, but the phone step runs through a clean, private route rather than your daily SIM.

Quick reminder, so it’s crystal clear: PVAPins doesn’t help anyone dodge KYC or local laws. The whole point is phone privacy, smoother OTP delivery, and fewer headaches when your primary SIM is offline or unreliable.

How virtual phone numbers work for Bybit SMS verification

A virtual phone number lives in the cloud instead of a physical SIM tray. For Bybit, the flow is simple: you punch in this number during phone verification, the OTP lands in your PVAPins dashboard or Android app, and you paste it back into the Bybit screen. If the route is private and SMS-ready, it behaves just like a regular mobile line.

Real SIM vs VoIP vs private non-VoIP routes

Not every number type feels the same from Bybit’s side. The details matter a lot for finance apps:

Real SIM numbers, Classic mobile lines from carriers. Solid, but glued to your identity and a physical card.

Generic VoIP numbers are often cheap and heavily reused. Many platforms rate-limit or block them because they’re abused.

Private non-VoIP routes (the PVAPins approach), Virtual numbers designed to act like regular mobile routes, without being dumped into public pools.

PVAPins aims to keep things closer to the “real SIM” experience without the hassle of juggling extra plastic:

Access to numbers across 200+ countries, so you can pick regions that work well with Bybit.

Routes tuned specifically for OTP and short-code delivery, not random marketing spam.

Complete control through the web interface or the PVAPins Android app, so you don’t miss codes while you’re away from the laptop.

In internal testing, clean private routes show far fewer “code not received” headaches than recycled, overused VoIP ranges, which matches what many users feel day to day.

One-time activations vs rentals for ongoing Bybit logins

If you’re serious about Bybit, you’ll hit that phone step more than once:

First registration and initial KYC

New device logins

Withdrawal confirmations

Security changes (password resets, 2FA changes, etc.)

That’s why PVAPins offers two main styles:

One-time activations are Great for one-off tests or low-stakes accounts. You use the number once, grab the OTP, then it’s done.

Rentals are Better for proper long-term Bybit setups. You keep the same number for days, weeks, or months, and all future OTPs land in that same private inbox.

If Bybit is part of your ongoing trading stack, a rental is almost always the more brilliant move. You don’t really want withdrawal codes going to a number that’s already been released and reassigned to someone else.

Step-by-step: Use a PVAPins virtual phone number to verify Bybit

To get Bybit verified with a virtual number, log in to PVAPins, select a Bybit-friendly country and number, paste it into the Bybit phone field, and request an SMS. When the code lands in your PVAPins dashboard or Android app, you drop it back into Bybit and lock in your account.

Choose a Bybit-ready country and number in PVAPins.

First job: pick a number that Bybit actually delivers SMS to cleanly.

Sign in to PVAPins and go to the live numbers view.

Check Receive SMS or Free Numbers for countries that usually play nicely with crypto apps.

Look at which apps/routes that number is good for, and prioritize finance- and exchange-friendly options.

Decide if you only need a single activation or a longer rental.

Paying for it isn’t a drama either. PVAPins supports a wide range of payment methods: Crypto, Binance Pay, Payeer, GCash, AmanPay, QIWI Wallet, Nigeria & South Africa cards, Skrill, Payoneer, and more. So even if your bank card is picky with crypto-related services, you’ve still got options.

Enter the PVAPins number in Bybit and request SMS.

Then hop back into Bybit:

Go to Security or Account settings and find the phone verification option.

Select the same country code as the PVAPins number you chose.

Paste the number without repeating the country code or adding extra zeros.

Hit Send Code and give the timer a moment.

On healthy routes, SMS usually arrives within a few seconds. If you see a countdown, let it finish before hitting resend. Hammering the button can get you throttled, which slows things down even more.

Grab the OTP in PVAPins and finish verification.

Now back to PVAPins one more time:

Open the inbox for that specific number or activation.

Watch for the Bybit text, usually a short message with a code and a small security notice.

Copy the OTP and paste it into Bybit before it expires.

Confirm, and you’re done.

From that moment, your Bybit profile is tied to the PVAPins number, not your personal SIM. It’s a small change, but it separates your trading life from your main mobile life in a very healthy way.

In practice, many users receive OTPs within a few seconds on clean, private routes, while on overloaded or recycled numbers, it can take half a minute or not appear at all.

Quick PVAPins CTA: Want to try this flow right now?

See live OTP-ready routes → https://pvapins.com/receive-sms

Test with a free line first → https://pvapins.com/free-numbers

Lock in a rental for long-term Bybit use → https://pvapins.com/rent

Free public inbox vs low-cost private Bybit virtual numbers: which should you use?

For Bybit and other finance apps, free public inbox numbers are a bad idea. Anyone can see your OTPs, reuse the same line, or trigger red flags on an account that actually holds money. Low-cost private virtual numbers give you a single-owner inbox, cleaner routing, and better delivery, making KYC, withdrawals, and long-term access much safer.

Risks of public inboxes for crypto and KYC

Public inbox sites exist to let strangers share the exact numbers. That’s fine when you’re:

For an exchange like Bybit, the same behavior is a security nightmare:

Anyone browsing that inbox can see your codes in real time.

Numbers get recycled constantly, so abuse history piles up.

Some platforms outright block well-known public-inbox ranges.

One stray SMS is enough for someone motivated to hijack a login or start probing the account.

Why private, non-VoIP, single-use routes perform better

Private, non-VoIP routes behave much more like standard mobile lines, but without being tied to your personal SIM:

Single-owner inbox. Only you see your OTPs.

Cleaner reputation, Less abuse history, and fewer filters.

Better deliverability, Fewer missing or delayed codes.

Predictable behavior is Ideal for repeated logins and withdrawals.

That small fee for a PVAPin's private number is basically a tiny security budget. You’re protecting:

Your balance

Your identity

Your KYC record

For less than what a coffee costs in many cities.

Security research often points to reused or shared phone numbers as a typical pattern in account takeover cases, which is exactly what you avoid by going private.

Bybit KYC in the USA: phone verification, levels, and limits

Bybit’s KYC and phone rules aren’t the same everywhere. Some countries can’t legally use the platform at all. In supported regions, you’ll typically need at least Standard KYC and a linked phone number for codes. Always double-check whether Bybit is actually allowed in your country before messing around with virtual numbers.

Bybit access and KYC requirements for US and restricted regions

Here’s where it gets a bit political. Most centralized exchanges work off an allowlist/blocklist playbook:

Some countries are fully supported.

Some are restricted; certain products are missing, or apps aren’t promoted.

A few are completely blocked from registering accounts.

That means:

If Bybit doesn’t serve your region (for example, many US residents), no clever phone trick will make it legitimately available.

Using a foreign number or VPN doesn’t magically fix licensing rules.

You can end up with frozen funds or stress later if compliance catches up.

PVAPins isn’t for geo-evasion. A virtual number helps with phone privacy, stability, and OTP routing, not with bypassing regional restrictions.

Safer options if you live in a supported country but travel a lot

If you’re in a supported country but constantly on the move, a virtual number can actually reduce friction:

You keep one stable number for Bybit, even if you’re swapping local SIMs while traveling.

SMS codes still land, even when your home SIM is off or sitting in another device.

You can keep your personal number for family and everyday apps, while the virtual number becomes your “finance layer.”

Combine that with Bybit’s KYC tiers, and you get a nice balance: honest documents, a compliant profile, and a dedicated number handling all exchange-related codes.

By plenty of countries will have tightened rules on centralized exchanges, so seeing more nuanced KYC and geo controls is normal, not a glitch.

Troubleshooting Bybit SMS codes, email codes, and 2FA

If your Bybit SMS or email code won’t show up, don’t panic. Start with the basics: check your signal, number formatting, spam folder, and resend timers. Clear any inbox issues, wait a couple of minutes, then try again. If nothing improves, that’s your cue to switch to a cleaner route and set up Google Authenticator so you’re not 100% dependent on SMS.

Verification code not received: quick checks

Before you assume something is broken, run this short checklist:

Is the country code correct? (+1, +44, +971, etc.)

Did you accidentally add the country code twice?

Is your phone stuck on airplane mode or flaky Wi-Fi calling?

Is your SMS inbox full, or does your carrier restrict it?

Have you been spamming the resend button and hitting cooldown limits?

A big chunk of “missing code” drama comes down to small formatting mistakes or impatience with the timer.

When to switch numbers or routes

If you’ve cleaned up everything above and the code still doesn’t land:

If codes start arriving instantly after the swap, you’ve basically confirmed the original route was congested or filtered.

Fixing Google Authenticator and device changes

SMS isn’t the only verification method you should rely on:

Set up Google Authenticator (or a similar app) once your account is stable.

Save your backup codes or recovery options in a safe place in case the device dies or gets wiped.

When you change phones, use Bybit’s official 2FA transfer procedures, don’t just delete the app and hope support can magically undo it.

When your 2FA is solid, you can lean less on SMS and use your PVAPins number mainly for key changes and recovery flows.

Support teams will tell you: many verification issues stem from formatting and throttling quirks, not from full-scale outages. Cleaning those up and using a reliable route solves most problems.

Is it safe to use a virtual number for Bybit? Security, privacy, and scams to avoid

A virtual number is as safe as the way you use it. If it’s private, SMS-capable, and entirely under your control, it can be a strong part of your security setup. What’s dangerous is sharing inboxes, using sketchy providers, or treating the number like a magic shield. Combine a private PVAPins line with solid passwords, 2FA, and basic scam awareness, and you’re raising your security, not lowering it.

What’s safe vs unsafe for finance apps

A few simple rules help:

Safer patterns:

The inbox is private, and only you can see messages.

The provider doesn’t constantly recycle the same number to strangers during your rental.

Routes are actively monitored for reliability and abuse.

You use the number alongside 2FA, not instead of it.

Risky patterns:

Free inbox sites where anyone can read every incoming SMS.

Numbers that are clearly being reused for finance apps within hours or days.

Sharing screenshots of OTPs around in chats or DMs.

Assuming “virtual number = anonymous and invincible.”

Used correctly, a virtual number is just one more security layer, not a replacement for good hygiene.

Spotting phishing SMS and fake “support” messages

Scammers absolutely love SMS because it feels official. Common tricks:

Texts pretending to be Bybit, warning you that your account will be “blocked” unless you click a link.

URLs that look almost right but slip in one extra letter or a weird domain.

Fake “support agents” in Telegram, Discord, or DMs asking for screenshots of your code.

Some simple habits go a long way:

Never share OTPs with anyone, even if they claim to be support.

Type Bybit’s URL manually or use the official app, not whatever link landed in the message.

If a message feels off, treat it as suspicious first and verify later.

A lot of crypto phishing waves start exactly this way, with a scary-looking SMS and a bad link.

Avoid shortcuts: buying a “verified Bybit account” vs doing KYC yourself.

Buying a “verified Bybit account” might sound tempting if you hate paperwork, but it’s a huge red flag. You’re trusting a stranger with KYC data, breaking the platform’s rules, and risking bans or frozen funds. The safer angle is boring but solid: do KYC yourself once, then use a private virtual number purely to tidy up phone privacy and OTP reliability.

Legal and security risks of buying verified accounts

On the surface, it looks convenient: someone else handled ID, selfies, and checks… You log in. Underneath, it’s messy:

You’re effectively using someone else’s identity, which can get very serious very quickly.

The original owner or seller can often still reach the email, phone, or recovery methods later.

If they report anything or if patterns look suspicious, the account can be frozen or seized.

It’s like renting a bank account from a stranger on the internet. It doesn’t feel clever once things go wrong.

Why a clean KYC + private number is the better long-term play

Doing KYC honestly gives you:

A stable relationship with the platform.

A clear trail for audits, tax reporting, or future disputes.

Higher limits and fewer random “prove-you-are-you” checks.

Pair that with a PVAPins private virtual number, and you get a much healthier setup:

Your documents and profile match your real identity.

Your phone privacy is protected, and OTPs have their own dedicated inbox.

You’re not constantly looking over your shoulder about account sellers or shared credentials.

Enforcement stories regularly mention that many seized fraudulent accounts are tied to purchased or stolen KYC profiles, not to users who verified themselves the usual way.

Numbers That Work With Bybit:

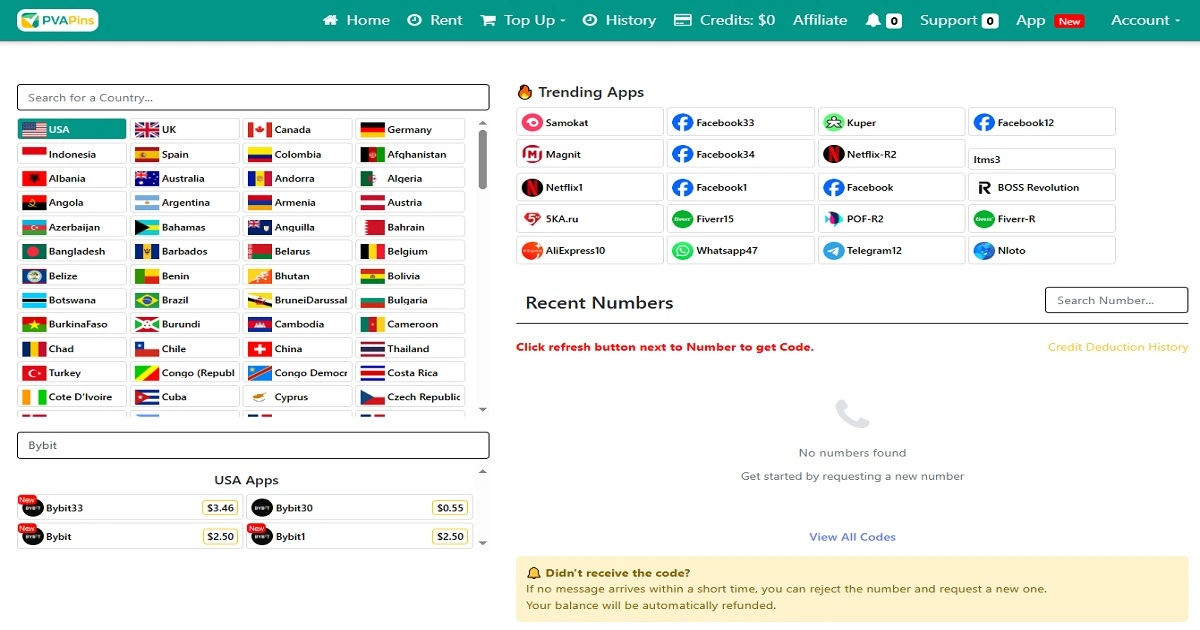

PVAPins keeps numbers from different countries ready to roll. They work. Here’s a taste of how your inbox would look:

| 🌍 Country | 📱 Number | 📩 Last Message | 🕒 Received |

Russia

Russia | +79272097228 | 9260 | 18/02/26 06:33 |

USA

USA | +12672907849 | 5168 | 28/03/25 12:13 |

Russia

Russia | +79998974290 | 4163 | 13/02/26 09:37 |

UK

UK | +447731008304 | 796426 | 28/05/25 02:46 |

USA

USA | +19124257443 | 5939 | 02/05/25 08:35 |

UK

UK | +447481001834 | 712-847 | 24/09/25 09:33 |

Russia

Russia | +79267613647 | 0055 | 19/02/26 11:03 |

USA

USA | +19202857630 | 3389 | 18/08/25 01:51 |

USA

USA | +19562010842 | 13562 | 29/11/25 04:23 |

Finland

Finland | +358468018076 | 792005 | 23/06/25 10:08 |

Grab a fresh number if you’re dipping in, or rent one if you’ll be needing repeat access.

Conclusion

You can’t really bargain with KYC anymore; it's baked into modern exchanges. What you can control is how much of your personal phone footprint gets welded to your trading accounts.

Using a PVAPins virtual phone number with Bybit lets you:

Keep your primary SIM off your exchange profile

Get faster, more reliable OTP delivery on clean private routes.

Stay within the rules while upgrading your privacy and convenience.

If Bybit is part of your daily stack, it’s worth tidying up your setup: honest KYC, strong 2FA, and a dedicated PVAPins number soaking up all the SMS noise in the background.

Compliance reminder: PVAPins is not affiliated with Bybit. Please follow each app’s terms and local regulations.

Russia

Russia USA

USA UK

UK Finland

Finland